This week’s update is written by Hadyn McLarney in our Isle of Man office.

Following some tempestuous weather at Augusta National earlier this month, Jon Rahm managed to stay on track and was appropriately fitted for the famous Green Jacket as he ran out victorious at this year’s Masters.

Looking ahead to this coming weekend, the global community will celebrate International Mother Earth Day, a day aimed at bringing attention to the Earth, its inhabitants, and the interdependence between the two. Many events will take place over the course of the weekend, not least the promotion of environmental causes. This reminds us of the recent “Green Day” observed in the UK – named so as it marked the unveiling of a number of eagerly-anticipated announcements covering the UK’s own sustainable finance strategy: namely, the Green Finance Strategy.

A 130-page government report centred on mobilising green investment, the long-awaited Green Finance Strategy was released on 30th March 2023 – the latest version of a plan that has been amended a few times since first released in 2019. The aim is to increase investment in sustainable projects and infrastructure, with a key decision being made to consult on the regulation of Economic, Social and Governance (ESG) ratings providers – a long-yearned-for element of the sustainable area of investment, not only for the obvious benefit of standardised statistics, but also because asset managers are required to meet reporting standards such as the Taskforce for Climate Financial Disclosures (TCFD). For some time now, it has been strongly debated whether the traditional “comply or explain” basis of such disclosure requirements are simply not adequate for this field, and that we urgently need mandatory and robust net-zero transition plans in place so that those in the market can assess risk and performance more accurately.

Treasury Minister Baroness Penn recently commented that a projected $33.9tn of global assets under management will consider sustainability factors within the next three years1, highlighting the importance of reliable data. As the idea of improved reliability and accuracy in sustainability data develops, it seems only natural for Artificial Intelligence (AI) to intersect the space at some point in the future. AI can be used to delve into the detail in a more efficient manner to assess the validity of sustainability product claims.

As such reporting standards come in, we are progressively seeing more instances where asset managers choose to file resolutions at company AGMs, in order to push through key changes required under the incoming sustainability directives. For example, asset managers representing over €1tn have filed a resolution ahead of TotalEnergies AGM, due on 26th May, requesting the oil major address its emission reduction target in order to align the Scope 3 target with the Paris Agreement for 20302. The resolution stated that the firm had not made sufficient progress in supporting the transition to low-carbon energy sources. Similar resolutions have been filed for the AGMs of Shell, ExxonMobil, BP and Chevron2, further highlighting the extent to which investors are prepared to push to see significant changes being made, that are increasing in urgency not just in a regulatory respect, but in a moral aspect also.

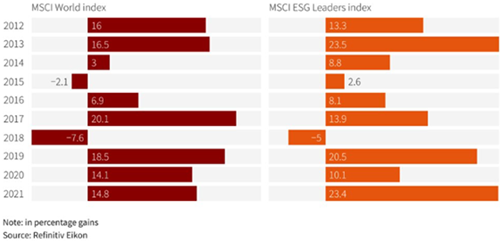

Comparisons are often drawn between the difference in return from traditional investment strategies and those leading the sustainable space. Whilst the two do not necessarily have to be mutually exclusive, it is interesting to see how price performance has differed in the last 10 years to end 2021, shown in the table below. From 2022, performance between the two has been largely aligned.

Source: Reuters

In wider market news, last week we saw a 1% drop in US inflation to 5%, albeit core inflation remained sticky, rising 10 basis points to 5.6%3. We await the UK inflation data on Wednesday this week. Last week saw positive gains across the major indices, with the FTSE 100 up 1.7%, S&P 0.8% up and DAX up 1.34%4. We are now well into earnings season, with the major US banks kicking us off last Friday. Results this week include Johnson and Johnson, Netflix, Tesla and American Express.

We hope you have a good week.

Sources:

- 1 Gov.uk

- 2 ESG Clarity

- 3 Trading Economics (Date accessed: 14th April 2023)

- 4 Google Finance (Date accessed: 14th April 2023)