Elliott Crowson from our advisory investment team pens this week's update

You may have noticed that investor sentiment has deteriorated in recent months in the face of tightening monetary policy. Lacklustre results from some of the tech heavyweights seem to have overshadowed a broadly positive corporate earnings season.

This has no doubt triggered a sell-off amongst a special group of amateur investors that believe they can ‘time the market.’ We are of the opinion that often, it is better to stick with your existing investment strategy and ride out any short-term volatility. Investing is said to require qualities of temperament rather than qualities of intellect and we will explore why…

Fear and greed are the two primary emotional drivers of market movement. Behavioural finance is devoted to understanding market psychology and can help explain why succumbing to emotional bias may lead to underperformance of investor portfolios. Our irrational nature often leads to ‘herding’ or following the crowd, but dancing in and out of investments is a dangerous and expensive game which shows a complete disregard for long term fundamental investing.

It is almost universally agreed by the most prolific investors that the ability to time the market is an impossibility. Terry Smith makes it clear that

“There are only two types of people: those who can’t market time, and those who don’t know they can’t market time.”

This is also backed up by empirical evidence, the vast majority of research shows that the odds are against you when trying to time the market.

For those readers that find themselves understandably a little panicky or nervous in times of market volatility, remember that it pays to be optimistic and to try and maintain a relaxed view:

“I had to teach myself to be bullish. But I promise you, as soon as I started looking on the bright side, not only did my investment performance begin to improve, but I felt and looked younger, too. Let’s face it – bearishness is the natural province of crabby old people. All the great investors – Buffett, Fisher, Munger, Templeton – stayed structural bulls and (have) reached grand old ages. Not only were they intellectually correct to be bullish – as history and their track records amply confirm – but they were emotionally smart, too.” - Nick Train

"It’s very hard to move around successfully and beat, really, what can be done with a very relaxed philosophy." - Warren Buffett

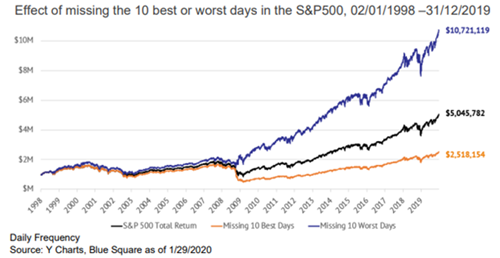

It would be remiss of me to ignore that successfully timing the market can (predictably) lead to exponential long term gains. As the above graph depicts, to be out of the market on the worst days can make a large difference. Many market participants observe charts and graphs with hindsight which can make beating markets look too easy as some patterns only reveal themselves with hindsight. However, predicting the start and end of eras is particularly difficult to be accurate on, for example, the Japanese equity market over the decades or inflation trends. It is far easier and more efficient to have broad market exposures and stay well diversified.

Ultimately, history indicates that time in the market pays. It is important to note that we do not see any issue with taking a profit, this can lead to a healthier, more balanced portfolio. Equally, it is important not to hold on to losers which have fundamentally changed in the hope that they may one day breakeven. The point being that we must assess our position rationally. To summarise, I feel this quote from the late John C. Bogle is fitting –

“Time is your friend: impulse is your enemy.”