Sophie Yabsley, head of client services at Ravenscroft, answers this month’s question.

First things first, congratulations on making your first foray into investing! If you have taken the first step and started investing your savings, you’re already making positive moves towards bettering your financial future. As with all aspects of finance, as basic as it sounds, it’s imperative to live within your means. If you do not have the “spare” funds each month to be paying into your investment account then there is certainly no requirement to do so. Your lump sum investment, however small, should benefit from the power of compounding over time, particularly over longer timeframes. If you do have spare funds each month and are happy for those to be squirrelled away into your investment portfolio, then you can tap into a powerful mathematical phenomenon known as pound cost averaging.

Pound cost averaging

Pound cost averaging refers to the process of making regular contributions to a specific investment or security, thereby helping to spread out the risk of investing your money. For example, rather than making a once-off lump payment, one would invest, say, £100 from their salary into their pension each month.

The idea behind pound cost averaging is that the regular payments help smooth out the ups and downs, the volatility, of the market.

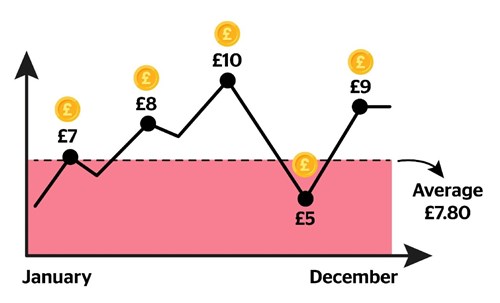

When markets are rising, as an investor that is obviously a positive as your total investment value should be growing. When you make regular payments, pound cost averaging allows you to also benefit when markets fall because your regular contributions enter the market at a cheaper price. In short, you are getting more for your money (although it is important to note at this point that the total value of your investments is likely decreasing in value). The graph below gives a simple example of how the price of an investment varies over time, and how pound cost averaging can work in your favour.

What are the benefits of investing regularly?

One of the main benefits of this type of strategy is that it evens out the ups and downs – effectively smoothing your investment return.

It can also be less daunting emotionally to commit smaller amounts of money to your investments rather than a larger lump sum, particularly in volatile markets.

It can also create a level of discipline around investing; automating the process of regular investment contributions can help investors to stay accountable and money tends to be whisked away to their portfolio before it can be spent.

Are there any downsides?

It’s always important to consider all sides of an argument and there can be downfalls to pound cost averaging, although unfortunately these can rarely be identifiable or quantifiable other than in hindsight. Of course, if markets go up more than they go down (which is always the hope!), you may end up paying more than the average price for an investment over time. There is also the danger of holding money in cash when inflation is running high, as it is at present. Oftentimes investors looking to contribute to their investment(s) regularly are doing so because they don’t have a lump sum to invest, so these points may be moot.

Ultimately, while there are benefits to investing monthly, it does come down to your financial situation and what works for you. It is worth keeping in mind that you don’t have to be investing on a monthly basis to take advantage of pound cost averaging. Even quarterly or bi-yearly contributions can help spread the risk, albeit it a lesser degree.

If you’d like to find out more about investing with Ravenscroft, or if you have any questions you’d like us to answer, please contact us.