This week’s update is written by Simon Sharrott, who is in our discretionary investment management team in Guernsey.

The Bank of England (BoE) has now raised interest rates for the 13th consecutive time in the space of 19 months, lifting its base rate to 5%. This is the highest it has been since 2008.

The size of the hike was certainly higher than most observers had forecast; the market had expected a 25bps rise but following the release of data showing a stickier inflation picture earlier this week, the Monetary Policy Committee seemingly had little choice other than to raise rates by 50bps. The move came with the warning that should inflationary pressure continue to be more persistent “then further tightening in monetary policy would be required”.

This communication resonated with Federal Reserve (FED) chair Jerome Powell’s message last week, who stated that although it had chosen to ‘pause’ its policy rate at its latest meeting, the FED would likely have to roll out further increases later in the year to hit its targeted 2% inflation objective, continuing its hawkish rhetoric.

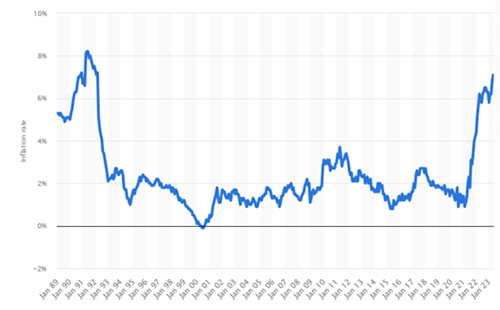

The rationale for the BoE’s rate hike lies firmly with the 8.7% May UK inflation print, which came in higher than the consensus forecast of 8.4%, with core inflation unexpectedly rising to 7.1% (versus 6.8% the previous month) to a 31-year high.

UK Core Inflation

Source: Statista

Core inflation measures inflation without food and energy prices, as these are usually far more volatile in nature than goods and services. Unfortunately, with core inflation growing as the headline rate declines, this is now starting to show signs of higher prices being embedded across the UK.

In short, increased rates should alleviate the inflation bubble, although it does take time to kick in, with conventional wisdom suggesting a lag effect of up to two years. There are other ways to curb inflation, such as higher taxes, thus resulting in a reduction of consumer/ individuals’ spending power. However, at a time when the cost-of-living crisis continues to hamper UK households, higher taxes would not be a politically popular decision.

Another noteworthy consequence of higher interest rates is that of increasingly higher mortgage costs (as well as normal loans) for borrowers – the BoE’s decision will be a big blow for mortgage holders who are already contemplating spiralling bills.

Fixed-rate mortgages are somewhat protected from the immediate changes in base rates for the term of the fix. Borrowers on variable and/ or tracker type deals, which are directly linked to lenders’ standard variable rate or base rates, typically respond more directly and swiftly to BoE announcements. As a result, some lenders began announcing changes to their variable rates soon after the decision last Thursday.

While fixed-rate mortgages offer the borrower some measure of protection, interest rate hikes will affect those borrowers who are applying to refinance their fixes, via the affordability tests lenders apply to gauge their abilities to repay, especially under ‘stressed’ conditions. As a result, the number of households feeling that squeeze is only going to grow. For example, an average two-year fixed deal, which was 2.29% in November ’22, is now above 6%! As people roll off cheap fixed-rate deals onto products with much higher rates, their monthly repayments will possibly become hundreds of pounds more expensive.

The secondary effect of this is of a slowing housing market, thus suppressing house prices due to a lack of demand. Capital Economics is forecasting a 12% decline in UK house prices between their August 2022 peak and 2024.

As households continue to feel the pinch, there may be more still to come. Bank Governor Andrew Bailey has stated that if prices continue to rise rapidly then further rate increases will be needed. The financial markets now expect rates to peak at about 6% early next year, resulting in more hikes and pain to come.

Unfortunately, it seems that the BoE has accepted that to achieve its hard line of a 2% inflation target, a recession may well be unavoidable due to its aggressive policy decisions. While this certainly seems likely, only time will tell.

Should the UK head into a recession this might not be the worst situation for bonds and equities. The BoE will have to look to stimulate the economy and there may well be some form of quantitative easing package, resulting in a potential positive swing for financial markets, as liquidity conditions improve, and in anticipation the market reprices to the upside.