This week’s update is written by Ben Byrom who is part of our discretionary investment team in Guernsey.

Earnings season is upon us in the world of Global Blue Chip. Monitoring these announcements plays a major role in our investment process as the information provided helps us gauge whether a company and its management are doing what we expect of them. In this week’s update we unpack Netflix’s quarterly report to better understand the negative reaction in share price.

Netflix’s Q2 report was of specific interest to us as it would largely explain how well the account sharing crackdown was being received by ‘borrowers’ of the service. Paid sharing was launched about two-thirds of the way through the quarter, across 80% of Netflix’s revenue base. The market was expecting an increase of 2m+ in global subscribers, $8.3bn in revenues, and $2.86 in earnings per share1.

On 19th July, Netflix announced an increase of 5.9m subscribers (+7% y-o-y)2, far outpacing the estimate. Global revenues came in at $8.2bn (+3% y-o-y, or +6% on a neutral foreign exchange basis) but missed expectations by ~$100m, whilst earnings per share grew 3% to $3.292, again beating expectations.

- Revenues came up light despite the strong net additions as average revenue per member (“ARM”) declined 3% (-1% on a neutral foreign exchange basis). Management explained the decline was due to:

- Limited price increases over the past 12 months as they prepared for the launch of their paid sharing initiative;

- The timing of paid net additions that were given a boost from the rollout of their paid sharing initiative; and

- A higher mix of membership growth from lower ARM countries.

Netflix generates its revenue from a combination of pricing, volume (number of subscribers) and new revenue streams such as advertising. Pricing was largely static for much of the year and advertising revenues are still in their infancy and not expected to be a major contributor. Volume, therefore, did much of the leg work and management have anticipated that volume growth will accelerate over the coming quarters.

Paid sharing

Management didn’t give much detail on what proportion of the paid net additions the converted borrowers made, or what percentage of borrowers converted out of the total known borrower population. They did mention most converted subscribers were those who watched a lot of Netflix content. Co-CEO Greg Peters was optimistic that a good majority of the new sign-ups showed “retention characteristics that generally look like higher tenure members”. They expect the full impact of this initiative to filter through in the fourth quarter of this year.

Basic with advertising (“Ads”)

Another piece of important news from their earnings update was the growth of their basic-with-ads membership base, which had almost doubled since the end of Q1 (albeit off a small base). During the quarter the company had removed its basic ad-free service in Canada and intends to roll this out across the US and UK imminently. The removal does not impact existing members, but new subscribers or returning customers will not be given a basic ad-free option in these markets. Another indication that the ad-supported-tier is significantly more profitable, encouraging management to think of ways to funnel more eyeballs towards its advertising customers. As has been debated within the team in the past, this prompts the question: Who is Netflix’s most important customer - is it the subscriber or the advertiser?

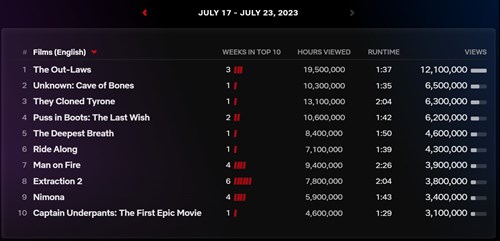

Netflix needs to satisfy the needs of both, whilst optimising long-term revenue. The viewer is offered a range of features to build their best value proposition from ads or no ads, video quality, number of simultaneous streams etc. For the advertiser, Netflix is encouraging more viewers onto the ad-supported service and looking to integrate innovative ways to target specific audiences. Management didn’t reveal much on what innovations they were looking at, but they did suggest their top 10 would give advertisers guaranteed participation in the most popular shows and films on Netflix at any given moment in time.

Source: Netflix

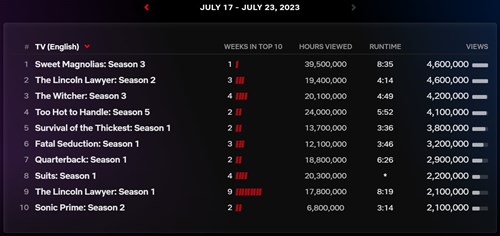

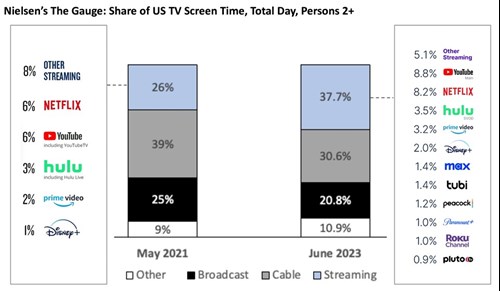

Increasing Netflix’s appeal to advertisers is its growing share of streaming, which itself continues to grow as a proportion of all TV time. Streaming now accounts for 37% of TV time in the US, and Netflix continues to dominate the most viewed lists compiled by Nielson3. This creates a number of possibilities, but all are dependent on building out the right technological capabilities to service the needs of their advertisers. In other words, one can expect higher expenditure on technology to support this growing revenue stream. The economics of the ad-supported plan would appear to be very compelling, with Chief Financial Officer, Spencer Neumann, confirming the overall ads ARM was higher than that of the basic ad-free plan globally.

Source: Netflix Q2 2023 Shareholder letter

Capital allocation and outlook

Operating margins and free cash flow (“FCF”) were encouragingly high at first glance, but it is clear that the WGA and SAG-AFTRA strikes in the US are a very serious affair and have impacted content spending. The company reported $1.3bn in FCF for the quarter2, which compared very favourably to the breakeven achieved in the year ago period. The company expects to produce $5bn in FCF for the year – a very healthy number and significantly up from ~$1bn produced last year2.

One of the factors that attracted us to Netflix was the move from negative to positive FCF and the prospect of meaningful FCF generation going forward – significantly de-risking the financial side of the investment opportunity. Management warned that we should expect lumpiness in FCF from 2023-2024 due to the timing of the production starts and the impact prolonged strike action may have, but their intention is to produce substantial positive FCF.

Debt of $14.5bn remains within their tolerance of between $10-$15bn, and cash of $8.6bn is above their targeted minimum level (working capital requirements for 2-3 months) so they expect to accelerate their $5bn stock buyback program over the second half of the year2.

The outlook gave a mixed message. We mentioned above how management expected volumes to grow but they also predicted ARM to be flat to down, suggesting that the net addition mix is weighted towards lower priced regions. It must be said, shares weren’t cheap heading into the earnings report after a 40% rally Y-T-D, therefore, without a meaningful beat and raise a sell-off of some magnitude was inevitable.

Netflix remains our number one pick in the portfolio, to gain exposure to the streaming industry’s growth and the continued disruption of linear TV, albeit at a lower weight on valuation grounds.

We hope you have a good week.

Sources:

- 1 FactSet 26/07/2023

- 2 Netflix Shareholder letter

- 3 Nielsen

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance.

Any mention of individual stocks are with reference to our management of the Global Equity Blue Chip Fund, are based on our own proprietary views and are not a recommendation to investors.