“It ain’t what you do, it’s the way that you do it

It ain’t what you do, it’s the time that you do it

It ain’t what you do, it’s the place that you do it

And that’s what gets results”

It Ain’t What You Do – Bananarama and Fun Boy Three, 1982;

(Songwriters: James Young / Sy Oliver)

Please click here to view/download the PDF of this update.

At a conference attended by one of our team recently, the opening speaker – founder and chairman of a highly regarded credit-focused fund house – reminded his audience of the quote attributed to JK Galbraith (or possibly Ezra Solomon - another eminent economist) that “The only function of economic forecasting is to make astrology look respectable”.

Events during the past quarter and year to date have done nothing to dispel that view. Despite the efforts of an entire army of analysts, consensus estimates have failed to match major economic releases with monotonous regularity, eliciting rallies or sell-offs across markets and prompting adjustments to forecasts for the next figure, which… well, you can guess the rest. The only real surprise is that anyone is surprised when the darts miss the number, or sometimes even the board.

Success in forecasting may be challenging for even the smartest, most qualified and best-informed observers (including central bankers!), but ignoring the macro in a post-QE, inflationary world is clearly not an option. To this end, a session presided over by our CIO Kevin Boscher and dedicated to surveying the top-down economic landscape is part of our group-wide monthly meeting schedule, from which it is the direction of travel, rather than individual data points, that we look to guide us. To be clear, in terms of our investment process this is an evolution rather than a revolution: the thematic approach that seeks to harness growth tailwinds from secular trends remains at its core. Nonetheless, the changeable environment that we expect to prevail over the medium-term dictates that an approach incorporating a greater element of flexibility and manoeuvrability that was previously necessary is not just desirable, but essential.

In portfolio terms, this has already been reflected in a number of changes during recent quarters. Within fixed income allocations a more active approach has seen sovereign debt exposure rotated between markets and maturities.

Meanwhile, funds with mandates that afford an active approach to positioning in duration and credit have replaced outgoing core investment grade corporate “buy and hold” offerings. In the equity space, strategies that target companies with in-built protection or that may benefit from inflationary conditions have been added to our manager roster, at the same time as exposure to traditional quality growth managers has been reduced. In addition to these changes, holdings in a dynamically managed absolute return fund have been initiated as a core position across all models. Our Blue Chip team have also been busy considering the implications of a more volatile and fractured world and they convey their thoughts, explaining some of the changes made, later on in this newsletter.

Separately, from the perspective of viewing “a changing world through a thematic lens”, we are re-visiting each of the aforementioned long-term investment themes, both individually and collectively, with the aim of identifying whether (and if so, how) an environment characterised by volatility in inflationary forces might affect them. Whereas early indications are that the relevance and durability of the current themes is (reassuringly) not in question, this process may well result in changes to the funds that underpin them, or even see new themes put up for consideration.

We wish our readers a healthy, happy and prosperous 2023.

Cautious Portfolios:

Lower Risk

By Robert Tannahill

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

Annus Horribilis

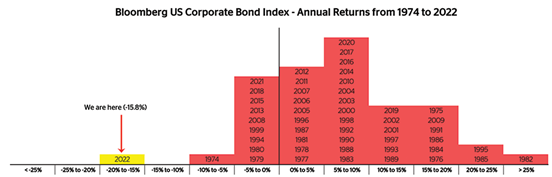

Some years go down in stock market folklore as truly horrible. For bond investors, the infamous years are 1974 and 1979 – the two big oil shocks – and 1994’s “the Great Bond Massacre” when a change in direction from central banks spooked a complacent market. We can now add a fourth year to this hall of infamy.

2022 is the worst year on record for bonds in a number of markets. US corporate bonds (which have a long history) ended the year down -15.8% (1) – more than twice as bad as the previous record year of 1974 at -5.9% (2). In mid-October the average sterling corporate bond fund was down a shocking -23.2% (3)! Truly a year most investors will be pleased to see the back of. The silver lining is that such years have always historically preceded strong recoveries, as the fears of a worst-case scenario which drive the lows in markets are replaced by a bad, but manageable, reality. This is displayed in the table below where some of the best years for bonds, 1975, 1982 and 1995, all came shortly after some of the worst.

Against this difficult backdrop, the Cautious Income strategy returned -8.6% (4) over the year thanks to a solid rebound in the fourth quarter of +3.9% (5), as markets began to feel they had a handle on the likely path for inflation and interest rates. This left the strategy comfortably ahead of both the IA Mixed (0-35%) Sector at -10.6% (6) and the average sterling bond fund at -16.1% (7). While relative numbers are clearly of limited comfort when portfolios are down; we hope that knowing that your portfolio returns are reasonable, given market conditions, offers some small relief.

As we covered in detail in our Q3 2022 commentary, the key focus throughout the year has been the likely path of inflation and, by extension, interest rates. As investors have swung between hope and fear on these subjects, we have seen markets rise and fall repeatedly. A major positive in the fourth quarter was the US inflation data (CPI) in October. This not only confirmed the ongoing downtrend in headline inflation, but also showed a drop in core inflation, which had spiked in August and worried markets. This data point was so influential that the market low lined up exactly with the US CPI release on 13th October. This good news on inflation was reinforced in November when the next data set came in on-trend and showed inflation to be falling faster than expected. This led to a broad rally in both bonds and equities from mid-October to late November when the Federal Reserve (“the Fed”) came out to try and cool markets’ heels, leading to a choppy December.

Market pricing is increasingly implying a so-called “soft landing”, whereby central banks bring inflation under control without causing a deep and painful recession. The Fed is cautious, however, worrying that an early recovery in markets could fan the flames of inflation and undermine the soft landing. Accordingly, there is something of a tightrope to be walked by markets and central banks over the next few months.

Over the course of 2022 we have been progressively moving the strategy to try to maximise the value in the portfolio whilst reducing uncertainty.

This has the goal of maximising the recovery potential in the portfolio – once markets find their feet – all while reducing risk.

On the value side, we have been building a position in Prusik Asian Equity Income, which not only owns a number of assets with inflation protection, but also sports a dividend yield of around ~6% and trades on valuations around the levels we saw in the 2008 Global Financial Crisis. We began buying Prusik in early March and it went on to be our top performing equity fund in 2022, which was very pleasing to see.

We also added Sanlam’s Hybrid Capital Bond fund. While this Fund hasn’t been as positive in the year as Prusik, given the value on offer within Sanlam, we are optimistic about it’s potential in 2023.

On the risk side, we have been aiming to build inflation protection into the portfolio and to move our core bond positions towards more actively managed strategies. An example of this is our move from a passive position in US Government Inflation Protected Securities (“TIPS”) to an actively managed fund in the form of Ruffer’s Total Return Fund. While the Ruffer fund plays a similar defensive role in the portfolio, it is both more diversified and more actively managed. The portfolio is built around a core of equities, gold and bonds and did very well this year in rapidly changing market conditions.

For example, when we had the UK government bond market crisis following the now-infamous mini-budget, Ruffer was able to buy long‑dated bonds at extremely attractive prices. Crucially, the window for picking up the best bargains was limited to a few hours one October evening. This, for us, underscores the need to be nimble in the sort of volatile markets we have seen this year and emphasises our move towards actively managed funds. My colleague, Tom, discusses Ruffer in more detail in the Fund in Focus section of this newsletter.

As we look forward into 2023, a significant portion of the portfolio is now trading at very attractive levels. We have one more change to come. Once this goes through, we would argue that around 60% of the portfolio is highly attractive from a valuation perspective, with the potential to produce returns over the next year or so in the high single‑digits to low double-digits. It is this value, which difficult years like 2022 create in markets, that sows the seeds of the eventual recovery. This is why, as we can see on the chart above, the worst years tend to precede some of the best years – provided they don’t scare people out of the market along the way. Our job is to make sure your portfolio is best positioned both to weather the current storm and then to benefit from the eventual recovery.

Balanced Portfolios:

Medium Risk

By David Le Cornu

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Ostrich or the Owl?

Despite its use by luminaries such as Robert F Kennedy, Arthur C Clarke and Hilary Clinton, the origins of the phrase “may you live in interesting times” is debated and often incorrectly referred to as originating from a Chinese curse. What can’t be debated is that 2022 was an interesting (challenging) year. Central Bank flip-flops, the acknowledgement of structural inflation, interest-rate rises, war, record heat-waves, diminished crop yields, strikes, magic money trees, the passing of the longest reigning monarch, and the shortest serving UK prime minister were some of the interesting things that occurred in 2022.

Events in financial markets were as interesting (challenging) as events in the real world. Investments mostly had a correlation close to 1 with defensive assets such as high-quality bonds falling in tandem with (and at times more than) their riskier cousins, equities. The UK Government 20 year Gilt lost more than one third of its value. Within equities, the combination of rising cost of capital and discount rate hit highly valued growth companies hardest; Meta losing about two thirds of its market value, Amazon, Tesla, Nvidia and Netflix around a half, Alphabet a third, and Microsoft and Apple a quarter of theirs (8). Crypto collapsed, with flagship Bitcoin losing two thirds of its value across the year. (8)

When faced with times such as we have been experiencing, the investment industry tends to embrace one of two strategies: the ostrich strategy or the owl strategy.

The ostrich strategy involves sticking your head in the sand, ignoring events around you, doing nothing and hoping that your clients will be patient and wait for better times.

The owl strategy involves keeping your eyes and ears open, being alert to changes around you, adapting to change and communicating with your parliament.

The Discretionary team has embraced its inner owls this year. The world has changed more than usual during 2022; accordingly, strategies have experienced higher than usual activity as we have adapted them better to cope with the high inflation and rising interest-rate environment in which we find ourselves.

At a headline level, when looking at the asset allocation of the Balanced strategy, it would be easy to think that we had followed the ostrich strategy and not changed over the year.

|

Asset Allocation |

1st January 2022 |

31st December 2022 |

|

Cash and Equivalents |

9.6% |

9.1% |

|

Bonds |

35.6% |

39.3% |

|

Equities |

54.8% |

51.6% |

However, when we look below the surface it becomes clear that a lot has changed during 2022. Turnover within the strategy is approaching 50% and the number of holdings has increased from 18 to 22, improving diversification.

Bond exposure was reduced and duration shortened. Within equity, we removed our growth bias by increasing exposure to value and equity income. We also sought to reduce the portfolio’s sensitivity to inflation by increasing exposure to equities that could cope better with an environment where inflation may be higher and volatile. Furthermore, we increased exposure to equities which we believe will be relatively insensitive to the recession that is rapidly approaching. A defensive multi‑asset class fund has also been introduced to help diversify the defensive part of the portfolio.

The Balanced strategy has seen a number of long-term favourites such as Fundsmith Global Equity, Lindsell Train Global Equity, PIMCO Investment Grade Bond, Arisaig Global Emerging Consumer and Polar Capital Healthcare Opportunities leave the strategy. In contrast, Guinness Global Equity Income, Prusik Asian Equity Income, KBI Global Sustainable Infrastructure, Lazard Global Thematic Inflation Opportunities, Sanlam Hybrid Bond, Polar Capital Global Insurance, Polar Capital Biotechnology and Ruffer International Total Return fund have entered the strategy.

A reasonable question to ask would be: Has all the portfolio activity in 2022 added any value?

When running a comparison of the performance of the holdings in the Balanced strategy as of the start of 2022, to the strategy’s actual performance, the activity added value.

Another reasonable question to ask would be: Will the flight path be smoother and portfolio activity be lower in 2023?

There are a lot of reasons to remain cautious in the near term, but is this wise? Owl thinks the worst is probably behind us and the 12 months ahead will be kinder to investors than the 12 months behind us. However, until inflation is unquestionably falling and Central Bankers’ rhetoric around interest-rate policy softens, markets will remain overly sensitive to every inflation print and Central Bank statement. There is also the risk that the Global recession that is approaching ends up deeper and longer than investment markets are anticipating. This is counterbalanced by many things, including lower valuation levels, investors deploying lower levels of leverage, high cash levels, and high levels of fear being displayed amongst investors. There may be some turbulence during the first half of the year, but, barring extreme unanticipated outcomes, this should lead to better flying conditions (and better return for investors) in the second half of the year.

As the year progresses, I suspect we will begin to look past the recession and begin to anticipate recovery. 2023 is expected to be a tale of re‑risking. First, I expect we will continue to add to bonds and extend bond duration to position ourselves to benefit from the crystallisation of some of the embedded value in fixed-income markets. Second, I expect we will be rebuilding equity towards our maximum allocation of 60% and rotating some of the equity content to emphasise those parts of the market that we expect to recover first and most significantly. There may also be some repositioning in relation to work that we are undertaking in relation to our long-term themes, some of which may be refined and refocused. Despite the vast amount of ongoing change in the world, I anticipate that turnover within the Balanced strategy will be much lower in 2023 than it has been in 2022.

The Balanced strategy posted +3.4% (9) for the quarter, versus the IA Mixed (20-60%) Sector at +3.1% (10). I hope that the Ravenscroft Owls have communicated well with our parliament this year, if not please let us know if you have questions about portfolio activity, performance, or the flight path ahead of us in 2023.

Growth Portfolio:

Higher Risk

By Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

If I were to use one word to describe 2022 from an investment point of view, it would be “difficult”. If I could use two, the second would be “volatile”.

Given the events of this year, the Growth strategy ended up +2.9% (11) for Q4 2022, versus the IA Mixed (40-85%) Sector at 1.5% (12), and for the calendar year of 2022, the strategy posted -9.5% (13), versus the Sector at -10.0% (14). No manager likes to post a negative year, and as investors with capital in the strategy, we understand that this may not have been the outcome our clients wanted.

But, when we look back on the year, it has been anything but straightforward, which helps explain why 2022 has been “difficult”.

The below shows the high (but mainly low) lights:

2022 – the entire year: Inflation grips the nation and Central Banks respond by increasing interest-rates for the first time in over a decade.

Bonds have taken the brunt of this, since bonds are sensitive to inflation and the associated interest-rate rises needed to curb this. The Bloomberg Global Aggregate Credit Hedge GBP (the broad index we use to measure bonds), year-to-date performance was -15.3% (15). At its worst point in mid-October, this reached lows of -19.1% (16). Growth-centric assets also fell heavily across the year as companies’ future returns were expected to lower on higher interest-rates. The MSCI World Growth Index fell -20.1% (17) year‑to‑date and at its nadir, in mid-June, it posted -23.8% (18).

21st February – and ongoing: Vladimir Putin declaring war on Ukraine.

This devastating announcement put even more strain on an already worried market, those assets which should act as a flight to quality and go up in such a scenario, were mixed. In US dollar terms, Gold rose nearly ~10% from the end of January to the end of March, whilst US Treasuries fell around -4%. This highlighted that the bond market was more concerned with inflation rather than war.

September 6th: Liz Truss is appointed Prime Minister of the UK after Boris resigns.

The UK had been fairly resilient over 2022, especially the FTSE 100 since it is peppered with large-cap energy companies. Given the energy security issues we were facing over the war, this worked in favour of the index. There had been a lot of volatility in the UK market as politics has not been easy this year at all, but the UK market bounced on her appointment.

October 16th – 23rd: 20th National Congress of the Communist party.

The market has been exceptionally volatile, especially due to China’s stance on operating in a zero-Covid world. For example, the MSCI China Index fell -19.3% (19) (in GBP terms) in October and rose +25.4% (20) in November.

October 17th – 25th: The UK mini-budget – known in the press as “Truss economics” – Rishi Sunak becomes Prime Minister after the resignation of Liz Truss on 20th October.

The market really disliked the budget that both Truss and Kwarteng put together. Markets were volatile in the run up to Liz Truss’s appointment over concerns about Boris, not to mention the budget, and then calls for her resignation. This came 44 days into her appointment, giving her the title as shortest-serving Prime Minister. From the 19th August to the 12th October 2022, the FTSE 100 fell -9.2% (21), it then rallied +10.4% (22) to the 30th November 2022.

These are just a few of the headlines for 2022. We also saw elections, Elon Musk buying Twitter and, most recently, the collapse of FTX Trading and a currency market seeing extreme moves. We saw the GBP vs USD go from 1.35 at the beginning of the year to lows of 1.07, ending the year at 1.22 (23).

I think the one overriding concern the market has had this year has been inflation, and the Growth strategy has tried to navigate this through purchases in Lazard Global Thematic Inflation Opportunities and Ruffer International Total Return, both of which Tom has written about in the Fund in Focus this quarter.

What Does the Future Hold?

If only I could answer this question with certainty; unfortunately, the last time I checked, my crystal ball was missing, and it was always a little bit wonky. Looking back over the last 10-11 years, markets have been in a highly stimulative mode, mainly due to the actions of the Federal Reserve (as in lowering interest-rates and buying bonds), inflation struggling to get above 2%, and investors being in the “Fear of Missing Out” mode, otherwise known as “FOMO”. All of this resulted is stock markets going higher, yields getting lower, and the price of bonds increasing.

I think the one thing I can say is that it is highly unlikely that the previous decade will be repeated in forthcoming years as we have hit “reverse gear”. The Fed is now in tightening mode, inflation is at a 40-year high and investors are thinking about preservation of capital.

Given this outlook, we have been thinking a lot about how we are going to position our portfolios. We have already started the process, as mentioned above, but there will be more changes ahead, some of which you may not have seen in our portfolios for a long time as we try to navigate the

difficult world that we now inhabit.

I would like to take this opportunity to say thank you as investors or future investors of the strategy. Your investment is never taken for granted and if you would like to contact any of the team with questions, then please do so at any time.

Global Blue Chip Portfolios:

Higher Risk

By Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

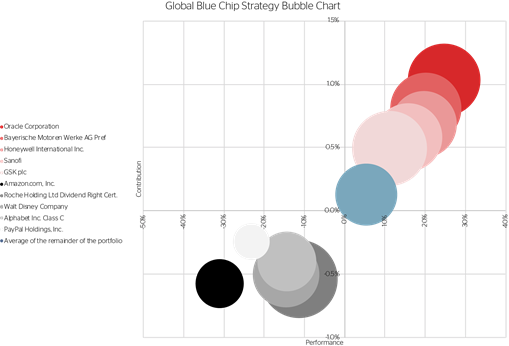

The Global Blue Chip strategy was up +4.8% (24) for the quarter. By comparison the MSCI World Index returned +1.9% (25) and the IA Global Sector +2.2% (26). The difference predominantly results from the strong performance of the strategy’s consumer discretionary and technology names which significantly outperformed their respective index components (adding over 400 basis points of relative performance). For the 2022 calendar year, the Global Blue Chip strategy was down 4.0% (27) outperforming the index by 3.8% (28) and positioning the strategy within the top quartile among the peer group.

The top contributor during the quarter was Oracle (up 24.7% in GBP and contributing 1.0% to the overall performance). The market reacted favourably to the very positive tone set at the Company’s annual CloudWorld conference where management estimated revenue would grow to $65Bn by 2026 – significantly ahead of consensus.

This was followed by BMW (+20.2%, +0.8%) which continued to benefit from the demand for its electric vehicles despite a challenging year for vehicle sales more broadly. In addition, the Company already traded on a low multiple and did not suffer from the same de-rating as some of the other more highly-rated (and growth-orientated) stocks within the portfolio.

Honeywell (+19.7%, +0.7%) had a strong set of Q3 results with the Company raising its year-end guidance. The Company offers exposure to an eclectic mix of commercial end-markets that are performing strongly and attracting investor attention. Honeywell has little end‑retail‑consumer exposure; in other words, most of its sales go to other corporate customers who have yet to moderate spending. For example, the commercial aerospace sector continues its recovery to pre-pandemic levels and high energy prices have encouraged oil & gas companies to increase spending on services and parts. Meanwhile, sustainability investment remains high – boosting sales of the Company’s building controls technologies and performance materials technologies.

Sanofi (+15.9%, +0.6%) and GSK (+11.2%, +0.5%) are both defendants in US class-action lawsuits alleging that Zantac causes cancer. Both companies’ share prices were adversely impacted in Q3 when analysts predicted potential liabilities should the defendants be found culpable. We wrote extensively on the matter. Recent developments regarding these lawsuits have been encouraging. In December, the judge overseeing the closely-watched Federal hearing, astounded all by dismissing the plaintiffs’ case entirely for lack of evidence – we see this as an extremely positive development.

Turning now to the detractors, Amazon (-31.0%, -0.6%) was the largest. Amazon shares continued to come under pressure as the market expressed concerns about the impact excess capacity at its fulfilment centers would have on profitability.

Roche (-11.3%, -0.5%) continued to suffer from tough year-on-year comparisons as treatments and diagnostic requirements for Covid-19 continued to fall. In addition, the Company had a major setback with its Alzheimer treatment – Gantenerumab – failing phase 3 trials after it did not prove to slow clinical decline in people in early stages of Alzheimer’s disease.

The market reacted unfavourably as the negative financial impact of streaming investment at Walt Disney (-14.5%, -0.5%) continued to mount. Bob Chapek attempted to calm investors on the earnings call by stating that streaming losses had peaked; but internal fighting led to the return of former CEO, Bob Iger, and Chapek was unceremoniously ousted. Now that the highly respected Iger is back at the helm, we expect stability and harmony to be restored. We continue to believe Disney’s cache of content is undervalued, but we suspect investors will want to see meaningful reductions in losses at its streaming division, Disney+, before shares start coming close to reflecting this value.

Alphabet (-14.4%, -0.4%) came under pressure when growth in its core Google Services segment slowed as brands cut advertising budgets in response to fears over the consumer’s ability to spend. Long-term, we believe Alphabet (and its vast quantity of first-party data) is likely to be a beneficiary of the crack-down on tracking and browsing privacy. This is likely to be a key differentiator between Alphabet’s ability to serve consumers relevant advertisements and that of its competitors, who rely heavily on third-party data.

We have long been admirers of PayPal’s (-14.4%, -0.4%) online checkout business which rose to prominence due to its undeniable improvement over the convention at the time (which involved posting physical cheques to merchants). This is a leadership position that, until recently, PayPal has been able to maintain. With the ascent of Apple/Android Pay we started to have concerns that PayPal’s position as the most convenient checkout method was under attack. This was confirmed during PayPal’s recent earnings update where the company announced an agreement with Apple under which it would make its own payment credentials available for inclusion within Apple’s digital wallet. We believe this move discourages PayPal users from logging into the PayPal ecosystem and thus limits PayPal’s ability to monetise its other services.

In light of the above, we worry that digital payments are becoming commoditised; further, we expect profitability may come under pressure as a result. We would prefer to admit our mistake and reallocate the funds to businesses where the existence of pricing power is beyond question.

During the quarter we also made a number of other changes to the portfolio.

We introduced Bio-Rad Laboratories to the portfolio. Bio-Rad is a well-run family-controlled business, operating in the life sciences and diagnostics markets; the company is this quarter’s Stock in Focus.

We also reintroduced Edwards Life Sciences to the strategy. In April 2022, we exited the business on valuation grounds. The shares then sold-off after the company announced revenues and earnings that missed expectations – for reasons, we felt, that were beyond the company’s control (hospital staff shortages impacting elective surgeries). This allowed us to re-purchase shares at a 40% discount to the price at which we previously sold and we were pleased to welcome a familiar name (and excellent business) back into the portfolio. These positions were funded by

the sale of Medtronic.

Medtronic has been a long-standing position in the portfolio, acting as our catch-all play in the med-tech sector due to its broad offering of medical devices. As our research deepens – and prices fall further – the number of focused, faster-growing alternatives and competitors is increasing (Edwards being a perfect example). Given this environment, we decided to exit the position entirely.

In addition to the Medtronic sale, we also exited our positions in Adidas and PayPal. Our investment in Adidas was a relative-value play in a sector we like but where our preferred company (Nike) was richly valued. Unfortunately, the Adidas management team has not proved as able as we initially believed, and inventory issues, combined with the collapse of the company’s licensing deal with Kanye West, have seen the shares come under significant pressure. As long-term investors, we believe the quality of management (and the culture it sustains) has an outsized impact on investors’ returns. It seems to us that Adidas has fallen victim to a poor culture. Whilst an overhaul may be successful, we think there are better opportunities elsewhere.

In summary, there is no doubt that 2022 proved to be a challenging year for equity investors. Whilst we would prefer to be here announcing double-digit returns, we were generally pleased with how the strategy held up in difficult markets. We believe the strategy’s performance is a direct outcome of our investment process and the desire to focus our time on identifying the highest quality businesses while ensuring that we don’t overpay for exposure to these future cashflows.

Our dedication to this approach is unwavering, since we believe it is the best way to navigate uncertainty. As always, we seek to position ourselves to deliver on the mandate while seeking to achieve your investment goals. In order to offer you more insight into the current market dynamics and what might be in store based upon previous market cycles – and why our approach remains relevant – please read ‘Market Cycles, Navigating the Journey from Exuberance to Despair’, which is available on our website.

We would like to take this opportunity to thank you for your continued support and look forward to working with you in 2023.

Global Solutions

Higher Risk

By Shannon Lancaster

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

‘Though we cannot direct the wind, we can adjust the sails’ is a quote attributed to many and one that is very apt for us this year. While the seas in 2022 have certainly been choppy, the past twelve months have been an outstanding training ground for learning some important lessons and provided us plenty of opportunities to ‘adjust our sails’. We have witnessed the importance of diversification and being nimble in our portfolios. We have reflected on our existing themes and the underlying funds within them. It has encouraged us to look beyond existing asset-class exposure to ensure our portfolios are resilient enough and flexible enough to withstand ongoing volatility and uncertainty.

While this has resulted in changes to other strategies, there were no changes in the first nine months of the Global Solutions strategy after initiating positions at the end of March. The strategy provides investors exposure to five themes: environmental solutions, basic needs, emerging equality, energy transition and resource scarcity. We have highlighted, below, some funds within some of the themes and discussed underlying performance since launch (on 31st March 2022):

Environmental Solutions

With three billion more people expected by 2030, pressure on the world’s finite natural resources will intensify and lead to scarcity challenges. There is an opportunity for companies to recognise this trend and offer innovative solutions to our global environmental issues.

One fund that benefits from this is KBI Global Sustainable Infrastructure, which returned +0.2% (29) and benefited from utilities and industrials exposure – both of which were strong performers this year.

On the other hand, Montanaro Better World, despite having some similar sector exposure, was the bottom-performing fund within environmental solutions. The Fund’s small and mid-cap quality growth tilt was very painful this year.

Basic Needs

As the population grows, more people will need more food, water, materials, and energy from an already resource-strained planet. We believe that everyone should have access to clean water, education, nutrition, healthcare, and an efficient waste management system. Investment is needed in these areas in order to meet this growing demand.

Candriam Oncology was the best performing fund within this theme, returning +6.9% (30). The world is getting older and with age, unfortunately, comes the increased risk of ill health. The Fund provides us with an opportunity to invest in the fight against cancer, which is the number two cause of death worldwide. It has benefitted from large-cap pharmaceutical names and biotechnology positions. Some merger and acquisition activity also contributed to performance.

On the other hand, while Polar Healthcare Discovery also enjoyed some beneficial take-outs of underlying businesses, being positioned further down the market-cap spectrum was a significant detractor this year. The team believes that while it is likely that macroeconomic challenges could be with us for a while longer (and many industries may see earnings downgrades) healthcare should be more resilient.

Emerging Equality

The investments in this space focus on addressing the basic needs mentioned previously – specifically in emerging markets. The topperforming fund was Aikya Global Emerging Markets, which focuses on providing strong downside protection by investing in more defensive quality businesses. The result is a portfolio that is primarily made up of consumer staples, discretionary and healthcare businesses that aim to improve lives in emerging markets. The Fund’s defensive positioning and regional exposure to areas like India were beneficial this year, making the Fund the top performer in this theme.

The bottom performer in the allocation was Impax Asian Environment. There are two emerging market funds within this theme; Impax focuses solely on Asia. The China and Japan exposure was painful; additionally, the portfolio has more technology and growth stocks, which both fell out of favour in 2022.

Energy Transition

Migrating from today’s carbon-heavy economy to a potentially low-carbon future will require massive investment across the value chain by 2050. The ongoing energy crisis brought the transition theme under scrutiny this year as many considered how the awful events in Ukraine could impact progress towards our renewable-energy-powered future.

The shockwaves of the European energy crunch have reverberated across the globe and politicians have been scrambling to shield consumers and businesses from the impact of substantially higher gas and electric bills. Additionally, they have been searching for ways to protect adequate gas supply for critical functions. As a result, in the short term at least, all options are on the table. The short-term measures focus on diversifying the gas supply, ensuring Europe’s gas stores are filled up ahead of next winter, and protecting vulnerable consumers and businesses against soaring power prices. Although these measures mean extending the use of traditional energy sources like coal, this should not be interpreted as a side-lining of the energy transition. In fact, many believe that decarbonizing and electrifying the energy could be a way to end energy reliance on Russia. The goal of net zero has not changed and this crisis has created an additional catalyst to move to a future free of fossil fuels, potentially at a more accelerated pace.

Our fund managers believe the energy challenges facing world economies today create substantial opportunities for investors due to the resulting heightened urgency to encourage renewables adoption, not only to combat climate change but also provide regional energy security. We access these opportunities through three funds in Global Solutions.

Gratifyingly, all three funds in this theme outperformed the MSCI World Index as they benefited from traditional energy exposure. It is pleasing to report that our underlying fund managers state the leaders of the major integrated energy companies understand the enormity of the energy transition challenge. Despite the near-term demands from many industries to increase the supply of oil and gas in the midst of the global energy crisis, these companies are aggressively redirecting their capital towards low-carbon-energy solutions, which is generally underappreciated by the broader market. Traditional energy companies have a crucial role to play in the transition and some should be considered as part of the solution.

Adjusting the Sails

As Howard Marks wrote in his latest memo, the investment world may be experiencing the third true sea-change of the last 50 years. One of our fund managers left us with a brilliant quote this year that we think is apt to end this note on: “a wise man focuses not on predicting the weather but on strengthening their boat”. With that in mind, we will continue to review our holdings and our process to ensure it evolves both to mitigate new risks and also to capture attractive investment opportunities.

Fund in Focus:

A Review of Polar Capital Technology

By Tom Yarwood

As my colleagues have previously touched on in this quarterly, it’s very much been a year of transition as we all look to navigate this new post-QE, inflationary environment that many investors have never experienced before. In order to make sure that our investment approach remains both relevant and appropriate for the decade ahead, it’s important to adapt to this changing world. In portfolio terms, this means building more resiliency and flexibility into our strategies to help better manage the more uncertain period that we’re expecting over the medium term whilst keeping Ravenscroft’s traditional thematic way of investing at the very core of the approach.

This intention to ‘think outside the box’ has so far manifested itself in the inclusion of Lazard Global Thematic Inflation Opportunities, Ruffer Total Return and Allianz Strategic Bond to our strategies. With inflation running at 40-year highs and the latest US print coming in at 7.1% (31), the medium‑term outlook on inflation is unlikely to be linear, so to help navigate a potentially volatile inflationary environment we have recruited the likes of Lazard Global Thematic Inflation Opportunities and Ruffer Total Return.

As Samantha has previously discussed in the Ravenscroft Growth strategy Q2 commentary earlier this year, Lazard Global Thematic Inflation Opportunities is a global equity strategy that’s specifically designed to protect against, and benefit from, an environment of structurally higher inflation. Ultimately, the Fund will still behave like a global equity fund and be affected by tailwinds or headwinds similarly to any portfolio of global equity stocks; however, it possesses the added utility of being an inflationary hedge. This has been reflected in the strategy’s performance this year, having returned +9.1% (32) amount since launch in GBP; it’s pleasing to see the strategy is performing as expected so far and proving to be a great inflationary lever in our Balanced and Growth strategies.

As part of our endeavour to ‘think outside the box’, we also invested in Ruffer Total Return this year. Capital preservation is at the very heart of their investment approach with the team seeking to run an all-weather strategy that is robust during any market conditions, including periods of market distress. In order achieve their aim they can’t be over-reliant on the direction of markets, so they create a balance of offsetting investments holding ‘growth’ and ‘protective’ assets alongside each other and varying their allocations. The strategy does this by blending inflation-linked government bonds, gold and value equities, currencies and derivatives. The idea behind this is that protective assets should perform well during a market downturn, whilst the growth asset should outperform in favourable market conditions – all the while protecting client capital. This deeply embedded philosophy of capital preservation is at the core of Ruffer’s thinking and has helped to create a long-track record of consistent performance. They have provided genuine protection in times of market stress: for example, during the 2008 Global Financial Crisis, the strategy was positive whilst the MSCI World was negative. It behaved in a similar way in March 2020 as the world sold-off during Covid. The Fund is a useful lever in our portfolios, as a durable, defensive asset that should withstand an environment with more volatile levels of inflation.

Given the structural issues potentially facing growth and inflation over the next decade, we have also been considering the world of bonds. We’ve decided to become more active in our fixed-income selection and have been meeting with strategic bond managers, such as Mike Riddell who manages the Allianz Strategic Bond fund. This is one of the newest additions to the Income and Balanced strategies. We first met with Mike back in late June and were impressed by the Fund, which is a flexible and globally diverse fixed-income strategy. Should uncertainty continue to cloud markets, conventional bonds may find it more challenging to avoid negative returns and provide diversification from risk assets – having something that behaves differently should be beneficial. Strategic bond funds, like Allianz, have the flexibility to help mitigate the potential downside risks presented by inflation and growth and are better placed to deliver outperformance compared to a traditional investment-grade credit fund, if the position size is managed accordingly. The Fund itself is an actively managed portfolio that will move in and out of sovereign bonds as market conditions vary. The strategy aims to build an asymmetric portfolio with more upside potential than downside risk by identifying contrarian macro-opportunities and using derivatives to limit their potential losses. This more flexible strategy should be better placed to weather volatile market conditions than traditional bond funds, making it a useful addition to our approved buy list.

Stock in Focus:

Bio-Rad Laboratories

by Oliver Tostevin

In November we added Bio-Rad Laboratories to the Global Blue Chip portfolio. Bio-Rad ticks many of our boxes in terms of what we look for in a prospective holding: competitive positioning in a sector with durable tailwinds; management which is competent, credible and oriented to the long term; and a share price unreflective of the embedded value.

As is often the case for us, we arrived at Bio-Rad indirectly, when we were actually looking at something else. That something else is a Franco-German business called Sartorius Stedim Biotech (SSB). In turn, our interest in SSB arose from our experience with our biopharmaceutical investments, which we’ve written about before on various occasions. With an ageing world and increasing disease burden, the need for cutting‑edge medicines will be increasing for many years to come – a powerful investment theme. But, in a competitive field, it can often be more profitable to hand-out the “picks and shovels” rather than charge right into the gold rush. While we already own a couple of such businesses in this arena (e.g. Waters and Illumina), we have been on the lookout for others and this is where SSB comes in. SSB is one of the four major players in producing the necessary equipment and consumables for manufacturing biopharma drugs. We think it’s a wonderful business with very significant competitive advantages. So far so good, but the problem is the share price – SSB’s qualities have not gone unnoticed. The business was already highly successful prior to the pandemic, but the increased demand for vaccine production coupled with exuberant stock markets put a rocket under the share price sending it to extreme levels. Fortunately, it has been coming back down to earth in the last 18 months, but it’s still not quite cheap enough yet.

Enter Bio-Rad. In the late 1990s and early 2000s, Bio-Rad’s management was far-sighted enough to acquire one-third of SSB’s parent company (with an unhelpfully similar name: Sartorius), at prices a small fraction of today’s. In fact, so successful has this investment been, it now accounts for more than 60% of Bio-Rad’s market capitalisation! This makes Bio-Rad shares trade as something of a proxy for Sartorius and SSB, and so they too have fallen sharply with the turn in markets. Indeed, Bio-Rad sentiment is currently the worst of the three and its shares have returned to pre‑pandemic levels. But when we turned our attention to Bio-Rad, we saw an excellent business in its own right, rather than a mere proxy.

California-based Bio-Rad was founded in the 1950s by husband and wife, David and Alice Schwartz. They started out “offering life science products and services to identify, separate, purify and analyse chemical and biological materials” (per the history section on the Company’s website) and this essentially remains what they do today, albeit under the stewardship of the founders’ son, Norman. Additionally, they entered the clinical diagnostics market in the 1960s – today both life sciences and diagnostics are the Company’s core offering, comprising thousands of products across laboratory instruments, apparatus and reagents. Bio-Rad’s products conform rather nicely to our picks-and-shovels approach, with applicability in drug discovery, through to development, production and diagnostics. The Company estimates that 80% of its products have a top-three market position, while 70% of their revenues are of a recurring nature – both reassuring indicators of business quality. The Company has always been managed with strong family values and this has provided them with a unique knack in picking markets that Bio-Rad should go into in the longer term. One example of this is the long-term strategic investment in Sartorius, but another is droplet digital PCR (ddPCR) – a rapidly growing technology, with multiple applications for finding molecular “needles in haystacks”. Today, Bio-Rad is the market leader. The Company first entered ddPCR in 2011 (through a small acquisition with negligible revenue) and, after years of further innovation and investment, they now put the ddPCR addressable market at $10bn – up from $500m nearer the time of the acquisition. Management believes its positioning in areas such as this, will drive a revenue and profitability acceleration in the coming years; from what we’ve seen, we believe it to be credible.

On the basis of Bio-Rad’s earnings and management’s growth ambitions, we think its shares are pretty decent value today. But when you consider that you’re getting the Sartorius stake effectively for free, we think that makes it a bargain.

Boscher's (Bite-Sized) Big Picture:

The world order is changing but 2023 should be a better year for investors

By Kevin Boscher

From an economic and investment perspective, 2022 has been extremely challenging with both bonds and equities suffering very large drawdowns at the same time. High inflation, slowing growth, monetary tightening, soaring energy prices and rising geopolitical concerns have largely characterised the global economy and financial markets throughout 2022. Against such a difficult background, virtually all asset classes have declined although energy-related plays and the US Dollar have been notable winners. Looking ahead to 2023, it is likely that disinflation together with economic and policy desynchronisation will be the defining macro themes that shape the investment landscape. Although the outlook remains problematic, asset prices should rebound as falling inflation allows central banks to cease their monetary tightening with rates expected to fall in the second half of the year.

Inflation remains the key factor for markets and the global economy.

Inflation remains the key factor for markets and the good news is that inflationary pressures have clearly peaked in the US and Europe, assuming that the energy shock is largely behind us. This is mainly thanks to the impact of monetary tightening, falling commodity prices, easing supply constraints, and weakening demand. A strong Dollar has also helped in the case of the US, where investors now expect inflation to fall back towards the pre-pandemic 2% level over the next year or so. This is important since central banks will be keen to prevent longer-term inflation expectations becoming entrenched.

The Fed is committed to raising rates towards 5% by early next year since it remains concerned about wage growth and “sticky” core services inflation. However, with unemployment picking up and rents starting to fall as growth weakens, this should persuade the Fed to turn more dovish early next year. Inflation is also expected to fall in Europe and the UK, which should enable the ECB and Bank of England to pause rate hikes soon, although they both face a very difficult task as they balance the containment of inflation whilst supporting very fragile economies. Markets currently expect rates to peak around 4.5% in the UK and 3% in Europe in the first half of 2023 and to be falling by the end of the year. We also need to remember that inflation is not a global problem. In China, for example, the economy is in a tough recession and deflationary pressures are evident.

Over the next year or so, the global macro background could feel quite disinflationary. However, longer-term, the debate between inflation becoming a more secular problem (akin to the 1970s) or a cyclical issue remains finely balanced, and nobody can be sure. I can still make a strong case either way, but I am now of the view that higher and more volatile inflation is here to stay due to 4 key factors: shrinking work forces; de‑globalisation; a higher cost of energy; and, central banks having to keep rates lower than they should be due to record debt levels and to finance growing fiscal deficits.

The global economy is in recession, but investors will start to discount an improving picture.

Global growth is slowing rapidly and is expected to be especially weak in the West with the US, UK and Europe all in recession. The UK recession is expected to be tough given the combination of falling real incomes, higher borrowing costs, rising unemployment and tighter fiscal policy. In addition, we are likely to see an increasing East-West divide in terms of economic and monetary policy, which will have major implications for investment strategy. The Chinese economy is also in recession as it struggles with a bursting property bubble, a weak banking sector and its

Covid policy. However, in recent weeks, China appears to have abandoned its zero-Covid policy and has also launched a series of policy initiatives to support and stimulate the economy. China should enjoy a significant acceleration in economic activity in 2023 and a stronger China will be a major boost for the global economy, especially if it coincides with a shift to more accommodative monetary policies from the Fed and other central banks. In addition, inflation in Asia has remained low and, as the Fed changes tack, Asian central banks will be in prime position to further ease policy. Asia is therefore ideally placed to benefit from continued economic expansion in 2023.

We are more optimistic on the outlook for bonds.

Turning to investment strategy, we believe it is time to selectively increase exposure to fixed-income and extend duration. Bonds have suffered their worst drawdown in over a century and now offer attractive valuations, even if inflation falls more slowly than expected and rates subsequently stay higher for longer. As I have previously pointed out, nobody from the Fed down has any clarity or conviction regarding the future path for inflation or growth. It is possible that inflation takes years to return towards the 2% level or settles in a higher range, which would clearly impact interest rates. However, the markets currently expect inflation to fall back quickly, and it is also possible that rates could drop below 2% if disinflationary pressures prevail for a period of time. Bonds, especially government bonds, tend to outperform equities in the early stages of a growth slowdown or recession, hence providing protection against a worse-than-expected growth outcome. Credit markets have been hit hard this year from the combination of rising yields and widening spreads. High quality corporate bonds are attractive from a yield and total-return perspective and should benefit from lower sovereign yields and the eventual Fed pivot. However, care is required regarding lower quality issues, such as High Yield, since spreads could widen further in the event of a deep recession and rising default rates.

There are reasons for caution, but equities should recover strongly next year.

Equities should gradually “climb a wall of worry” over the next 12‑18 months, but the upward path will be volatile, fraught with risks and hesitant. There are good reasons for optimism: valuations have moved into cheap territory for many markets; earnings forecasts have already been downgraded significantly; 2023 should see an improving environment for liquidity; equities have suffered a very large drawdown; and both sentiment and positioning remain pessimistic. However, there are also plenty of reasons for caution since a recession will negatively impact earnings and the Fed cannot yet declare victory on inflation. As the year progresses, we should get a lot more clarity around how quickly inflation is falling, the subsequent Fed response, the extent and duration of the growth and earnings slowdown and the re-opening of China. Hence, the bull market in stocks should gain speed and breadth over the next few months.

We continue to look for selective opportunities to add to equity weightings. In addition to our core themes, which remain attractive long‑term and are considerably cheaper, we also favour a number of other sectors and regions. Commodities, including energy, are likely in a secular bull market and related stocks should perform strongly. Cyclical stocks, such as industrials, and mid/small cap equities also tend to do well once rates have peaked and investors start to look forward to an improving growth outlook. There is also a strong argument in favour of adding exposure to emerging markets, which are cheap in relative and absolute terms and should benefit from a stronger China, a less hawkish Fed, a weaker Dollar and the improving growth outlook for Asia.

The US Dollar bull market is ending whilst Commodities, including Gold, are in secular bull markets.

The 2-year US Dollar bull market appears to be coming to an end as investors start to discount the weaker growth outlook and a less aggressive Fed, although any depreciation should be gradual. A Chinese growth rebound would also add to downward pressure on the Dollar as global capital flows would become less US-centric. Sterling has strengthened significantly over recent weeks as markets have welcomed the Sunak Government’s tougher fiscal stance and evolving economic strategy, although it remains undervalued on most measures. The macro background for the Euro zone remains very challenging but the Euro should also strengthen versus the Dollar over the short-to-medium term.

I am bullish on commodities, Energy and Gold for 2023 and on a longer‑term view. A Fed pivot, weaker Dollar and a recovering China would lead to an improved global macro background beyond 2023 and push energy prices higher. A more uncertain and challenging geo-political environment and de-globalisation is also likely bullish for energy prices. In addition, global energy capex has been too low for too long, inventories are tight, and OPEC spare capacity may be smaller than generally realised. The broader commodities sector, including Gold, will also be a beneficiary of these same trends. Specifically, Gold prices tend to be negatively correlated with the Dollar and real interest rates; both factors should be moving in the metal’s favour next year. Gold also does well when market or geo-political volatility and risks are high, and when governments and central banks are busy printing money and debasing paper currencies.

The changing world-order presents both risks and opportunities.

Looking longer term, we are likely going through a once-in-a-generation period of economic, political and social change. I think there are 3 key and evolving dynamic shifts coming together at the same time: a huge change in geo-political risks; an ageing demographic across many developed and large developing nations; and a return to fiscal policy dominating over monetary policy. There are a number of sub-themes emerging below these main headings, such as globalisation going into reverse, shrinking labour forces putting upward pressure on wages, the debt super cycle, Governments facing a large and diverse set of challenges (which will require more spending) and the return of inflation.

A different investment strategy will be required for the next decade.

Clearly nobody knows how these issues will evolve and the range of potential consequences and outcomes is huge. The global economic and market environment is almost certainly going to be more volatile, less certain and more changeable than we have been used to over the past twenty years or so. With that will come new and dangerous threats from an investment strategy point-of-view, as well as some outstanding and attractive opportunities. Our job will be to try to make sense of the changing macro backdrop and adapt our investment approach accordingly as we seek to manage risk and deliver attractive returns for our clients. We are currently reviewing our major themes to gain an understanding of how they will be impacted by this change – as well as looking for new themes that may emerge. We will continue to be thematic in our approach but recognise that the world is rapidly and dynamically changing around us, and we therefore need to react to this changing world through our thematic lens. One thing seems certain: the next decade or so will require a very different investment strategy to that which has worked so well for the past 15-20 years, which was largely based on low inflation, falling bond yields and interest rates, lots of liquidity and a relatively stable economic and geo-political backdrop.

In conclusion, the macro picture is changing. A few months ago, financial markets feared inflation and the continued rise in interest rates. In recent months that fear has shifted to recession. Inflation has not yet been crushed, but there is clear evidence that 2023 should see a return to disinflation and an easing of monetary tightening. Hopefully, this can be achieved with relatively modest economic pain. There are still lots of reasons for caution and the outlook remains uncertain, but we are hopeful that the economic environment will turn more favourable as the year progresses and that markets will also follow suit. It has been a very tough year for investors, one of the most difficult years in a century. The risks still need to be managed, but 2023 should bring more cheer and a continuation in the market recovery that started a few months ago.

Data Sources

1. Bloomberg US Corporate Bond Index, USD Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

2. Bloomberg US Corporate Bond Index, USD Total Return 31/12/1973 to 31/12/1974. Source: FE fundinfo.

3. IA Sterling Corporate Bond Sector Average, GBP Total Return 31/12/2021 to 12/10/2022. Source: FE fundinfo.

4. GBP Ravenscroft Cautious Model Performance Data, Total Return 31/12/2021 to 31/12/2022. Source: Ravenscroft (CI) Limited.

5. GBP Ravenscroft Cautious Model Performance Data, Total Return 30/09/2022 to 31/12/2022. Source: Ravenscroft (CI) Limited.

6. Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

7. IA Sterling Corporate Bond Sector Average, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

8. Source: Bloomberg.

9. GBP Ravenscroft Balanced Model Performance Data, Total Return 30/09/2022 to 31/12/2022. Source: Ravenscroft (CI) Limited.

10. IA Mixed Investment 20-60% Shares Sector, GBP Total Return 30/09/2022 to 31/12/2022. Source: FE fundinfo.

11. GBP Ravenscroft Growth Model Performance Data, Total Return 30/09/2022 to 31/12/2022. Source: Ravenscroft (CI) Limited.

12. IA Mixed Investment 40-85% Shares Sector, GBP Total Return 30/09/2022 to 31/12/2022. Source: FE fundinfo.

13. GBP Ravenscroft Growth Model Performance Data, Total Return 31/12/2021 to 31/12/2022. Source: Ravenscroft (CI) Limited.

14. IA Mixed Investment 40-85% Shares Sector, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

15. Bloomberg Global Aggregate Credit Hedge GBP, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

16. Bloomberg Global Aggregate Credit Hedge GBP, GBP Total Return 31/12/2021 to 21/10/2022. Source: FE fundinfo.

17. MSCI World Growth, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE fundinfo.

18. MSCI World Growth, GBP Total Return 31/12/2022 to 16/06/2022. Source: FE fundinfo.

19. MSCI China, GBP Total Return 30/09/2022 to 31/10/2022. Source: FE fundinfo.

20. MSCI China, GBP Total Return 31/10/2022 to 30/11/2022. Source: FE fundinfo.

21. FTSE 100, GBP Total Return 18/08/2021 to 12/10/2022. Source: FE fundinfo.

22. FTSE 100, GBP Total Return 18/08/2021 to 30/11/2022. Source: FE fundinfo.

23. Source: Bloomberg.

24. GBP Ravenscroft Global Blue Chip Model Performance Data, Total Return 30/09/2022 to 31/12/2022. Source: Ravenscroft (CI) Limited.

25. MSCI World, GBP Total Return 30/09/2022 to 31/12/2022. Source: FE FactSet.

26. IA Global Sector, GBP Total Return 30/09/2022 to 31/12/2022. Source: FE FactSet.

27. GBP Ravenscroft Global Blue Chip Model Performance Data, Total Return 31/12/2021 to 31/12/2022. Source: Ravenscroft (CI) Limited.

28. IA Global Sector, GBP Total Return 31/12/2021 to 31/12/2022. Source: FE FactSet.

29. KBI Global Sustainable Infrastructure, GBP Total Return 30/03/2022 to 31/12/2022. Source: FE fundinfo.

30. Candriam Oncology, GBP Total Return 30/03/2022 to 31/12/2022. Source: FE fundinfo.

31. US Consumer Price Index Unadjusted 12-months ended November 2022. Source: U.S. Bureau of Labor Statistics.

32. Lazard Global Thematic Inflation Opportunities, GBP Total Return 21/06/2022 to 31/12/2022. Source: FE fundinfo.

All performance data above was collated on 05/01/2023