We like a challenge here at Ravenscroft so for this week’s note we thought we would try and offer a summary of the complex dynamics currently playing out in inflation and, as a result, interest rates. We hope it provides some clarity for those readers who have been asking themselves what on earth is going on!

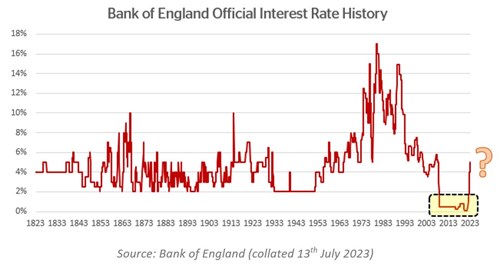

For more than a decade following the global financial crisis in 2008 we have all grown accustomed to a world of near-zero interest rates. For those of us based in the UK, we can now say that we lived through the longest period of the lowest rates since the Bank of England (“the BoE”) was founded in 1694.

This very long period of ultra-low rates came to a very abrupt end in 2022 as central banks, including the BoE, scrambled to try and get rampant inflation back under control. This led to another record, one of the most aggressive hike cycles since the 1970s with interest rates rising from 0.1% to 5.0% in a breakneck 16 months. This exceptional move is either very good news or very bad news depending on your situation. If you have cash savings, then this is very good news, as today you can achieve/obtain interest rates that we could only dream of a few years ago. If however, as is true for most people, you have a mortgage and/or you have investments that include bonds then this has been a huge shock. In fact, if you were a bond investor through 2022 you now have the dubious honour of being able to say you lived through the worst bond market since modern records began some 50 years ago. This rollercoaster ride has left everyone asking the same question:

Where do interest rates go from here?

While nobody knows the exact answer to this question, what we hope to offer you today is a feel for the range of possible outcomes and the key variables that will determine their future path.

The reason the future for interest rates is so uncertain comes down to the uncertainty around inflation. We know that inflation was driven sharply higher over the last two years due to a combination of pandemic-induced bottlenecks and the war in Ukraine however as we exit those shocks big questions remain. Has this shock masked other longer-term trends that could drive a longer-term shift into a higher inflation environment? There are some good reasons to worry about this, including:

Possible causes of higher inflation in the long term

- Increased government spending

Over the last three fiscal years the US government, by way of example, has spent over $7 trillion dollars1 more than it has taken in in taxes and there are plenty of reasons why this could continue. Governments today have a laundry list of concerns that call for spending. Even with Covid mostly behind us, we have issues with inequality that need addressing and rising geopolitical tensions call for higher defence spending. There are concerns about artificial intelligence eating into jobs and climate change is, one way or another, going to be expensive to tackle. All this suggests government spending could be greater, as a share of the economy, than in the recent decades and if this is not matched by spending cuts and/or tax rises then it will be an inflationary influence.

- Labour shortages

As the global population ages (a long-standing investment theme of ours) the global working-age population has reached a peak and is starting to decline. This has been compounded globally by a wave of early retirement associated with the pandemic and doubly so in the UK by Brexit-induced changes in immigration. A structural shortage of labour is also inflationary.

- Increased geopolitical tensions

Whatever you think of globalisation, outsourcing manufacturing jobs over the years to cheaper jurisdictions has been a big deflationary force, pushing down the cost of most goods. The increasing desire to diversify supply chains and even build in redundancy for possible future geopolitical conflicts could throw this force into reverse if it goes far enough.

- The dreaded wage/price spiral

Finally, there is a risk that inflation has been high enough for long enough now that public psychology could become a cause in itself. This is the point that central banks fear most and could be referred to as the “genie getting out of the bottle” with regard to inflation. If workers start demanding higher wages because prices are rising and firms deliver these higher wages by raising prices further it is possible to create a vicious cycle.

Whether these factors can derail the glacial forces that have driven inflation down for the last forty years are the questions that investors are wrestling with today. And fear of the wage/price spiral in particular is causing markets to obsess over wage growth statistics. The UK has a problem here. Average earnings excluding bonuses are growing at 7.3% which makes very uncomfortable reading for the BoE. Until we see this slow they are unlikely to feel able to ease off on their rate-rising programme.

Current expectations (think our collective best guess of the future) are that rates will have to stay in the 5% to 6% region in the UK for a year or two before the BoE is forced to cut as rates finally bite and the economy goes into recession. While this sounds broadly reasonable to us, we wonder if that expectation of a year or two is on the long side given that UK growth is expected to have gone negative in the second quarter of this year. So the slowdown may be closer than markets are currently expecting. That would be good news for anyone with a fixed-rate mortgage renewal in the next year or so.

The opportunities for investors

While nobody knows where these forces will balance out, the turmoil has created opportunities that investors can take advantage of. Particularly on the bond side of markets, we are seeing some opportunities today that we could only dream of just a few years ago.

- Cash (interest rates in the 4% to 5% region)

For very conservative or very short-term savers, cash pays a rate of interest worth paying attention to again.

- Short-dated, high quality bonds (yields2 in the 5% to 6% region)

For those with a one to two-year horizon, you can buy short-dated high-quality bonds today yielding in the 5% to 6% range and with minimal default risk from issuers like the UK government or the European Investment Bank.

- Corporate bonds (yields2 in the 7% to 15% region)

For longer-term investors with three-to-five-year horizons or longer there is a wide range of opportunities. At the lower-risk end of the spectrum, short-dated high-yield bonds offer returns in the 7% region today. And for investors with a longer-term view and/or a higher tolerance for capital volatility, it is possible to find bonds that have the potential to deliver returns in the 10% to 15% range without venturing into what we would describe as speculative assets.

These are the type of areas that we are focusing on at the moment and actively shifting our clients’ portfolios towards. So while the last few years have been tough for investors and the future looks uncertain the value on offer in parts of markets today is making us quite excited about the opportunity to generate future returns for you, our clients.

Sources:

- 1 US Department of the Treasury

- 2 Yields” refer to the yield to maturity on the bonds. This is a proxy for the total return (capital gains plus income) that a bond could offer before fees if it is purchased and held to maturity and does not suffer any default losses