This week’s update is written by Shannon Lancaster, who is in our discretionary investment team in Guernsey.

Despite the ominous warnings as we entered this year, the market has been surprisingly resilient. In the face of multiple bank failures, negative investor sentiment and continued Fed tightening, the S&P 500 is up nearly 16% in USD year-to-date. This index is generally viewed as a barometer of the broader health of the US market, so why has the strong headline performance left many investors feeling uneasy?

At a glance, everything is rosy but a quick look under the bonnet shows the rising tide has not lifted all boats. The market breadth, which describes how many stocks in an index are participating in a move in either direction, is narrow. This indicates that a small number of stocks are moving the performance of an index.

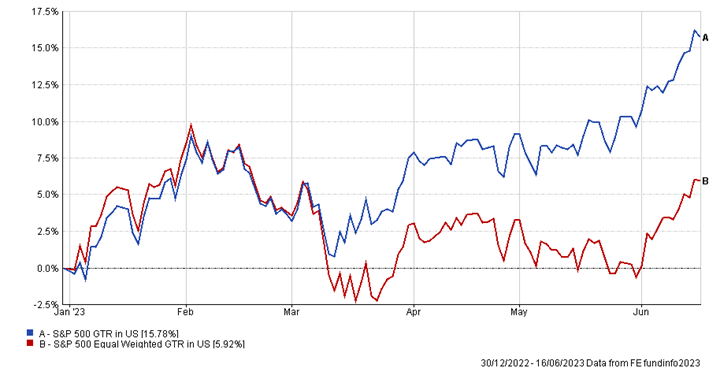

Many indices are weighted by market capitalization and periods of outperformance by certain sectors or companies can lead to declining breadth. Mega cap tech has driven a large portion of S&P 500 gains. The impact of chunky weights in these companies can be seen in the below chart, which depicts the performance divergence between the S&P 500 and the equally weighted S&P 500. The gap started when SVB collapsed and the trend has continued. The ‘Magnificent Seven’ (Apple, Alphabet, Tesla, Amazon, Microsoft, Meta and Nvidia) are around 30% of the S&P 500 have contributed nearly 20% to top line performance. The eye watering returns from these seven stocks, shown below, help to disguise negative performance from over 200 stocks in the S&P 500 year to date.

| Stock | Weight | YTD performance |

| Nvidia | 3% | 192% |

| Meta | 2% | 134% |

| Tesla | 2% | 112% |

| Amazon | 3% | 49% |

| Microsoft | 7% | 43% |

| Apple | 8% | 42% |

| Alphabet | 4% | 40% |

The popularity of these stocks has been driven by two main narratives. As we entered this year, there was a consensus view of impending doom and many investors tilted their portfolios into higher quality companies with strong balance sheets. As a result, market breadth started to narrow as the largest companies in the index reaped most of the reward from this repositioning.

The artificial intelligence (AI) hype has been another other significant catalyst. Since ChatGPT hit headlines last year, many investors have piled into AI related stocks. Alphabet and Microsoft have grown in size year-to-date and, most notably, chip maker Nvidia joined the trillion dollar club as it was seen as a clear beneficiary of this theme.

So is narrow market leadership an issue? While wider breadth generally indicates a healthier market rally, narrow leadership does not always indicate an imminent sell off. Concentration of returns can serve as an indicator of frothy pricing but doesn’t help us with timing. Breadth can stay narrow and elevated pricing can persist – for far longer than makes sense!

Without a crystal ball it’s impossible to know what happens next. We are confident that our active managers are nimble enough to trim and add as they see fit and take full advantage of increased market volatility. If the tide turned on the AI trend, for example, it is likely active managers in this space could outperform and protect on the downside. They are positioned to pick businesses that are best placed to utilise and benefit from the technology and not driven by hot money flow and sentiment. While undoubtedly businesses like Microsoft and Nvidia are incredible and likely to remain a key part of our lives, there are many beneficiaries of AI outside the technology sector and the US.

For example, Siemens Healthineers is a business that focuses on medical imaging. It has a dedicated supercomputer called Sherlock that trains algorithms on 500 million curated images that will aim to quickly and accurately identify certain medical conditions to help diagnose patients. In addition, emerging markets can benefit significantly from AI. Its applications are providing new ways to leapfrog infrastructure gaps and solve pressing development challenges in critical sectors. Investing solely in an S&P 500 tracker to gain exposure to this theme may not work over the coming years as the trend plays out. Additionally, Jim Cramer (the notorious CNBC Mad Money host) declaring that now is the time to double down into the Magnificent Seven stocks after the incredible rally may indicate now is a good time to keep an eye on the ‘Inverse Cramer ETF’.

Across the Ravenscroft fund range, we remain diversified at a sectoral and regional level and focus on building resilient portfolios with long term performance in mind.

We hope you have a good week.