This week’s update comes from Matt Girard in our precious metals team.

A relatively lacklustre Q2 has followed a solid start to the year as gold prices have taken a step back and currently sit around $1,850 per troy ounce1. Although this may look disappointing given the highs seen earlier in the year, as they say, every cloud…

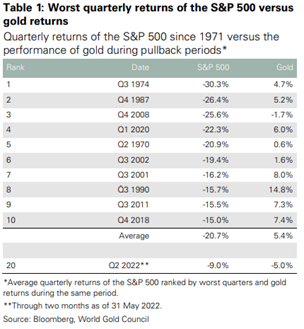

It’s difficult to compare the current market conditions to anything we’ve experienced previously, however, as the World Gold Council outlined in their latest market update, when equities are performing poorly, gold often has positive returns. As it stands, the S&P 500 is currently sitting at number 20 on the worst-performing quarters, yet gold is down 5%2. If history is anything to go by, there may potentially be some positive momentum for gold over the coming weeks.

Platinum group metals have also had a slow start to Q2 with prices being pulled back to $1,000 and $1,950 p/oz for platinum and palladium respectively3. The latest press release from the World Platinum Investment Council noted:

Unprecedented events in Q1’22 had a huge impact on both the supply of and demand for platinum, adding a layer of complexity on top of pre-existing issues, which will continue well into 2022. During the quarter, both demand (-26%) and supply (-13%) fell year-on-year leaving the market in surplus of 167 koz. However, for the full year, supply is expected to be 5% less than in 2021, yet demand to be 2% greater.

Another important driving factor for prices is demand in the jewellery sector. Due to further Covid outbreaks in China, subsequent lockdowns ensued and fabrication fell significantly. Although there was solid demand across Europe and North America, this still didn’t offset the deficit as China is the world’s largest platinum market.

It seems fitting that our precious metals update falls just after the Queen’s Platinum Jubilee weekend and, as many were anticipating, the Royal Mint has produced several commemorative coins to celebrate – as they normally do for these types of milestones. However, one particular (and rather large!) coin stands out amongst the rest. The Royal Mint produced its largest gold coin to date – an astounding 15kg. They estimate that 400 hours of work went into the private commission and the design was personally approved by the Queen4.

Sources:

1 LBMA (London Bullion Market Association)

2 Goldhub

3 World Platinum Investment Council

4 The Royal Mint