The last two decades have seen a substantial amount of financial commentary going to print on the investment prospects aligned with the Chinese economy. Initially, this related primarily to the urbanisation of the population and the opportunity this shift afforded to investors as the country’s economy expanded exponentially. Whereas more recently the emphasis has centred around the ability of policymakers to transform the economy from manufacturing to services led, whilst shifting away from providing cheap low-tech goods to being a world leader in technology-intensive products.

Indeed, over the past 12 months, we have commented on the struggles of the Chinese economy created by the early rapid expansion and the problems associated with this change in policy. (See ‘The China conundrum’, ‘In every crisis, there is opportunity’, and ‘Here we go again… Further trouble brewing in China’).

With two of the principal investment themes underpinning Ravenscroft’s discretionary portfolios being increasing global consumption and the rise of the emerging market middle class, clearly, any troubles associated with the third largest global consumer market - behind the US and European Union - and by far the largest emerging market, has caused us to take note.

The fundamental premise supporting China as an investment theme was leveraging the extensive industrialisation and purchasing power of Chinese consumers as they ascended the income scale into the ‘middle class’. According to the Pew Research Centre, it is estimated that China’s middle class grew from 3% in 2000 to over 50% by 2018, some 707 million people.

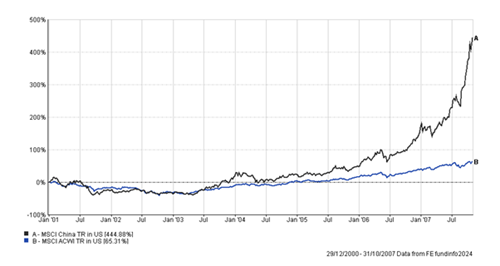

Chinese companies were in high demand resulting in a pronounced outperformance of Chinese stocks relative to global indices from 2000 to the end of October 2007 (see fig. 1 below).

Fig 1. China stock returns as measured by the MSCI China Index versus global stocks as measured by the MSCI All Country Index. All returns in USD on a total return basis. Source FE Analytics.

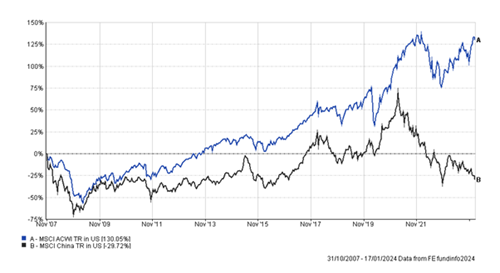

Since the Global Financial Crisis, various policies have been implemented by Chinese policymakers impacting investor sentiment. Furthermore, idiosyncratic factors have also weighed on sentiment, putting downward pressure on Chinese markets. (See fig. 2 below).

Fig 2. China stock returns as measured by the MSCI China Index versus global stocks as measured by the MSCI All Country Index. All returns in USD on a total return basis. Source FE Analytics.

While the well-documented challenges facing the Chinese economy have translated into poor asset market returns from markets exposed to the region, the importance of India in financial markets has been rapidly increasing, drawing investors’ attention alike. As such, fund managers with which we invest have been, or have indicated the intention to, increase exposure to the country whilst reducing exposure to Chinese assets.

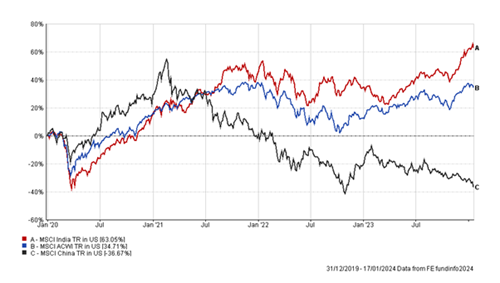

Indian equities have markedly outperformed since the opening of the global economy after the announcement that a Covid vaccine had been developed (see fig. 3).

Fig 3. China stock returns as measured by the MSCI China Index versus India stocks as measured by the MSCI India index and global stocks as measured by the MSCI All Country Index. All returns in USD on a total return basis. Source FE Analytics.

There are numerous theses supporting India as an investment prospect, not least, the stage at which the Indian economy is in in its development. Similarly, to China going into the turn of the millennia, India’s low-income economy is growing fast as it embarks on the initial stages of urbanisation, harnessing the opportunities created as incomes grow and infrastructure investment is required to support this shift. Unlike China, however, the demographics are very favourable. The population is young and growing rapidly, allowing for India to be one of the few global economies whose working-class population is expanding.

From a political perspective, the country has, arguably, the most democratically stable government in the world. Polls taken in December of last year, had Prime Minister Modi receiving a 76% approval rating placing him amongst the world’s most popular. A popularity of which has allowed difficult reforms to have been introduced. For instance, improving government finances through the introduction of a goods and services tax and implementing policies to address corruption in the economy.

Though, perhaps of most significance, was the introduction of an identification system, Aadhar. The system is the world’s largest biometric ID system, which has facilitated access for almost all Indians to bank accounts leading to the administering of benefit transfers and credit facilities – amongst other uses – contributing to economic expansion.

Moreover, India’s economy is open. Many of the world’s largest multinational companies are investing in the country endeavouring to capitalise on the low penetration rates on consumer products such as electronics and staples, while a growing middle class allows for a demand for healthcare and other services.

Undoubtedly, Indian markets have had a good period of outperformance and from a valuation perspective appear expensive, both, versus their long-term average and from a relative sense, particularly trading on a premium against Chinese equities. Nonetheless, we believe a rotation of this magnitude takes years to unfold and would suggest we are in the early innings of a marked outperformance of Indian equity markets, albeit with periods of volatility.

Our chosen method to gain exposure to the emerging markets (‘EM’), China, India and others, is via specialist managers who are seeing these trends evolve from the ground up and those who have direct contact with the businesses at the centre of this change; whether this is Colgate India, Mahindra & Mahindra, India’s largest vehicle manufacturer or Kotak Mahindra Bank, India’s largest banking and financial services business.

As with most investment sectors, different EM regions will rotate in and out of favour and we entrust our selected managers to tilt exposure on our behalf depending on valuations and opportunities across the region.