Matt Girard from our precious metals team writes this week’s update.

Just over a year ago I found myself back in the precious metals’ world (from which I had taken a lengthy hiatus in 2013) and as I sat down at my desk on my first day in the Ravenscroft office, I was wondering “what’s changed?”. Well, other than the spot price of gold moving from around $1,300 per troy ounce to around $1,900… I’m pleased to say not much.

There’s still a healthy appetite for physical metals and over the last two years we’ve seen another example of how both gold and silver shine (pun intended…) in times of uncertainty. In August 2020, when worldwide lockdowns were in place and there was little news of a successful Covid vaccine, gold reached a peak of $2,061 p/oz and silver jumped to over $28 p/oz [1]. As financial markets recovered, the prices have tailed off from those heights, but it shows the potential from metals as part of a diversified portfolio.

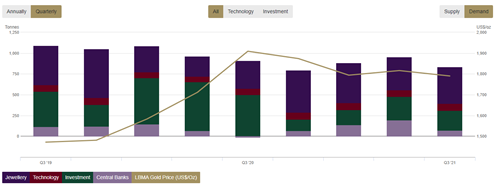

During Q3, overall demand was down 7% year-on-year but this was mostly driven by outflows in ETFs. Most other sectors were significantly up, with jewellery increasing 33%, technology 9% and the bar & coin sector up 18% [2].

Source: https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics

Another key area is Central Bank buying. Global gold reserves continue to grow, as they have for the past 11 years, and are up 400 tonnes year-to-date. Although there’s very little movement in terms of the ‘big players’… it’s interesting to see countries like Thailand, Brazil and Hungary significantly increasing their holdings. With inflation expected to rise, global labour shortages becoming a bigger issue, and repeated spikes in Covid cases, it might just be the perfect storm for precious metals.

Sources

[1] https://www.lbma.org.uk/prices-and-data/precious-metal-prices#/

[2] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2021