For those thinking this article is about the smash hit TV series of the same title, you may be disappointed. To be honest, I like nothing more than a good box set and should you have the time I would highly recommend a watch – for fans of cowboys, horses and fantastic scenery, this is your show. The series is based in the beautiful states of Wyoming, Montana and Utah, the former of which was the home of the Jackson Hole Economic Symposium held from 24th to 26th August 2023.

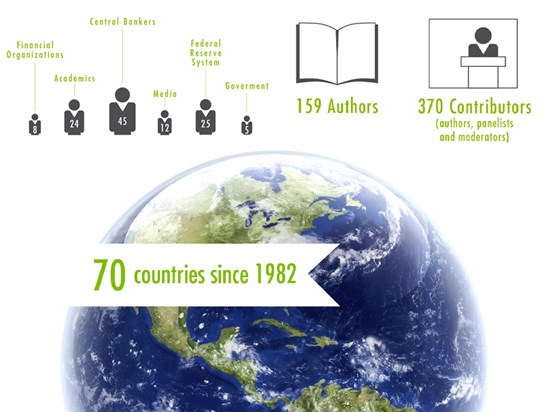

The annual event is hosted by the Federal Reserve Bank of Kansas and brings together dozens of central bankers, academics and economists to discuss the most pressing matters facing global economics. This year's theme, "Structural Shifts in the Global Economy,” explored several significant, and potentially long-lasting, developments that affect the global economy. While the immediate disruption of the pandemic is fading, there likely will be long-lasting aftereffects on how economies are structured, both domestically and globally, as trade networks shift and global financial flows react. This is what we refer to in discretionary asset management as trying to navigate the “changing world”.

The keynote speaker was Jerome Powell who, in his live address, “Inflation: Progress and the path ahead” on Friday, stated:

“It is the Fed's job to bring inflation down to our 2 percent goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Jerome spoke about the impact Covid had on both very strong demand and pandemic-constrained supply as well as the effects of Russia’s war against Ukraine, both of which have been primary drivers of the changes in headline inflation around the world since early 2022.

The main tool the FED uses to bring inflation down is raising interest rates (for those over 70, as my parents are, this is not your first rodeo, as you would have seen and experienced this back in the 70s). For many, including us at Ravenscroft, the last 18 months has been our first time experiencing this type of market, where inflation has been an issue. During most of my working, life inflation has been fairly well constrained, between two to three per cent, so this for me has been both fascinating and frustrating.

Jerome concluded that they would assess their progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, they will proceed carefully as they decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate – the dual mandate refers to both price stability and maximum sustainable employment.

They will keep at it until the job is done.

Equity markets took the speech in their stride, and the fixed-income markets had to adjust their price to reflect the potentially higher interest rates.

From an investment perspective, this means markets will continue to be tricky to navigate, and for the time being, we will continue to live in a changing world. Time will be our (and your) friend and we have positioned your portfolios to navigate this as best we can.

We hope you have a good week.