There is a lot of uncertainty surrounding the future direction of financial markets at present. Whilst the uncertainty has always been there, this current time feels quite different, and quite rightly so. Many investors, myself included, have not lived through a scenario akin to that in which we currently find ourselves—that of higher interest rates, inflation, and geo-political tension—and coupled with the volatility experienced over the past few years, many question whether staying invested remains a valid approach. The good news is that these questions are nothing new and what follows is a short discussion of why taking a long-term view could be a better option and how, at Ravenscroft, we are approaching the investment landscape.

Opportunity amidst the panic

A great quote in Morgan Housel’s The Psychology of Money sums up the seduction of selling an investment in times of turmoil.

‘Optimism sounds like a sales pitch. Pessimism sounds like someone trying to help you.’

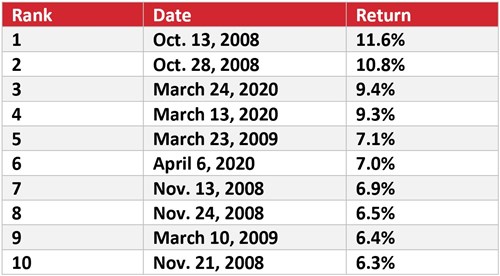

Reading that, it is easy to understand why an investor, especially in recent years, would be nervous right now. We are far more easily swayed by the negative than the positive, and the last few years certainly have not been short of gloomy headlines. Some even prompt panicked investors to get out of the market altogether, thinking the wait-and-see approach to be a better strategy. But this, I would argue, is incredibly short-sighted and could be to an investor’s detriment. We see the best opportunity in times of market volatility, and the numbers don’t lie. The table below shows the 10 best days in the S&P 500 from 2002 to March 2022. The best days in the market occurred after the worst days, so an investor selling amid the sell-off will likely miss most of the upside in the recovery.

Source: CNBC

In fact, Lorie Konish at CNBC calculated that.

‘Had someone invested $10,000 in the S&P 500 on Jan. 1, 2002, they would have a balance of $61,685 if they stayed the course through Dec. 31, 2021. If instead, they missed the market’s 10 best days during that time, they would have $28,260.’

If that is not an incredible argument for staying the course, I don’t know what is.

Ravenscroft’s approach

With pessimism comes a tendency to get bogged down in the short term and lose sight of the bigger picture. However, short-term fluctuations are almost impossible to predict. If you look at any economic forecasters' predictions for 2020, 2021, or 2022 and then have a look at what actually happened, they are almost always wrong. To avoid this, Ravenscroft adopts a thematic approach to investing. Our themes of ageing populations, accelerating innovation, and rising global incomes are trends we have identified that have underlying long-term upside growth potential. They are irrefutable trends that cannot be easily swayed by the short-term fluctuations of the market.

That is not to say that we do not pay attention to what is happening around us; some short-term trends do require some vigilance. For example, the credit contraction phase of the business cycle that we are in, or fast approaching, tends to offer up great investment opportunities. An awareness of this, in a very simplified way, is why higher levels of cash can be seen across our strategies at present. There are times when it is prudent to dial up or down exposure to riskier investments, but the long-term themes remain. Yes, in times of worry, you could get out of the market and wait for a perceived better time to invest, but as shown above, that could be to your detriment. Markets will always oscillate up and down along a trend, and having a thematic approach positioned to benefit from those long-term trends with the greatest upside potential, we believe gives our clients the best chance to reach their investment objectives.