“There’s something wrong in the world today

The light bulb’s getting dim

There’s meltdown in the sky”

Livin’ On the Edge – Aerosmith, 1993;

(Songwriters: Steven Tyler, Joe Perry & Mark Hudson)

Please click here to view/download the PDF of this update.

As tired and clichéd as they may seem, there is a very good reason why adages such as Graham & Dodd’s description of the stock market as a voting machine rather than a weighing machine, or Nathan Rothschild’s reported exhortation to buy on the sound of cannons and sell on the sound of trumpets are repeatedly trotted out during times of market distress. It’s because they are as relevant today as when they were first coined (in 1934 and 1810 respectively).

As creatures hard-wired for responses of fight or flight and predisposed to the strong urges of fear and greed, it’s useful to dust off and re-visit these, and other, maxims at time when, in market terms, animal spirits are raging.

Whether it is re-examining the investment case and assumptions for the chosen businesses within Blue Chip accounts; drilling down into and analysing the aggregated portfolios of Global Solutions and Growth portfolios’ underlying equity holdings; or running the numbers for the sensitivities and pay-off profiles of fixed income funds held for Income and Balanced mandates, it is crucial that such exercises are conducted dispassionately with no interference from market noise. “Keep calm and carry on” remains as appropriate a mantra as ever.

Reassuringly, as activity within over the last quarter attests, few, if any, of the changes made to portfolios have been made because we have been obliged to conclude that our original (and long-term) rationale for an investment was flawed, a manager to whom we have allocated clients’ capital has lost their mojo or, worse still, has been “swimming outside the flags”. Rather, some (timely) de-risking has taken place on a tactical basis, selected switches have been made into even better ideas and, in one notable case, a new style of asset (for us) has been introduced. Importantly, all of these decisions have been weighed and measured in exhaustive detail and executed in a considered fashion.

Invariably, the kind of market conditions we have witnessed over recent months can present significant opportunity to the level-headed and appropriately positioned investor. Amongst others, this is increasingly the case for some selected parts of the fixed-income market, where specialised managers to whom we have existing allocations are operating. There, the combination of those aforementioned animal spirits, forced selling and the exit of “hot money” have resulted in levels of yields and positive asymmetry in prospective return profiles that, though by no means unprecedented, are rarely seen – and which one veteran manager who we follow has described as “generational”. Though this is unlikely to result in major changes to portfolios, given that we are already invested in these areas, adjustments in position sizes are likely in due course.

In this newsletter, the managers across our range of strategies describe the activity within and positioning of their respective portfolios, as well as setting out their market views.

Cautious Portfolios:

Lower Risk

By Robert Tannahill

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

The third quarter proved to be another difficult one for markets and especially for cautious investors. While these episodes are regrettably an inevitable part of investing, we are conscious that they are very unpleasant to live through. So, if you are worried about your portfolio, we would like to take this opportunity to reiterate that we are always available for a call or a cup of tea and are happy to discuss your concerns and the options available to you.

The Cautious Income strategy fell by -2.3% (1) over the quarter, beating the IA Mixed (0-35%) Sector which fell by -3.7% (2).

The surge in inflation that began in 2021 with the post-lockdown rise in demand, catalysed by the energy price increases driven by the war in Ukraine, has not shown the clear signs of rolling over that we would all prefer. Headline CPI (Consumer Price Index) inflation rates in places like the US most likely peaked in July and core inflation measures, which exclude the more volatile factors like energy, had been reassuringly falling since March. This caused some optimism in markets and July was a good month for asset prices as markets began to work on the basis that the Federal Reserve (“the Fed”) could bring inflation under control without taking interest rates to extreme levels and causing a deep recession. Unfortunately, this assumption was short-lived since core inflation measures fell less quickly than expected and then rose again in September, which caused the Fed to make a series of statements cautioning investors against assuming interest-rate increases would end soon.

The concern now is that the temporary inflationary surge has spread into other parts of the economy – and possibly into the public’s psyche. This would cause inflation and higher interest rates to persist for much longer than previously thought and potentially require Central Banks, like the Fed, to cause deep recessions (as Volcker did in the 1970’s) to bring it back under control.

To compound these issues, in the UK we had the very poorly received recent mini-budget. While markets were expecting the UK government to borrow to cap energy prices, this was seen as pragmatic and temporary. However, the surprise announcement of tax cuts which would be funded, initially at least, by increased government borrowing, came as a nasty shock to investors. Markets repriced aggressively on the back of the announcement since the much of UK government debt is bought by foreign investors. Funding for government deficits is likely to continue to flow from foreigners; however, a much cheaper currency and higher interest rates will be required to attract them in sufficient numbers to balance the books. We saw a big sell-off in both the Pound and Sterling bonds on the back of this.

This selling was compounded by a feedback loop that developed within defined-benefit pension schemes. After years of falling bond yields, causing the value of their future liabilities to rise faster than the value of their assets, many had sought to defend against this by using derivatives. When bond yields spiked, however, those derivatives began to show losses which created a vicious cycle. Rising bond yields caused losses on pension funds derivatives which caused them to sell bonds to raise cash, pushing bond yields up further. This continued until the Bank of England stepped in with an emergency bond-buying program to break the cycle. The net effect was record-breaking moves in Government bond prices. We could well see further examples of nasty surprises coming out of the financial plumbing as the global financial system is put under pressure by a very strong US dollar and rapidly rising global interest rates.

Thankfully, the UK is protected from the worst type of crisis this could cause (a so-called balance of payments crisis) by virtue that the UK primarily borrows in its own currency and so will never be unable to pay lenders back. However, if lenders lose faith in that paper money, the UK government and Bank of England could be forced to take extreme steps to restore that faith inflicting pain on citizens and the economy in the process.

Looking at the Cautious Income portfolio today, while the year has been painful, it is important to focus on how assets should behave in the future. While nobody knows when the eventual recovery will come, we do know that sooner or later markets adjust to the new world and greater stability will return to asset values. Our aim today is to make sure the portfolio is positioned in the next one to two years to make up the ground lost so far this year – assuming we get a middle-of-the-road outcome in terms of the global economy, i.e. one that is neither an optimistic quick recovery nor one where some new significant negative event occurs.

A significant portion of the portfolio is now sporting very high yields. Funds such as Sanlam Global Hybrid Capital and Royal London Short Duration High Yield are yielding nearly 10% today. These funds account for around 33% of the portfolio and they simply need sentiment to stop getting worse to recoup 2022’s losses within a little over 12 months. We are very comfortable with these holdings and their ability to bounce back.

Similarly, the equity funds within the portfolio, although not as clear-cut as high-yielding bonds, have the potential to deliver the sort of returns required in sensible time frames. These funds account for a little over 27% of the portfolio.

This leaves our positions in core bonds and cash which makes up the rest of the portfolio. As with the higher-yielding bonds discussed above, yields have risen here as well, however, they have not risen high enough to make holding onto them as obvious a decision as for other assets. This is the space where we are focusing our attention.

Some areas such as sterling bonds – which have been hit particularly hard – are offering quite compelling returns. Our TwentyFour Corporate Bond Fund, for example, now yields around 7.4%, which is appealing. On the other hand, our cash position, currently around 10%, while nice to have had so far, will clearly struggle to produce the type of returns we want to see over the next year or two. As such, this allocation is likely to be a bit of a mixed bag. Sticking with those funds that have the potential to deliver solid returns as markets calm, switching other funds where we see better ways to navigate the new environment, and using some cash to pick up bargains and lock in future returns.

With these changes and slightly more benign market conditions, we should be able to put this difficult period behind us over the next year or so.

Balanced Portfolios:

Medium Risk

By David Le Cornu

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

Autumn has arrived and we find investment markets are still grappling with the same issues they were when spring sprung six months ago. Persistently high inflation, Central Bank interest-rate policy and an overly strong US dollar continue to strain the global economy and remain the key agitators of investment markets. When we have these uncomfortable periods in investment markets, there is normally a big event that marks a turning point where the powers that be are forced to take whatever action is necessary to underpin investment markets.

Over the quarter, investment markets started strongly staging a rebound through July and the first half of August, then performed a U-turn as the Federal Reserve gathering at Jackson Hole reiterated that inflation was enemy No1, and that it would embrace recession rather than inflation. In this environment, the Balanced strategy generated a return of -1.9% (3) which compares favourably to the return of -3.0% (4) from the IA Mixed (20-60%) Sector.

I am wondering how close we are to that turning point in investment markets. In September, the Reserve Bank of Australia had to announce its capital had been completely wiped out. Unlike you and I, this doesn’t matter as they have a magic money tree, so, can step into their garden, give the tree a shake and all is well. The Bank of England had to ride to the rescue of the UK government as Kamikwazi economics caused the IMF to question the fiscal profligacy of the new chancellor, causing a spike in UK Government Bond yields which in turn was forcing UK pension funds to sell assets (probably UK Government Bonds). The Bank of England also have a magic money tree, so, to bring some semblance of order, they committed to buying UK Government bonds to restore order to the UK Government bond market and defend UK pension funds. This has given the UK government some brief respite and may prompt a rethink of their plans. The point of all of this is that the stresses and strains within the global financial system are extreme, many countries have similar issues, so, the point where the Central Banks are forced to blink and change their rhetoric and actions may be closer to hand than many think.

Our clients tend not to have magic money trees, so we have continued to try to get the right mix of investments in the Balanced strategy to temper some of the volatility in investment markets and to generate attractive returns when investment markets recover. To this end within the Balanced strategy, we have undertaken the following transactions.

• We sold Polar Capital Healthcare Opportunities (-5%) and bought Polar Capital Biotechnology (+4%) to focus the thematic Healthcare allocation in the Biotechnology sector. The Biotechnology sector has suffered an extreme derating over many months with many businesses now trading below the value of the cash they have on their balance sheets. We view an investment at these depressed levels as an opportunity to generate outsized returns for our investors over the next few years. Whilst we would not buy purely in anticipation of Merger and Acquisition activity, we note with interest that many large pharmaceutical businesses are cash rich and struggling for growth, so suspect corporate activity could provide a kicker to performance. We are mindful that the Biotechnology sector has displayed higher levels of volatility than the broader healthcare sector, so an analysis of the volatility of the two funds has guided us to a position size of 4%.

• We sold PIMCO Investment Grade (-3%) and bought Sanlam Global Hybrid Capital (+3%). The broad-based sell off in investment markets is throwing up pockets of opportunity. An area of particular interest to us is subordinated debt amongst financials, where the market pricing on these assets does not seem to reflect the balance-sheet strengthening that has taken place since the Global Financial Crisis. Exposure to this area of fixed-interest markets has been introduced via a 3% position in the Sanlam fund, funded by the sale of the remaining holding of PIMCO. We mentioned when we previously reduced the Fund that their macro-overlay had been misfiring and recent conversations had not restored our confidence in their overlay, so, it was a natural source of funds for the new investment.

• Finally, we bought Polar Capital Global Insurance (+4%). The Fund has £2bn+ under management and over its 23-year life it has generated attractive returns averaging more than +14% per annum. The Fund focuses upon specialist insurance underwriters who can pick and choose which risks to take, whilst avoiding big unknowns such as cyber security. In a world full of uncertainty, insurance appears to be an area of investment markets where we can be fairly certain of attractive returns. Non-life insurance tends not to be a discretionary purchase, so, the Fund should not be impacted by an economic slowdown or reduction in discretionary spending. Likewise, the Fund does not appear to be overly attuned to inflation. Whilst some of the underlying companies may not appear cheap by historic standards, we believe they are attractively priced when taking into account present underwriting margins and the investment income they can now generate from their short-dated bond portfolios.

Polar, Polar, Polar, Polar (please sing along to Kaiser Chiefs’ song, Ruby). An investment consultant recently asked about the rationale for investing in four Polar Capital funds, so, in case the question is on investors’ minds, we are sharing the answer. Polar has a number of thematic funds so they naturally feature in the Ravenscroft investment universe.

Each fund has been selected on its own merits. There is no significant overlap in the investment process of the Polar funds we are invested in, nor in their underlying holdings; accordingly, investing in more than one of their funds does not increase risks for our investors. There is no financial or other incentive for Ravenscroft to invest in Polar Capital funds. However, the scale of our investments gives us bargaining power in allowing us access to cost-effective share classes for our investors and gives us unparalleled access to their fund managers.

At times like these, our investors may understandably be unnerved by the gyrations of investment markets. The Ravenscroft team are here for you in good times, and in bad, so please reach out to us if you have any questions or if there is anything we can help with.

Growth Portfolio:

Higher Risk

By Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

As the majority of our readers are mostly interested in performance, here it is. For the third quarter of the year, the Growth strategy posted +0.5% (5), versus the IA Mixed (40-85%) Sector of -1.9% (6).

I think if you had asked us if we thought we would have been ahead of our peers for the third quarter of 2022 given the start to the year in January, the honest response would have been a “tricky” one; so, overall, we are slightly happier today versus January.

Whilst nobody likes to post negative numbers, 2022 so far has been difficult, not just for equity and bond markets, but also for us; one can only hope that everything calms down and a better outcome is reached.

In this uncertain environment, investing has been anything but straightforward, and we have made a couple of changes to the portfolio.

• We hedged Polar Capital Technology. For those who have been investors for a while, you may know that we have executed this trade before. When the GBPUSD rate fell consistently below 1.20, we thought it was prudent to hedge our purest US dollar exposure – we did that at 1.18. To be honest, we thought we were doing the right thing – little did we know Truss would come along with her “mini-budget” which basically sent the Pound spiraling down towards 1.03. As outlined within the Cautious Income commentary, the Bank of England then stepped in and shored up the markets by buying back government bonds, and since then, markets have calmed a little and GBPUSD has moved back up to 1.13. Only time will tell where this is rate is headed (we do have lines in the sand as to where we put on and take off hedges in the strategy).

• We sold TIPS (-2%) and the seven to 10-year Treasuries (-2%) and bought Ruffer (+5%).

• We sold Vontobel Global Corporate Bond (-2.5%) and Rathbone Ethical Bond fund (-2.5%) and topped up Ruffer (+4%).

In these difficult markets it was difficult to see how fixed-income was going to react. Therefore, we opted to hand over the management of these instruments to a house that has done nothing else over the last 27 years but invest in the fixed-income market. We met the team in Guernsey in September and whilst they have always looked at the world in a “glass half empty” kind of way, they are at this point the most defensive they have ever been. When we think about what the bond allocation in Growth strategy is supposed to do, it should be able to provide some ballast (in an ideal world, defensive qualities) to the equity allocation in the portfolio. So far this year, fixed-income has provided anything but this and Ruffer has historically provided those defensive qualities. As highlighted in the Cautious Income commentary, there are some bargains to be had out there, but there could be some volatility on the way. When markets settle down, we will more than likely revisit the short-dated credit fund managers in the form of Royal London and Schroders.

Polar Update

In the words of David Le Cornu and the Balanced strategy commentary: Polar, Polar, Polar, Polar. We, too, have a number of exposures, so, on the 27th of September, we spent the entire day with them.

Whilst they do not have a “macro” house view, all the fund managers we spoke to were on the same page – as in: the market was hated and investors were selling and holding cash on the side-lines. It didn’t matter if you were UK Value Opportunities, Healthcare or indeed Technology, the fund managers agreed.

Shaun introduced Nathan Rothschild, he is credited with saying that “the time to buy is when there’s blood in the streets.” Whether or not Rothschild actually said this is not known, but it reveals the psyche of the contrarian investor and the fact that they act differently to market convention: when prices fall and markets tumble, they start investing.

While the Polar managers tended to be prudent, they are starting to see blood on the streets and selective investment opportunities. In the Technology space, companies which were trading at 34x price to earnings are now at 9x – which means they’re very cheap compared with what they were. Tom, one of our analysts, has written about this in the Fund in Focus.

The catch up with George and Georgina who manage the UK Value Opportunities fund was interesting, you may remember the managers if you came to, or viewed, our annual presentation back in March 2021. The rationale behind the investment was one of relative valuations, as global markets were expensive, and the UK was unloved and cheap. In short, nothing has changed in terms of their process, so all good. If anything, the sell-off this year has enabled them to increase the quality of their portfolio as companies that were previously too rich are hitting the right prices.

The only cloud that hangs over the UK is that of the “macro”. This is nothing new for the UK – the market seems to have been in and out of favour since 2016 – but right now the Fund is the cheapest it has been since 2006, so we continue to hold and review.

Liquidity is King

Finally, the one thing we should highlight is that in times of market stress we look at all the underlying exposures in our strategies to ascertain our worst-case scenario: affectionately known as doomsday. The one thing that is true today, as it has been over the entire time we have been investing, is that giving you your capital back as and when you want it, is of paramount importance. We are very pleased to report that the underlying exposures are still liquid and everyone is open for business; some other asset classes are not so blessed. So, whilst you may not like the price you are currently looking at, you can be rest assured that you can get hold of your investment should you need too.

Global Blue Chip Portfolios:

Higher Risk

By Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The third quarter of 2022 was a particularly challenging time for the market with a strong rally that started in June, ran hard through to mid‑August before pivoting and heading lower through all of September. The reason for the turn in mood was largely down to stubborn inflation, more evidence of slowing growth, a very strong US dollar causing pain in numerous foreign markets, and a Federal Reserve unyielding in their battle against US inflation and rate-rising regime.

In US dollar terms the market return (MSCI World) was -6.2% (7) over the quarter, but it was up +2.1% in sterling terms (8). This disparity in performance is due to the strength of the US dollar although domestic politicians and policy makers haven’t made life easy, especially in recent weeks.

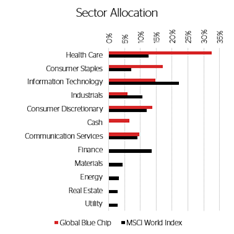

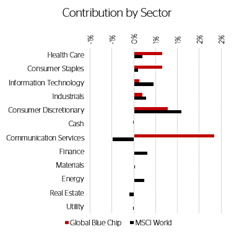

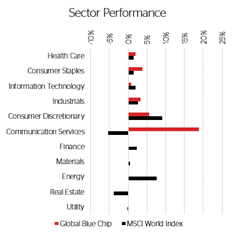

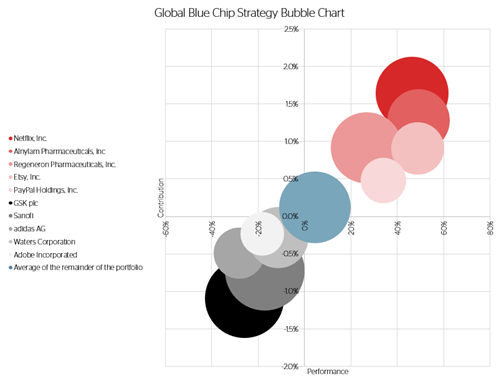

Amidst this backdrop, sterling-based investors were shielded from the worst of it thanks largely to the strength of the dollar and Global Blue Chip’s significant exposure to dollar assets. Our strategy recorded a return of +4.2% (9) for the quarter, thanks largely to a comeback within our communication services holdings as seen in the charts below.

Netflix was our strongest performer after the wave of negative sentiment seemed to have exhausted itself. Helping arrest the negativity was the announcement that subscriber losses were significantly below expectations. With the Company making good progress towards an ad‑supported tier we wait for further updates on how households are dealing with the cost-of-living crisis and whether subscription services related to home entertainment are at the top of the cancellation list or more towards the bottom. We suspect there are plenty of areas where households will pare back expenses before choosing to cut down on their home entertainment – particularly if rising costs forces the population to go out less often and spend more time at home.

GSK and Sanofi were our poorest performers after an analyst note reminded investors of an upcoming raft of lawsuits where both pharma businesses are identified as defendants. Plaintiffs are accusing GSK, Sanofi and a number of others that their various cancers were the direct result of them taking a heartburn drug known as Zantac. We wrote extensively on the matter at the time and we have little new to offer you on the situation at this point. We said then (and remain of the view now) that the trials could have an overhang on the performance of the shares. However, we remain confident in the underlying properties of both companies which look, valuation-wise, very attractive (outside of extreme trial outcomes).

The biggest surprise came from new entrant Adobe Systems whose good earnings report was somewhat crashed by the news that management had acquired Figma – a web-based design platform that bears the most similarity to Adobe’s user interface/user experience, “UI/UX”, design product XD – for the staggering sum of $20bn. This stunned the market and sent Adobe’s shares to fresh bear-market lows. Whilst we may have been unhappy about the price paid (or the less-than-optimal choice of financing) we can see how the technical hurdles Figma has demonstrated its ability to surmount could be beneficial to Adobe’s evolution. Following the negative market reaction, Adobe’s shares now look attractive even after accounting for the share dilution and we added to our position as a result. Further thoughts on the acquisition can be found on our website.

Towards the end of September, Illumina showcased its latest genesequencing technology which can sequence a whole genome for an all-in cost of $200. The announcement went some way to allaying fears over growing competition; but, even if Illumina ultimately cedes some market share to its competitors, the field remains one of critical future importance, growth, and size, while the company has once again demonstrated its ability to push the boundaries with the likely result that it will not be displaced as the largest player. Yet the shares remain under pressure as its anti-trust battle with European regulators over its acquisition of GRAIL, a business that has an innovative new pan-cancer blood test, continue. The regulatory situation remains unclear, and Illumina could well be forced to divest GRAIL on unattractive terms. For this reason, we are somewhat hesitant about adding to our position despite the positive technology developments and depressed share price, but we would also note that this is subject to change as we continue to assess the impact of the recent technology announcements and further regulatory developments.

The precariousness of the current financial system was put on show during late September when the Bank of England had to step in and buy UK government bonds in order to stabilise a disorderly market that was rapidly deteriorating. We really are having to navigate a treacherous passage with a rising swell on a falling tide. The scope for policy errors is wide and that is without even touching on the geopolitical events that continue to unfold at a rapid pace!

We would like to assure our investors that we are acutely aware of this. We have studied previous periods, particularly the 1970’s, that were characterised by unstable inflation, rising interest rates, geopolitical uncertainty, and volatile markets. Whilst it would be foolhardy to prepare for the last war, we are comforted that our strategy of owning quality companies at attractive valuations offers defensive characteristics. Pricing power fosters growth helping offset inflationary pressures, whilst strong financial metrics offer management flexibility when navigating the operating environment and competition. For more on our approach please read our investor series on the website.

And finally, the flow of news on all our companies is too great to mention let alone speak about at length so we have created a twitter feed for the strategy where we will re-tweet news announcements and media coverage that we think our followers will find interesting. Follow us @RavenscroftGBC on twitter.

Global Solutions

Higher Risk

By Shannon Lancaster

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

It has been a rollercoaster of a six months to say the least since Ravenscroft Global Solutions launched. As we reflect on the past few months, we are in awe at the relentless intensity of market-moving news. It has been a bleak year, but we are pleased with how resilient the strategy has been during such a turbulent period. Over the past quarter, the strategy has returned +4.6% (10) versus the MSCI World Index which returned +2.1% (11).

In some instances, the events of the past months have shone the spotlight on some of our underlying themes. A focus on energy security caused by the Russia-Ukraine conflict has meant all eyes are on the energy transition. In some places, this will accelerate the move to renewable energy; but, it will also stimulate renewed fossil fuel production and use in others. In the short term, someone must replace the Russian role in Western energy supplies and the long-term investment opportunities still remain attractive for the world’s transition to clean energy. The European Union is speeding up its plans to boost its share of energy from renewable sources this decade, while simultaneously accelerating plans for a green hydrogen infrastructure. More consideration is now being given to the entire energy value chain as we look for innovative technologies that will enhance energy efficiency and storage capacity.

We have exposure to this investment theme through three funds and in September we were thrilled to meet one of them in person. Thiemo Lang has a background in engineering and technology and runs the Polar Capital Smart Energy Fund. This Fund invests across the clean energy value chain, focusing on segments with strong structural growth drivers such as clean power production, smart grid and storage solutions, green hydrogen infrastructure, electric vehicles, and the energy efficiency of big data.

The team believes that, given the urge to accelerate the energy transition towards clean energy solutions and electrification, governments worldwide will continue to explore the possibilities for reducing the dependency on imported energy sources and fostering local manufacturing and power generation. The fundamentals of the clean energy sector and the outlook for the underlying energy transition theme therefore remain as strong as they have ever been.

A clear example of this government support in practice is the introduction of the Inflation Reduction Act (IRA) in August this year in the US. This wide-ranging legislation contains several provisions aimed at reducing healthcare and clean energy costs.

The IRA will benefit the energy transition businesses in numerous ways. It includes a vast array of funding programs across renewables, electric vehicles, hydrogen and storage supply chains, with the objective to also support domestic manufacturing. Another area that stands to benefit from the IRA is healthcare. The Act will lower prescription costs and will make health insurance more affordable, making healthcare more accessible for many families in the US.

We have long believed that investing in healthcare could prove to be very profitable. Our healthcare investment theme is underpinned by a growing ageing global population which needs an efficient, accessible and affordable system. Much investment is needed to improve diagnostics, treatment, and general patient care. It is a theme we have had exposure to for many years in our Balanced and Growth strategies.

In Global Solutions we own two funds in this space and, in September, we met with the Polar Capital Healthcare Discovery Fund manager, Deanne Donnigan. This was our first in person meeting with Deanne who we have had many virtual discussions with in the past. We were once again impressed with her deep industry knowledge and experience. With over 36 years’ industry experience, including over 20 years within healthcare asset management both in the UK and the US, she has incredible knowledge of the businesses and the management teams operating in the healthcare sector.

The Polar Capital Discovery Fund invests across the market cap spectrum in areas like biotechnology, pharmaceuticals, and healthcare equipment. Deanne’s experience and knowledge of management teams is extremely beneficial when selecting small and mid-cap businesses that are less well covered in terms of research. It was a productive and fascinating meeting. We remain very happy holders of the Fund and believe it works well alongside Candriam Oncology (also a 5% position) in the healthcare bucket within the portfolio.

As we head into the final quarter of 2022, we remain grateful for our investors and as always would like to remind all readers to contact a member of the team if there are any queries. We would be delighted to help.

Fund in Focus:

A Review of Polar Capital Technology

By Tom Yarwood

It’s been a difficult year so far for investors, to say the least. Issues such as heightened inflation, rising interest rates, the energy crisis, and global geopolitical instability (to name but a few) have created the tough financial conditions and volatility in markets that we’re experiencing today. Against this backdrop, equities have suffered – some sectors more so than others.

The decision by central banks to prioritise bringing down inflation at the expense of economic growth has put downward pressure on long-duration assets like technology, contributing to the sell-off and negative sentiment towards the sector. As a result, technology has been one of the hardest-hit sectors this year. Polar Capital Technology is one of our worst-performing funds for 2022, the Fund is down -25.1% (12) on a year-to-date basis in sterling terms. Accordingly, we’ve chosen to review it this quarter.

Absolute performance has been uninspiring this year; nevertheless, whilst we are not happy with it, this is both understandable and explainable. Technology companies have borne the brunt of the repricing this year given their sensitivity to interest rates; higher rates incentivise investors to take profits from riskier assets like tech stocks, as well as contributing to lower share prices for growth stocks, again like tech stocks. This is because future cash flows must be discounted with a higher rate.

Polar Capital Technology’s growth bias therefore makes it difficult to outperform during periods of weakness in markets like this. In this sense, performance can be explained by the macro-led market and simply by technology being out of favour. Whilst disappointing, it’s important to remember that performance can be volatile over shorter time periods, when economic conditions have more of a significant impact than the underlying company fundamentals. It’s therefore more appropriate to focus on performance over a three and five-year basis, in which the Fund has returned +34.5% (13) and +97.6% (14) in GBP respectively. Polar’s long-term track record is strong and this is what matters. There will be periods when technology is unloved, like it is today, just as there are periods when the stars align for the sector (thinking back to when the Fund delivered +54.2% (15) in 2020 when their core themes mapped well to the pandemic). Whilst not shooting the lights out now, the Fund remains a useful thematic lever in our portfolios.

As we’ve spoken about in our earlier commentaries, we visited Polar Capital in September and had our annual catch-up with manager Nick Evans at their office in London. As always, the meeting provided a unique first-hand insight into the sector that you can’t get elsewhere. The team remains confident of the sector’s value proposition in a more challenging environment and the secular drivers of technology continue to be strong. Company valuations are more attractive than they’ve been for some time.

To mention some interesting trends, the team remains very constructive on the opportunity to be had in cloud infrastructure. A subsector accelerated by the pandemic that provides cloud customers with greater ability to do more with less, reducing costs, improving scalability, and creating more flexibility (e.g., WFH and online shopping). Public cloud companies have continued to deliver strong growth at a great scale and the runway for growth is compelling. The rearchitecting of enterprise workloads to the cloud expenditure accounts for just 22% of today’s budgets and this is expected to rise to 42% in 5 years (16).

Artificial Intelligence (AI) is another such trend. AI is hitting an inflection point in its development and could well be one of the biggest themes for the next decade. The potential contribution to the global economy could be as much as $15.7trn by 2030 (17). Despite the deteriorating environment, companies have learnt from prior downturns that if you stop investing, then you fall behind; thus investment into cloud infrastructure or AI remains a constant.

Trends like this gives us confidence that demand for the sector will remain healthy in the longer term, whilst it’s the identification of these core themes and inflection points by the Fund that will help them to outperform over their investment horizon. Looking at valuations, the previous excess in the market driven has now been unwound and multiples have compressed significantly – essentially, areas are looking cheap. This has dramatically improved the risk-reward profile of some of the higher growth names in their portfolio, whilst also allowing them to start building positions in businesses that have passed their quality process but were previously too expensive to buy. The benefit of these more compelling valuations can be best exploited by proven bottom-up stock pickers, like the Polar team, who now have the opportunity to demonstrate their experience in active management and add alpha (e.g., outperformance potential) at a stock-level.

It’s near impossible to not mention inflation in this commentary. It’s the highest it’s been in my lifetime and has been dominating markets this year. The good news is that inflation is generally a positive for investment in areas such as technology and the current backdrop has even been accretive in pushing the persistence of the digital transformation (using technology to do more with less, etc.) for many of Polar’s companies. Further accelerated by the impact of wage inflation, businesses are turning to technology to be more efficient and increase productivity to avoid employing more workers. Finally, many tech subsectors possess the characteristics to respond well to higher inflation. For example, the semiconductor sector exhibits very high pricing power and concentrated markets.

The Polar team continues to exhibit all the qualities we look for when managing money: fundamental bottom-up stock pickers, a repeatable process and in-depth knowledge of their chosen sector. The trends in technology remain strong and valuations in many subsectors have fallen to attractive levels to provide opportunity for long-only investors. We therefore remain happy holders of the Fund.

Stock in Focus:

Etsy

by Samuel Corbet

Our long-standing investors will know that one of the criteria we look for when appraising investment opportunities is the existence of a robust and beneficial trend. Such trends typically endure for decades and their existence is akin to swimming with the current. Whilst we always endeavor to seek out the highest quality businesses and most lucrative opportunities for our investors, in a growing market there is room for multiple businesses to succeed. Such a trend provides a margin of safety, giving us (and hopefully you) an additional level of comfort that our investment will succeed.

In 2022, global ecommerce is expected to represent just shy of 20% of total retail sales. This is up from 10% just 5 years earlier. Whilst short-term growth has been expedited by the impact of Covid-19 lockdowns, the long-term direction of travel is clear. It is hard to imagine a scenario where e-commerce penetration levels in 10 years’ time are not meaningfully higher than where they currently sit and this presents a huge opportunity for the companies operating within the industry. Cue Etsy.

For anyone not familiar with Etsy, the company operates a global ecommerce platform specialising in the sale of craft and homemade goods. The primary purpose of platforms is to overcome the barrier that prevents transactions between unconnected parties from occurring – lack of trust. When consumers purchase branded goods online (Colgate toothpaste, Garnier shampoo, Nike trainers etc) the trust consumers place in a particular brand does a lot of the heavy lifting. Branding is powerful in removing friction but is generally not a tool applicable to the types of goods sold on Etsy’s platform.

Instead, Etsy becomes the brand consumers trust and its individual sellers leverage the goodwill it has created to facilitate their own transactions. This makes Etsy an extremely valuable proposition to its sellers who would otherwise have to spend significant time and resource fostering trust with buyers across the globe. The risk to this model of course is that Etsy is only as good as its weakest seller – poor customer experiences negatively impacting Etsy’s own credibility and diminishing the power of its brand. This is something Etsy Management is acutely aware of and actively manages with a robust review system – bad actors are quickly uncovered by the community and removed.

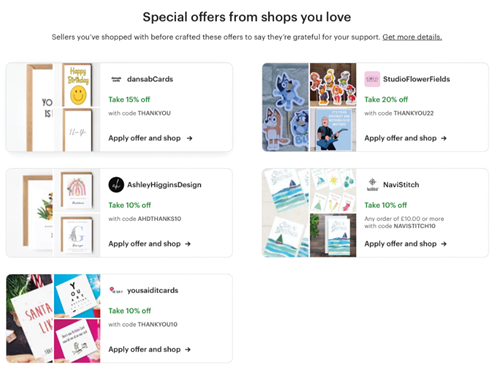

Shopping on Etsy is a remarkably human experience. Buyers communicate with sellers directly, sellers retain discretion over how they wish to present and package their wares (the most savvy including things like personalised ‘thank you’ notes) and can encourage repeat purchases with targeted, seller-specific, discounts (these appear directly in buyers’ digital wallets, ready to use on their next visit – see image below). This approach is extremely refreshing within an industry that prioritises efficiency over, well, everything. There is no doubt that speed is a major competitive advantage when your business revolves around selling and delivering commoditised goods. However, speed is often a less critical factor for Etsy customers who accept that hand-made and personalised goods take longer to produce and are willing to accept the trade-off to receive something truly special.

We love companies that obsess over delighting their customers. This often means pursuing initiatives that fly in the face of conventional financial wisdom. In Etsy’s case, this includes doing things like limiting ad-inventory to ensure the buyer experience isn’t degraded – or more rigorously enforcing its “Handmade Policy” by removing listings that don’t meet this criteria. More often than not, this is viewed unfavourably by the market and such discrepancies can present us with opportunities to purchase shares in excellent businesses. We refer to this as our time arbitrage opportunity and it describes the divergence in the value we are able to ascribe a business when viewed through the shareholder value creation lens versus the short-term, profit-focused, view of the market.

We strongly suspect such an opportunity is unfolding with Etsy. Etsy’s shares have cratered from their Covid highs as analysts began to downgrade their growth expectations. At the same time, the business has announced numerous innovative initiatives designed to enhance trust and increase engagement. The most significant of which was, perhaps, the introduction of Etsy’s Purchase Protection Plan. This went live on 1st August this year and is designed to protect both buyers and sellers on orders up to the value of $250. If the item received does not match the seller’s description, goods arrive damaged (or fail to arrive at all) Etsy will refund the buyer at no expense to the seller.

Etsy expects this program will cost it $25 million annually. More telling, though, was that management described this ongoing cost as “an investment” and we think this is a perfect example of a company concentrating on the right metrics – enhancing the value it offers to its userbase – and acting accordingly. We expect this focus to prove beneficial to our shareholders over the medium term and look forward to continuing to see how Etsy unlocks value for its stakeholders over the years ahead.

Boscher's (Not So Bite-Sized) Big Picture:

Recession or inflation - which poses the biggest threat

By Kevin Boscher

This has been an extraordinary quarter for the global economy and financial markets. It started off promisingly in July; markets rallied on the prospect of a better-than-expected US inflation report, and weaker growth, which in turn persuaded the Fed to become less hawkish. However, the optimism didn’t last for long as inflation disappointed yet again forcing the Fed to reiterate very strongly its commitment to fighting inflation.

The major surprise over the past two months has been the significant rise in expectations for where interest rates will peak for this cycle. For example, at the end of July, markets were expecting US rates to peak around 3.4% and the UK at under 3%. As at the end of September, markets are pricing in US rates at around 4.7% early next year and UK rates at close to 6% (18). With central banks, and the Fed in particular, making it clear that they intend to take rates much further than was previously expected, and keep them there for longer, the current monetary tightening cycle is likely to be the most aggressive in three decades. This provided an unpleasant backdrop for risk assets and equities fell back through their June lows, whilst bonds also sold off aggressively, resulting in the largest declines for many decades. Currencies were also volatile with Dollar strength again the notable feature, although Sterling weakness also came to the fore on the back of a surprisingly accommodative UK budget.

It is clear that the global economy is headed for recession, as defined by less than 2% growth, with the major economies all struggling but for different reasons.

In the US, the Fed is actively looking to weaken demand and bring inflation under control through tighter monetary policy, even if this results in recession and higher unemployment. In China, the slowdown is largely man-made as the authorities persist with their extraordinary zero-Covid policy and try to contain the fallout from the bursting of a property bubble. In Europe, including the UK, the energy crisis and higher commodity prices are largely to blame although Brexit has continued to be a factor for the UK. The duration and depth of the recessions will vary from country to country and will largely depend on when easing inflationary pressures or an economic/market crisis will encourage the central banks to reverse their tightening policies. In the case of China, inflation is less of a concern, but the authorities seem reluctant to aggressively ease policy or change their Covid stance at present.

The outlook for inflation remains the key factor for the global economy and markets. It’s true that inflation in the US and Europe has been more persistent than previously forecast but arguably it’s the central bank’s reaction to high inflation which has been the surprise. The Fed, in particular, is concerned that core inflation, which excludes many of the more transitory factors such as energy and food, is still rising strongly with services inflation especially strong. The Fed is also worried that rising wage growth is becoming more widespread and will lead to a more permanent shift in both consumer and business psychology. In the short term (6-12 months), I think it is likely that inflationary pressures will subside, perhaps materially thanks to the lagged impact of monetary tightening, significantly lower commodity and energy prices, rapidly easing supply constraints and falling demand. With the Chinese Yuan having fallen more than 10% versus the Dollar over the past six months, China is exporting deflation to the rest of the world.

The best outcome for both the global economy and markets would be if falling inflation enabled the Fed to pivot and become less hawkish over the coming months. This would likely lead to a weaker Dollar, which would take pressure off many emerging markets and Dollar debtors, and would also enable markets to look forward to an improving growth environment. I am hopeful that this will materialise quicker than expected, perhaps as early as Q1 next year. A less ideal scenario would be if the Fed is forced to change tack due to a major economic, financial or credit crisis. This is a distinct possibility given that the market, and specifically Dollar liquidity, is drying up fast, global growth is slowing sharply, the Fed is still in hawkish mode and the fact that leveraged sectors will find it hard to contend with interest rate hikes, as evidenced in the UK pension and mortgage markets this week. The extreme volatility seen across all assets over the past few weeks – equities, bonds, currencies and interest rates – is a warning sign that the risks of a major event or crisis are elevated.

Looking longer-term, the debate between inflation becoming a more secular problem (akin to the 1970s) or remaining a cyclical issue remains finely balanced and nobody can be sure.

I can still make a strong case either way, but I am now leaning towards a return to the 70s due to four key factors;

• shrinking work forces putting upward pressure on wages;

• higher energy and commodity prices for an extended period;

• de-globalisation, and;

• the combination of looser fiscal and monetary policy.

As the global economy breaks into competing blocs (east vs west) with countries focusing more on their own domestic needs, this will negatively impact trade, growth and inflation through supply side disruption and higher energy prices. Also, governments in developed economies are facing a number of challenges including income and wealth inequality, an ageing demographic, climate change and energy security. It is very likely that they will look to increase spending and run with bigger fiscal deficits for a prolonged period of time. Central banks will be forced to maintain financial repression and keep rates lower than they should be due to record debt levels and to finance the growing fiscal deficits. This was amply demonstrated in the UK this week as the Bank of England was forced into more QE to put a lid on Gilt yields in order to prevent a major liquidity event in pension funds.

The good news is that even if we are returning to a more secular period of higher inflation, there will still be plenty of opportunity to make decent investment returns. For example, in the 1970s, there were three separate periods of recession, followed by recovery with related bull and bear markets for both bonds and equities. However, we will need to pursue a different investment strategy to that which has worked so well for the past decade or so and will need to be more active and flexible with our approach. We have already made a number of significant changes to our portfolios over the past year or so as we navigate our way through the changing world. As I have already stated, the short-term outlook is highly uncertain and it is even more difficult to take a long-term view with any level of conviction. Hence, we will continue to monitor events closely and react, as required.

Markets are likely to stay volatile over the next few months given the unusually challenging and uncertain macro backdrop. Weakening growth, falling liquidity, high inflation, a Fed that looks intent on making a policy error and elevated geo-political risks are a powerful and potentially negative combination. Having said that, I think the bear market in bonds is pretty advanced and yields are now pricing in a lot of bad news about inflation and interest rates. Any good news on this front would likely see a strong rally, especially in sovereign bonds. Care is still required with credit markets and emerging market debt given the strong Dollar, deteriorating growth outlook and risk of rising default rates. However, yields are looking very attractive in a number of areas and bonds could deliver surprisingly decent returns over the next year or two should the inflation and growth outlook improve, as I expect.

Equities remain at risk in the near term and whilst I hope that the current year-to-date lows will hold, further downside is possible given the above. The good news, however, is that valuations across many markets and sectors are looking much more attractive, although the market still seems to be too optimistic on earnings given the likelihood of a longer and more severe growth slowdown. It’s also important to note that sentiment towards equities is very negative at present, indicating that a lot of the bad news has probably been discounted in current prices. At some point, the Fed will be forced or able to ease policy, hopefully thanks to falling inflation, and markets are likely to recover strongly as they discount lower rates and bond yields together with a recovering growth outlook. In the meantime, a number of interesting opportunities are starting to appear in stocks, sectors and markets, which we will look to take advantage of.

The strong Dollar continues to dominate the global backdrop and is causing problems for many emerging markets, Dollar debtors and indeed other developed economies. I don’t think this will change any time soon, or at least until the Fed changes tack. The Dollar is strong due to falling money supply, a very hawkish Fed, rising real yields on Dollar assets and the fact that the US economy is strong relative to Europe, Japan and China. It will need one or many of these attributes to change for the Dollar to reverse course but as I have already explained, this could materialise sooner than expected. Another way in which the Fed could take some of the pressure off the currency and help markets would be if it enters into some sort of currency agreement with other global central banks. During similar periods of Dollar strength, when the economic and market outlook has been threatened, the Fed has sometimes made Dollars available to other central banks to weaken the Dollar and add liquidity outside of the US. With a G20 meeting coming up in Bali in November, this may be the welcome surprise that markets are looking for. Risk assets would likely rally strongly should this materialise.

I have previously explained that I think we are in a long-term bull market for commodities, especially energy, based on the changing world order, de-globalisation, a likely excess of demand over supply across many sectors and an under-investment over a prolonged period. Commodities, including energy, will struggle over the next few months as recession bites but any further weakness will provide an attractive energy point. Whilst gold has been relatively disappointing in Dollar terms, it has been an excellent investment over the past year or so in Sterling, Euro or Yuan terms thanks to the appreciation of the Dollar against those currencies. As I have mentioned previously, I think gold is in a bull market and should be in many portfolios as a hedge against higher inflation and a more volatile macro environment. However, at some point, investors may elect to hold gold but hedge out the Dollar risk given the possibility of a reversal of recent trends.

Given the uncertain and problematic economic and market background, we remain defensively positioned for now with lower equity weightings, more cash, short-duration bonds and a suitable balance between growth, value and defensive equities. However, I am hopeful that markets will stage a powerful recovery over the next few months as inflation eases, the Fed backs down and markets look forward to stronger growth.

We are looking for a number of catalysts to turn more bullish on risk assets and these include a Fed pivot, signs that inflationary pressures really are easing quickly, co-ordinated action to weaken the Dollar and aggressive easing from China. Capital preservation remains a key focus for now, but markets have discounted a lot of bad news and better times lie ahead.

Sources:

- GBP Ravenscroft Cautious Model Performance Data, Total Return 30/06/2022 to 30/09/2022. Source: Ravenscroft Investment Management Limited.

- Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return 30/06/2022 to 30/09/2022. Source: FE fundinfo.

- GBP Ravenscroft Balanced Model Performance Data, Total Return 30/06/2022 to 30/09/2022. Source: Ravenscroft Investment Management Limited.

- IA Mixed Investment 20-60% Shares Sector, GBP Total Return 30/06/2022 to 30/09/2022. Source: FE fundinfo.

- GBP Ravenscroft Growth Model Performance Data, Total Return 30/06/2022 to 30/09/2022. Source: Ravenscroft Investment Management Limited.

- IA Mixed Investment 40-85% Shares Sector, GBP Total Return 30/06/2022 to 30/09/2022. Source: FE fundinfo.

- MSCI World, USD Total Return 30/06/2022 to 30/09/2022. Source: FE FactSet.

- MSCI World, GBP Total Return 30/06/2022 to 30/09/2022. Source: FE FactSet.

- GBP Ravenscroft Global Blue Chip Model Performance Data, Total Return 30/06/2022 to 30/09/2022. Source: Ravenscroft Investment Management Limited.

- GBP Ravenscroft Global Solutions Model Performance Data, Total Return 30/06/2022 to 30/09/2022. Source: Ravenscroft Investment Management Limited.

- MSCI World, GBP Total Return 30/06/2022 to 30/09/2022. Source: FE FactSet.

- Polar Capital Technology, GBP Total Return 31/12/2021 to 30/09/2022. Source: FE fundinfo.

- Polar Capital Technology, GBP Total Return 30/09/2019 to 30/09/2022. Source: FE fundinfo.

- Polar Capital Technology, GBP Total Return 30/09/2017 to 30/09/2022. Source: FE fundinfo.

- Polar Capital Technology, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

- The rearchitecting of enterprise workloads to the cloud expenditure. Source: June 2022 factsheet for Polar Capital Global Technology.

- Monetary figure for the potential contribution from Artificial Intelligence to the global economy. Source: PwC, Sizing the prize What’s the real value of AI for your business and how can you capitalise?

- US and UK interest rate projections for July and September. Source: Bloomberg World Interest Rate Probabilities.

All performance data above was collated on 04/10/2022