This week’s update comes from Richard Allen, who is in our discretionary management team in Peterborough.

Following a blistering start to the year, financial markets eased back slightly last week as investors digested the latest “give and take” message from the Federal Reserve. On the one hand investors have reacted positively to comments from Fed Chair Jerome Powell that the prospect of a soft landing for the US economy seems to be on the up. However, Fed officials expressed doubts about the all-important pivot on interest rates, which has led to a degree of nervousness setting in. A brighter spot for markets though was the energy sector, where BP became the latest company to join European majors such as TotalEnergies and Equinor in reporting record profits.

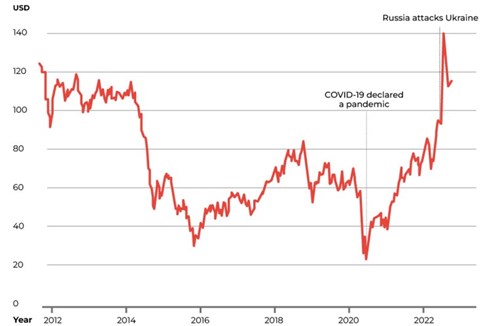

As we near the first, and perhaps ominous, anniversary of the Russian invasion of Ukraine, the vast profits generated by the oil majors illustrates just how much the outlook for the energy sector has changed. Indeed, it may well be that higher oil prices are going to remain a feature of the global economy moving forward. Traditionally, the fortunes of the oil sector have been closely linked to the ups and downs of the global economy and it can quite literally be “feast or famine”, and notoriously difficult to predict. The International Energy Agency, though, expects half of the growth in global oil demand this year to come from China on the back of their reopening1. Further strong demand is likely to come from the aviation sector as flight activity returns to pre Covid levels. The continued resolve of Western Hemisphere countries to hold large stocks of energy supplies could also be supportive for prices.

Brent crude oil prices (2012 - 2022). Source: Refinitiv

A range of structural issues suggest that the energy sector and companies within it might be facing a more sustained period of fortune. Taking Europe as an example and having taken the decision many decades ago to reduce its dependence on Middle Eastern oil and gas, the relationship has now gone full circle. Almost overnight Europe has gone from having a supply chain on its doorstep to one which is now thousands of miles away and much more fragmented. Looking at the global picture, a notable supply-demand imbalance exists in the oil and gas market. Arguably this can be traced back to the long decline in oil and gas prices that set in after 2008 and also the 2015 Paris Agreement on climate change which led to capital being diverted from traditional energy to renewables. According to some analysis undertaken last year by the IMF the typical capital expenditure of an oil and gas company was 35% lower after the Paris Agreement2 .

And what of the companies in the sector? Like the mining sector before them, the oil majors have had to go through a period of painful adjustment and have learnt to become more attractive to investors. A priority has been placed on generating consistent shareholder returns through effective capital deployment and reliable operational performance. Oil companies, for example, have been increasingly selective when bringing on new supply and have focused instead on making their existing assets work harder and more efficiently. A notable example is the Permian Basin in the United States where it now only requires 15 rigs to generate the same output as the 50 used back in 20183. The net result of this has been that corporate balance sheets across the wider sector appear quite robust with strong cashflow and generally low levels of debt. In turn this has led to higher dividends and share buybacks.

At some point in the future the balance is going to undoubtedly tip overwhelmingly in favour of renewable energy versus traditional energy. But it is worth remembering that historically whenever a new energy source has come on stream it has worked alongside other sources rather than replacing it overnight.

Have a good week.

Sources: