This week’s update is written by Elliott Crowson from our advisory investment service team in Guernsey

Last week, we witnessed US congress pass Joe Biden’s enormous $1.9 trillion economic relief package which will provide a desperately needed cash injection to millions of families and businesses hit by the pandemic. This money will fund Covid-19 vaccines and send stimulus cheques of up to $1,400 to most American citizens. The news closer to home, in the UK, has not been so positive, with plenty of commentary on the conflicts surrounding vaccine exports, data revealing that UK exports to the EU in January dropped by over 40% compared to last year and UK GDP shrinking by 2.9% in January alone, the largest fall in nine months. [1]

However, we’re not sure that this should be allowed to mar the progress that the UK is beginning to see. The Ravenscroft advisory investment service probably has a natural bias towards UK markets, but there are many logical rationales currently upholding this.

UK markets have faced a number of headwinds over the past decade, including the EU referendum (which led to a significant devaluation of GBP) and the initial difficulties suffered when tackling coronavirus in its early stages. The UK is unloved, both domestically and internationally, and the relative poor performance of UK market indices throughout 2020 bears witness to this. The fact that the UK markets are unloved is one of the main reasons we consider them to be generally undervalued. Share buyback schemes, carried out over the past few years by some of the larger FTSE 100 firms (including Lloyds, Whitbread and Diageo), indicate that many boards consider shares in their own companies to offer good value.

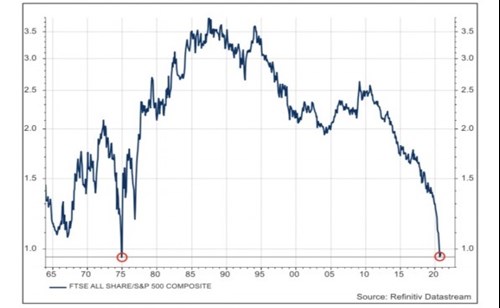

As the above graph shows, the FTSE All-Share now at its lowest level since 1975 when compared with the US S&P 500 and we must consider the reasons behind this. On a recent call with Gervais Williams from Premier Miton, he highlighted that the company’s recent research had concluded that this is because the UK tends to have shorter duration-type investments, which deliver a faster cash payback, but do not offer the same potential for “long-term knockout returns”. Despite this, the shorter duration investments could outperform the long-duration technology-led ‘potential’ companies in the next 10 to 20 years. If bond yields increase for whatever reason – because there are more defaults or perhaps inflation picks up, and there has been plenty of commentary surfacing supporting this idea – it will make long duration investment opportunities less attractive, especially when there have been ultra-high valuations in bonds recently.

According to the current asset allocation suggested by the MSCI PIMFA Private Investor Index Series, domestic investors should hold approximately 27.5% of their portfolio in UK equities regardless of whether they seek income, growth or a balanced portfolio. [2] It is important to note that asset allocation will vary depending on individual client circumstances but it provides us with insight regardless. We consider the reasons behind this suggested allocation:

- When domestic investors place money in foreign companies, they are exposed to additional currency risk. For most UK investors, future spending commitments will likely be in Sterling so it makes sense for their investments to be denominated in that currency also. Perhaps a suitable alternative for investors that wish to diversify and gain a broad exposure to other currencies lies with large multinational FTSE 100 firms.

- Quoted UK companies are wide ranging in terms of market capitalisations meaning you can more easily invest in companies that vary in size depending on investor objectives.

- The UK offers attractive yields and UK corporates have a notably strong dividend culture and this discipline should benefit investors for the foreseeable future. [3]

- The aforementioned value that can be found when compared with other markets.

Whilst in current conditions we may favour UK markets, we base the majority of our investment decisions on whether we see value in a company’s share price. We hold firm that there are plenty of opportunities to buy good businesses in most markets on this basis as opportunities present themselves frequently thanks to the irrational behaviour of investors as they tend to generalise past performance of stocks and overreact. Although we must be wary and avoid buying overly distressed companies, after all, the share price has fallen for a reason. The art of stock picking lies in finding the right balance. In light of the above, it is therefore appropriate to suggest that going forward, we abide by Warren Buffett’s wisdom;

“it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

[1] https://www.ft.com/content/55f116d8-6f3b-400a-825a-94be4d379db0 - (12/03/2021)

[2] https://www.pimfa.co.uk/indices/current-asset-allocation-2/

[3] https://www.schroders.com/id/uk/asset-manager/insights/markets/what-are-the-prospects-for-dividends-in-the-uk/