This week’s update is written by William Lynne, from our team in Bishop’s Stortford

Most private client portfolios will comprise a blend of fixed income and equity investments. There is an historic reason for this approach. For the last few decades (excluding this year) fixed income and equities have been inversely correlated and thus the blend of these asset classes reduces the overall volatility of the portfolio and smooths the performance. Adjusting the blend 60:40 or 20:80, for example, can allow for risk-targeted portfolios to be constructed to suit different client risk mandates.

However, this inverse correlation is not a permanent state1 and there have been long periods of positive correlation through different eras. Inflation is a key factor here. Rising inflation is typically dealt with by raising interest rates, which negatively impacts bonds and worries equity markets, both in terms of recession and discounted cashflows of future returns.

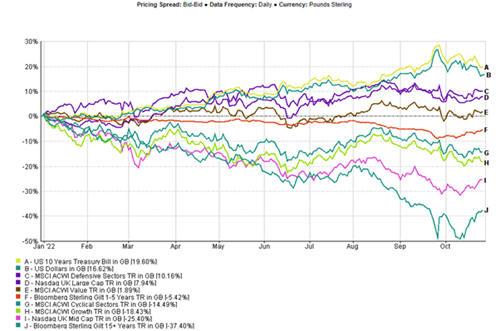

Whilst bonds and equities have become more correlated, the sub-sectors within these broad asset classes have become anything but. For example, in the UK a Large Cap Index is down 4.2% year-to-date, whereas a Mid Cap Index is down roughly 24%. The 15+ year Gilt Index is down 37%, making the 1-5 year gilt index's demise of 5% look reasonable.

But it has not just been size and maturity driving the differentials. Style factors have become uncorrelated too. The MSCI World Defensive Index is up 10.2% and the MSCI Growth Index down 18.4%. There is even dispersion between two styles that were bundled together in most people's minds back in January, but year-to-date the MSCI Value Index is up 1.9%, while MSCI Cyclicals Index is down 15.5%.

Layered on top of all this, we have had significant currency swings, the dominant one being the strength of the US Dollar. As sterling investors, we have seen around a 17% benefit from being in USD earners/yielders. Consequently the 10-year US Treasury Bond has returned a positive 19.6% year-to-date in GBP. Imagine what it would feel like if you were a US investor in the UK Mid Cap, with the market and the currency doubled up against you. This might explain some of the extreme underperformance in that segment as overseas investors have bailed out.

So, what can we make of all these seemingly chaotic swings in fortune?

Firstly, that it still holds true that a well-diversified portfolio across maturities, credit ratings, styles, factors, geographies, currencies, size &c. remains a sound mechanism for smoothing volatility. Bonds and equities may be correlated for some time to come, but not all bonds are equal and not all equities either.

More exciting is that from all the chaos there will inevitably arise pockets of opportunity. Fear and panic, (not to mention margin calls and mini-budgets) have already begun to create extreme situations in niche sub-sectors that we will look back on in years to come; wistfully if we take those opportunities and regretfully if we do not. It is not yet a time to be brave, but definitely a time to be pragmatic.

We hope you have a good week.

Sources:

- All Index and currency references from FE

- 1 Graham Capital Management Research Note