This week’s update comes from Jonathan Gollop who is in our discretionary investment management team in Jersey.

President Biden has made a huge statement of intent just four months into his presidency by announcing his plans for a colossal $2.3 trillion infrastructure and jobs package that if passed, would rank as one of the largest federal efforts to tackle the United States’ greenhouse gas emissions.

Despite the likelihood of increased corporate taxes, the news was well received by markets as just one day after the announcement the S&P500 topped 4,000 for the first time in history. Many of the larger technology companies such as Apple and Facebook received welcome boosts after a difficult few weeks where investors had been more focused on the hard hit airline and oil companies in the hope of capitalising on the post-coronavirus economy.

This initiative, whilst focusing on tackling climate change, may also be a significant tailwind for ESG (environmental, social and corporate governance) investors.

Many aspects of President Biden’s new infrastructure plan contain clean-energy measures, such as the availability of electric vehicles and the accessibility of charging points. According to the White House, the President is looking to achieve the ambitious target of net-zero emissions by 2050.

ESG investing has been around for some time now and the considerations and factors that drive the concept of ESG investing have long been a desire of investors. Last year, over $50 billion of net new money was captured by ESG funds, which, according to Morningstar data, is the fifth year in a row that the annual record has been broken.

Electric vehicles and energy efficient buildings are a major factor when it comes to greenhouse gas emissions and it’s therefore no surprise that we see over $600 billion in allocated funds to tackle and improve these sectors. In addition to Biden’s 2050 zero emissions target, he has also set a target of zero carbon electricity by 2035.

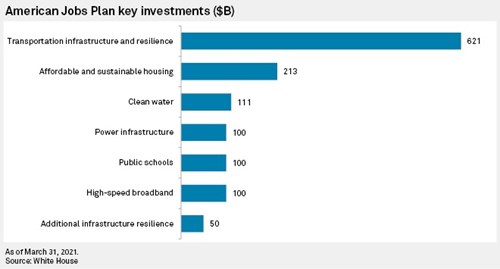

However, it is not just an ESG consideration and it’s not only clean energy companies that stand to benefit. There are significant benefits to the wider economy because, as with all infrastructure developments, there is a huge reliance on basic materials, utilities and construction companies. The significant amount of investment into developing new roads, modernising property and infrastructure will surely result in a boost to the wider economy. The plan will also go some way in tackling unemployment where we will likely see hundreds and thousands of jobs created for not only those implementing the strategy but actually putting in the groundwork. This is all part of the jobs plan as detailed below:

Whilst there is no doubt that President Biden’s proposed plan has significant benefits to both the US economy, and subsequently its approach to becoming more environmentally focused, it does have its drawbacks.

There are concerns that increased government spending could result in an increase of inflation and there is also the fact that increased tax rates for corporations is never going to be received well, but funding has to come from somewhere and raising corporate taxes was always part of President Biden’s campaign plans so really shouldn’t come as a surprise. That said he has countered this with the proposed extension of tax credits for clean energy and domestic manufacturing, which will, in some way, help him overcome the challenges of getting the proposal passed and further support the potential success we might see in businesses in that sector.

At Ravenscroft, we are strong believers that a thematic investment approach is the best way to capitalise on key themes and trends and for quite some time now, ESG and environmentally-focused solutions has been a theme that you just can’t ignore. Whilst we do not manage our strategies to be entirely focused on ESG, we do ensure it is part of our way of thinking and we believe that companies which can demonstrate strong track records on this front are better placed to achieve consistent returns over the long term.

As the focus on ESG investing becomes more prominent and a growing requirement for investors, you will see this reflected heavily in portfolios of the future. Furthermore, the underlying companies in which you are investing into will have a greater responsibility on ensuring they are ESG compliant therefore increasing the impact of key events such as President Biden’s recent announcement.

ESG investing is growing in popularity and we will be discussing this topic in more depth in our upcoming discretionary investment management quarterly update.