This week’s update is written by Ben Byrom, who, as part of our discretionary investment service, heads up the Global Blue Chip fund.

Given the rise in AI-related news and its soaring popularity, it’s no surprise that we should be asked by investors how we are ‘playing AI’ and encompassing this trend in their portfolios. Within our multi-manager portfolios, the investment case is specifically played through a dedicated fund, Sanlam AI, that invests in the enablers of the technology and businesses where AI-enabled products may provide or improve a competitive advantage.

Within Blue Chip, we aren’t playing AI through any dedicated, conscious move. Rather, we have been the beneficiary of AI’s integration into a range of products across several of our companies. We will touch on a handful of these in our upcoming quarterly commentary, as they were some of our strongest performers. Microsoft, Dropbox, and Oracle all had very specific AI-related rips in their shares after they had either announced the launch of new productivity-enhancing applications that integrated AI or discussed growing investment requirements to satisfy AI-related demand.

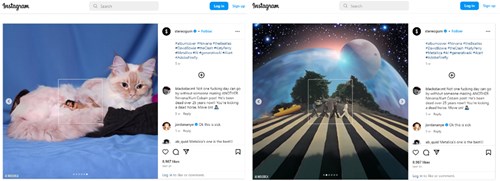

There were others who didn’t make despatches, either because the rip in shares was short-lived or their influence in the portfolio was too small. Adobe, for example, saw shares rise meaningfully higher towards the end of May, soaring as high as $5181 in just a matter of days after investors caught wind of the power its latest AI-based applications possessed when enhanced images of iconic photo albums started going viral on social media.

Yet, this was not new news. Adobe Firefly, a creative, generative AI engine that lies at the centre of this new wave of creativity, officially launched in March of this year to no fanfare, especially with regard to share price appreciation. Further still, the knowledge of such power was known as far back as October 2022 when the company showcased two projects in development during “Sneaks” - a feature within their annual creativity conference, Adobe MAX, where new ideas are introduced to the Adobe faithful to gauge their reaction and obtain their feedback before integrating them in future upgrades to Adobe’s products. If the market is such an efficient, forward discounting mechanism, why didn’t we see meaningful appreciation last October or even March of this year? Instead, we had to wait for pictures to go viral before investors got themselves into a tis-was.

Here's the thing, maybe the market isn’t that efficient, especially around a relatively unknown and not-so-well-understood technology such as AI. After all, OpenAI’s chatbot - ChatGPT3 - was unleashed on the masses in November 2022. The exponential growth rate in active monthly users - from 100m within two months of launch to over 1.5 billion at the time of writing2 - highlights the outsized potential of this technology.

AI and closely related Machine Learning are technologies that have been in development and in use for some time. We would expect good management teams to be up-to-speed and, where necessary, implement these technologies within their products and operations. AI as a point-of-differentiation will be short-lived for most, and it will become a point-of-parity for all in the not-too-distant future as firms strive to stay relevant by keeping pace. It should therefore come as no surprise that an AI-induced productivity arms race is unfolding and that its utilisation will only accelerate.

It’s possible investors’ enthusiasm for AI could last years, like the internet era of 1995-2000, and reach comparable levels of euphoria as the technology becomes better known and more tangible. Like previous manias, the market will overpay at some point for the direct, first tier, plays and then the second, then the third and so on. A sure, tell-tale sign that things are getting too hot will be when shell companies appear with dubious use cases but whose marketing documents are festooned with AI material. The threat of scammers entering the market is real and dedicated funds (such as Sanlam AI) with AI-specific expertise will help those looking to navigate this fast-moving landscape. We suspect the market will bifurcate between the haves and the have-nots, and the real long-term winners will be those who have managed to harness the technology appropriately and benefitted from its productivity potential – similar to the internet. This is where we feel investors potentially stand to make long-term sustainable gains and, in this regard, we anticipate that we will continue to play AI as a consequence of our investment approach rather than as any dedicated effort.

We hope you have a good week.

Sources:

- 1 Factset data

- 2 DemandSage