Portfolio manager Tom Craske explains the differences between these two methods of investing.

Generally speaking, there are two methods for an investor to choose from – income or growth – and which one you pick will depend on your goals for the investment and how you want it to work for you. For now, think of investing for growth like growing a tree, and investing for income like harvesting fruit from that tree.

Investing for growth

There is an old saying about acorns that relates to growth investing:

“From tiny acorns mighty oaks grow.”

Like the acorn, when you invest for growth, you are looking for your investment to grow into something more substantial and increase in value over time. For example, if you buy shares of Microsoft, you hope that the company will do well, sell lots of computers, services, and software, and the value of your shares will go up. Growth investment strategies tend to focus on equity investments. A portfolio manager will look to buy stock in companies or sectors that are expected to perform well in the future and return a higher amount of capital back to their investors. Equity investments tend to be the riskier part of the investment universe because there are no guaranteed returns to investors. The upside of taking this risk is that investors can be rewarded with potentially unlimited returns.

An acorn, given time, will grow. So, it is natural to think about the long term when investing for growth. There will be bumps along the way, the tree could lose a branch in a storm or be struck by lightning, but over time will flourish into a mighty oak. Similarly, someone investing for growth is patient and willing to wait for their investment to grow.

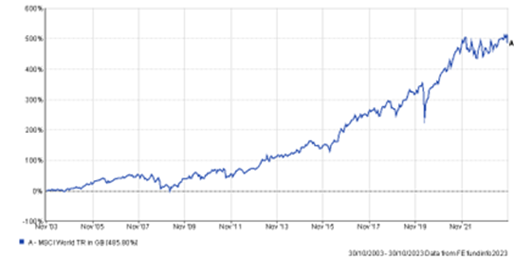

To illustrate the point, the chart below shows the performance of the MSCI World Index (think of this as the global stock market) over the last 20 years. Investing in the market for 20 years would have returned 485%! During that time, an investor's portfolio went through plenty of ups and downs – the 2008 Global Financial Crisis, the Covid-19 pandemic, and, most recently, the war in Ukraine and the inflation shock. These were all difficult times for financial markets, but patient investors have been rewarded.

Source: MSCI

Investing for income

Investing for income, on the other hand, is like having a fruit tree that you can pick on a regular basis. For investors, this means investing your money into assets that provide a steady stream of income, usually bonds or stocks that pay a regular dividend. You can think of a bond as a loan you give to a government or company. You give them money and in return, they pay you interest for using that money. Dividends, on the other hand, are the profits a company pays out to investors. Because there is a guarantee of return on bonds, they tend to be less risky and offer lower returns than the equity investments common in growth strategies.

You could also look at income investing as something that pays you a monthly salary or like a tenant who pays rent on a property. If you own a rental property, you get money from the tenants so they can live in your property. Likewise, if an investor were to invest in bonds, the bond issuer would pay you interest or a coupon regularly, like rent for using your money.

Income investors often want to have a reliable source of money. It is a common strategy for investors who are retired, no longer working and want to replace their usual income—but not always. They might not be as concerned about their investments growing in value, but they want to know they can rely on getting money regularly.

A bit of both

Both income and growth investing have their pros and cons, but you do not have to choose just one method; it is common for investors to opt for a bit of both. You may want to have a portion of your capital invested for long-term growth and the remaining part invested for income where there are more capital guarantees and less risk. What is important is that you think about what you want from your investments and what makes sense for your goals and plans.

If you’d like to find out more about investing with Ravenscroft, or if you have any questions you’d like us to answer, please contact us.