Welcome to our fourth-quarter Global Blue Chip Insights commentary for 2023.

In this update we will cover the following:

- Performance commentary for Q4 and year-to-date

- Stock selection and portfolio construction insights – Time Arbitrage

- Stock in focus – Estée Lauder

- Deep dive – ‘New’ Sanofi

Please click here to view/download the PDF version of this update.

Global Blue Chip Q4 2023 performance commentary by Ben Byrom

Equity investors had to navigate a number of macroeconomic and geopolitical issues throughout 2023 but arguably their biggest test came in the fourth quarter when weakness in September mutated into a brutal capitulation in October. Bond yields had been soaring on the fear that interest rates would remain elevated for longer than had been expected. Market positioning was overly bearish at this point and sentiment was at a particularly low ebb - conditions were ripe for a relief rally. The spark that lit the touch paper under equities was falling inflation data which sent bond yields sharply lower. Jerome Powell, the Federal Reserve Chairman, threw petrol onto the fire when his dovish comments suggested they were prepared to pivot on interest rate policy. Attempts by Fed officials to play down this expectation only fanned the flames higher. What ensued in terms of price action will go down in the record books as a very rare event with nine straight winning weeks registered across a number of major equity market indices.

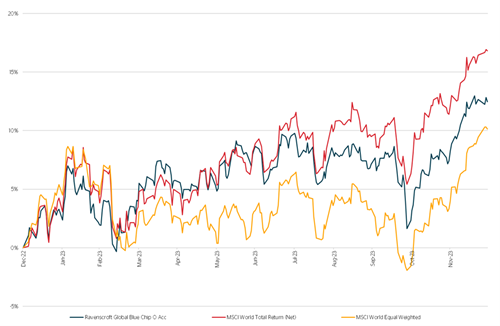

Chart 1. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) and the MSCI World Equal Weighted for Q4 2023, in GBP

Source: FactSet and Ravenscroft, compiled 02/01/2024

It is important to note that past performance is not a reliable indicator of future results.

To illustrate the strength and breadth of this rally we have included the MSCI World Equal Weight Index in the chart above (a full five-year performance table can be seen below). The equal weight ensures all companies have the same representation irrespective of their size. It therefore removes the influence bigger companies, such as the ‘Magnificent 7’, may have on the performance of the index, offering a different perspective on the health of the market. Given the Ravenscroft Global Blue Chip Fund’s defensive positioning, it was pleasing to see it compete favourably in this type of environment although the wind was unexpectedly taken out of its sails towards the end of the quarter after Oracle and Nike announced their quarterly earnings. Nonetheless, the fund delivered a 5% return for the quarter[1] with both MSCI World indices finishing the period up around 6.6%-6.8%[2]

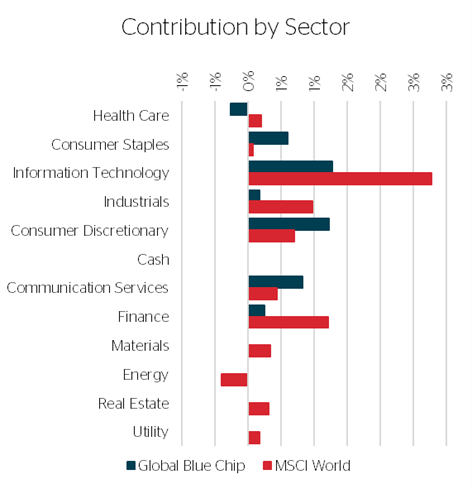

Chart 2. Contribution by Sector for Q4 2023 (returns in GBP)

Source: FactSet and Ravenscroft, compiled 03/01/2024

|

Top 5 Contributors (GBP) |

GBP Contribution |

|

|

1 |

PTC Inc. |

0.63% |

|

2 |

ETSY Inc. |

0..61% |

|

3 |

Netflix Inc. |

0.50% |

|

4 |

Microsoft Corporation |

0.43% |

|

5 |

Estee Lauder Inc. |

0.39% |

|

Top 5 Detractors (GBP) |

||

|

1 |

Sanofi |

-0.59% |

|

2 |

Bio-Rad Laboratories |

-0.44% |

|

3 |

Oracle Corporation. |

-0.20% |

|

4 |

Haleon PLC. |

-0.20% |

|

5 |

Diageo PLC. |

-0.17% |

Source: FactSet and Ravenscroft, Compiled 03/01/2024

Our biggest contributor to performance was PTC Inc., the designer of product software for use within the industrial environment. We upped our position following its Q4 and full-year earnings announcement in early November, which showcased the resilience of its software business which continues to grow profitably at attractive rates in the face of deteriorating economic indicators. The shares clearly got caught up in the strong equity rally and we reduced the position in mid-December on valuation grounds.

Etsy’s shares also got caught up in the strong market rally after a positive earnings announcement. The company beat on both the top and bottom lines, beating expectations in an uncertain environment for retail platforms. Despite the uncertainty, Etsy showed it was back to growing its ‘Gross Merchandise Sales (GMS’) – an important performance metric for the company and investors.

Netflix was a clear beneficiary of the writers’ and actors’ strikes that lasted the best part of five months with resolutions to the individual disputes being found in September and November respectively. Netflix’s Q3 results demonstrated how well it had weathered this period. You would have to read between the lines amongst the plethora of information to understand just how dominant Netflix now is in the streaming industry. The fact that Suits (a Universal Content production) is one of the most watched shows on the platform sends two clear messages: 1) Other streamers are suffering and need to monetise their content in the most profitable way possible and 2) Netflix may not have to produce so much of its own content if others are willing to license theirs – not only would this be cash flow accretive it would also serve as a strong marketing tool for future subscribers. Shares climbed as high as $500 in December almost closing in on the price it last traded at prior to its disastrous Q4 2021 earnings announcement. Shares are not cheap so it may take some time before it gets there, but the fundamentals look very good for Netflix.

Microsoft had a very strong year thanks to its collaboration with OpenAI and the integration of AI in a suite of productivity tools it calls Copilot. Whilst Microsoft’s financial results have clearly benefitted from its collaboration with OpenAI we suspect the hype around AI is starting to moderate as litigation mounts. A major issue behind language models such as OpenAI’s ChatGPT is the allegation that they have been trained on a foundation of stolen property such as copyrighted texts, images and videos taken without permission or compensation. One such litigation was filed by the New York Times on 27th December and may act as a bellwether ruling should it go to trial.

Finally, Estée Lauder – a new entrant as of November - rallied so hard that it was our fifth biggest contributor to performance. While the timing was fortunate, the reason for entering was based on fundamentals. We have been watching Estée and its inventory woes for the best part of a year, firmly believing that an opportunity to buy the company at a price that compensated us for the risks involved was unlikely to present itself. Our patience was finally rewarded following its Q3 results. The V-shape recovery from its lows suggests we’re not the only ones who saw value at those levels. Estée still has work to do so we may get another bite of the cherry and an opportunity to build up our position. You can read more about the company and why we see value in this quarter’s Stock in Focus section.

Sanofi was the fund’s largest detractor during the period thanks largely to a surprise announcement made by management during their Q3 trading update. They forewarned that 2024 earnings would not grow after deciding to up their pipeline investments in a bid to secure growth beyond the end of the decade. The sacrifice of roughly 7% near-term earnings growth for an uncertain but much greater reward later on down the road was too much for investors who sent the shares down sharply some 20%. We cover this in this quarter’s Deep Dive section.

Bio-Rad Laboratories had been faring better than most of its peers in the life science industry, which has clearly been going through its own recession – especially in bioprocessing. However, Bio-Rad’s resistance to these negative forces caved in during the third quarter resulting in a big revenue and earnings miss and a revision to year-end targets. There are green shoots potentially emerging within bioprocessing – an area where Bio-Rad is exposed principally through its one-third stake in Sartorius. Shares look cheap once the fair value of its Sartorius stake is taken into account. Any meaningful recovery in bioprocessing or the broader life science sector should improve Bio-Rad’s share price.

Oracle temporarily took the wind out of our December rally when it announced its Q2 2024 earnings on 12th December. The company’s revenue and earnings came in at the mid-point and high end of expectations respectively, yet the market chose to focus on the slowing cloud infrastructure growth figure of ‘just’ +50% on a $6.5bn run rate, clearly interpreting the figure as a sign of slowing demand. The reality is Oracle continues to build out capacity as quickly as it can with demand in excess of what they can currently provide for. Our thesis, therefore, remains on track and we are happy holders although meaningful headway on the shares may be pared until we get some 2025 guidance in its Q4 announcement.

Haleon missed revenue expectations in its Q3 trading update released in November. Whilst it delivered reasonable organic top-line growth of 5%, thanks to its ability to hike prices with little erosion of volume, it did show some weakness in North America – a major growth market. Shares failed to participate in the rally and tracked sideways-to-down for much of the quarter. We remain very comfortable holding a pure-play consumer healthcare business such as Haleon. Medicinal brands have the ability to build enduring bonds with their consumers who trust them to deliver on their health and well-being characteristics.

Finally, Diageo surprised investors with a Q3 trading update that cut year-end and 2024 growth forecasts after it admitted to higher-than-expected inventory levels within its Latin American division. The company noted that Latin American customers were trading down in the face of higher cost of living expenses.

In terms of changes to the portfolio, we introduced Heineken, Estée Lauder, and eBay to the portfolio and removed in their entirety Relx, Roche, L’Oréal, and Unilever.

We sold Relx and L’Oréal, two exceptional businesses, on valuation grounds. We waited until the last bit of value had been drained and all that was left was more downside risk than upside optionality. We do hope we are gifted an opportunity to own these companies again in future!

The decision to remove both Unilever and Roche was based on the premise that there were better risk versus reward propositions in the portfolio more worthy of the capital tied up in their shares.

We bought Heineken, a Company we have been following for over six years, after we noticed meaningful value was materialising in the shares. Nothing much moves fast in the beer industry but Heineken has continued to build intrinsic value by re-orientating the company’s focus on emerging markets and Africa in particular, where in our opinion beer consumption is highly likely to rise for many years to come due to growing populations and income levels.

We also reintroduced eBay a company which continues to execute on its Focus Category Playbook which doubles down on innovation in a bid to reinvent the shopping experience in categories where it can differentiate its services beyond connecting buyers and sellers. Despite the clear evidence of early success (with its Focus Categories growing 700 basis points faster than the overall business[3]), eBay remains overlooked by the market with its stock trading on a single-digit multiple.

Estée’s inclusion came down to a compelling valuation driven by an exceptional set of circumstances that we go into more detail in this quarter’s Stock in Focus.

|

|

31/12/2022 - 31/12/2023 |

31/12/2021 - 31/12/2022 |

31/12/2020 - 31/12/2021 |

31/012/2019 - 31/12/2020 |

31/12/2018 - 31/12/2019 |

Annualised Since Inception 31/12/11 |

|

Global Blue Chip Portfolio |

12.4% |

-2.10% |

2.61% |

1.82% |

0.11% |

10.6% |

Source: Ravenscroft, compiled 05/01/2024

It is important to note that past performance is not a reliable indicator of future results.

Full Year Commentary

The fund’s O Accumulation units generated a 12.5%[4] return for the year in what was a tricky environment outside of the AI hype that had propelled a handful of large-cap stocks, collectively referred to as the ‘Magnificent 7’. To illustrate the impact the ‘Magnificent 7’ has had on the performance of the MSCI World Total Return (Net), which generated 16.8%[5] over the past year, we compared it to that of the equal weight alternative, which rose 10.1%[6]. While it doesn’t remove their involvement completely, it pares it back sufficiently to demonstrate their influence.

Chart 3. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) and MSCI World Equal Weight for 2023, in GBP

Source: FactSet and Ravenscroft, compiled 02/01/2024

It is important to note that past performance is not a reliable indicator of future results.

Although it is disappointing to have underperformed the broader market, it is worth noting that our exposure to the Magnificent 7 was significantly curtailed. We sold out of Amazon on valuation grounds, and we have been cutting back our exposure to both Microsoft and Alphabet due to valuation reasons throughout much of the year. As things stand today, we still own Microsoft and Alphabet but our AI exposure does not finish there. We have had great success with Adobe, Dropbox and Oracle, all of which have been beneficiaries of the AI trend – although we pared back our stake in Adobe after shares had their own AI-related run.

One of the redeeming features of our performance has been the strength of our technology stocks for much of this year. Putting the final quarter aside, where Oracle’s earnings announcement had an out-sized detrimental impact, our tech picks have led the way and have been one reason why we have managed to hold our own for much of the first nine months of the year.

Healthcare has been a drag on performance for a variety of idiosyncratic reasons. We let Roche go on the back of disappointing pipeline results and we sold Illumina with its board and executive team in disarray. Whilst Sanofi dropped an earnings bomb on investors in November, we do like the focus on its longer-term outlook. One area that we have been growing more fond of has been the life sciences sector, despite it having a difficult year. We may have been a little early in buying into some names, such as Bruker, and scaling up their positions (particularly Bio-Rad and Edwards Lifesciences) but we are very excited about their long-term potential and competitive positioning. Offsetting some of this volatility was our holding in Regeneron which rallied some 22%[7], adding 0.7%[8] to performance.

Consumer staples were surprisingly strong relative to their sector with returns being driven primarily by our cosmetics holdings: L’Oréal and Estée Lauder. We were quick to chop Henkel in Q2, when it became apparent the business model needed restructuring. We sold Colgate on valuation grounds and to fund new investments in Q3, and we culled Unilever, for similar reasons to Henkel towards the back end of the year. Within our alcoholic beverage businesses, Heineken entered the portfolio in early Q4 and has had a positive impact on performance, whilst Diageo detracted after it revised down profit guidance following an unexpected inventory build within its Latin America division. Consumer healthcare business Haleon went sideways for much of the year.

The portfolio has always been light on industrial companies, carrying a significant underweight position. However, what we did own held up well in absolute terms. Relx was the star performer, up 22% until the point we sold it in October.

Our consumer discretionary positions were very much in the line of fire due to the strong recession narrative surrounding markets for much of the year. Such narratives provided a great entry point for us in Airbnb, which we introduced in April. Inventory issues in China presented us with a nice opportunity to bulk up our exposure to Nike, which made a nice recovery up until it reported earnings in December. Etsy’s shares were under pressure for much of the year as the market fretted about the direction of its GMS. While the Q3 earnings announcement helped with sentiment it was the risk-on rally at year-end that drove shares meaningfully higher. On the e-commerce front, we introduced eBay, an old friend to Blue Chip, on valuation grounds. BMW and Stellantis, the latter of which was introduced in July, had a good year despite the negative headlines on Chinese competition, workers’ strikes, and recession. Amazon was also a significant contributor to returns with shares bouncing off their lows at the beginning of the year, rallying some 65%[9] to the point where we sold them on valuation grounds in August.

Our streamers give us exposure to the communication services sector. Disney continues to grapple with its legacy TV business and a pathway to profitability with its streaming division. There are a lot of moving parts to Disney at this point in time, but shares are underpinned by its Parks and Resorts division - giving Bob Iger time to work on a revival at the magical kingdom. Please see last Quarter’s Deep Dive ‘Has Disney’s Castle Been Breached’ for our take on the situation. Netflix, as mentioned earlier, has almost certainly crowned itself the market leader in streaming with competitors all but throwing in the towel, licensing their content to them in an attempt to make some money. It is likely we will see some consolidation in the sector which will continue to benefit Netflix in our opinion.

Finally, Visa, which sits all on its own in financials due to a benchmark reclassification, is our sole play in a sector where we have very little appetite. The company had a solid year and shares have reacted well. We continue to believe the payment rail companies will play an integral part in society’s move to online retailing and cashless transfers.

Stock selection and portfolio construction insights – Explaining Time (Horizon) Arbitrage by Ben Byrom

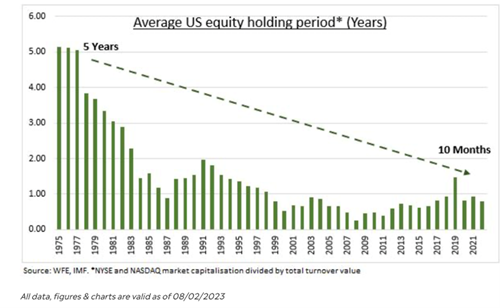

Global Blue Chip is not about predicting market trends or trading, it is about understanding and believing in the intrinsic value of businesses. We wholeheartedly adopt an approach that the late Charlie Munger would call ‘sit-on-your-ass’ investing – buy high-quality assets and be patient. In his words “The big money is not in the buying and the selling, but in the waiting”.

To have sufficient faith in such an approach you must believe in the enduring power of good businesses, the passage of time, and the power of compounding interest. Whilst this may come across as a disarmingly simple approach, it is backed by discipline to stick to overarching principles and a rigorous investment process, as well as possessing Zen-like mastery over one’s emotions.

Independent thinking allows you to see the wood through the trees and filter out all the opinions that clutter the news headlines. Having a strong understanding of the drivers behind the businesses you invest in better prepares you to assimilate any new information that comes to light and make timely decisions as to whether any price movements were justified.

The anxiety that unexpected change can bring often leads to knee-jerk reactions and poor decisions. By truly understanding and having a firm belief in what you own and why you own it, you give yourself the confidence to make informed judgements regarding the risk/reward propositions each investment offers, culminating in better decisions when unexpected matters occur. Likewise, for the prepared investor, irrational moves can offer fantastic opportunities.

It would be ludicrous to suggest that we have an information advantage - we don’t. It’s impossible to know everything about a company and its particular set of circumstances. However, we do believe that wanting to own for the long-term forces you to also think long-term, and by raising your time preference to years or even decades you give yourself a genuine edge – time.

“Time is the friend of the wonderful business, the enemy of the mediocre” – Warren Buffet

By valuing companies over extended periods of time you place yourself in the hard camp where the number of variables increases dramatically, raising the level of uncertainty within an investment. To overcome this, we do our due diligence and apply a healthy dose of conservatism to our assumptions in order to ensure there is a margin of safety in our calculations. As advocates of the ‘sit-on-your-ass’ and wait doctrine, this cautious approach may further undervalue high-quality (wonderful) businesses and their long-term potential. We’re okay with that because if we’re buying then we believe a stock to be cheap relative to its long-term potential which skews the risk/reward proposition in our favour, reducing anxiety and the likelihood of poor, emotionally driven decisions.

Often, we see long-term opportunities in companies that the market has tacitly ignored because of its myopic focus on what the next quarter or two will deliver. The chart below shows how holding periods have declined dramatically, increasing the influence short-term news and financial announcements have on investor’s decision making. This mismatch between our time preference and that of the average market participant is what we call Time Arbitrage, and it has yielded a number of new ideas that have gone on to deliver significant returns.

To help illustrate Time Arbitrage in practice, our next two features - Stock in Focus and our Deep Dive - focus on Estée Lauder and Sanofi respectively, both of whom experienced out-of-character price drops that presented us with compelling investment opportunities.

Stock in focus: Estée Lauder by Samuel Corbet

“From Cleopatra’s fabled milk bath to the ancient Egyptians’ pot of black kohl, from the rouged flapper cheeks of the 1920s and the hard, lollipop colours of the Hollywood vamp to Estée Lauder’s soft magic, women have always enhanced their god given looks. It has always been so. It will always be so”

Estée Lauder, founder of Estée Lauder & Companies, (1985)

It would be difficult to start any discussion on Estée Lauder (or the beauty industry more broadly) without referencing the quotation above. This was taken directly from Estée Lauder’s autobiography and succinctly explains why using beauty products is akin to opening Pandora’s box – once the benefits have been experienced, consumers are reluctant to go back to the ways of dry skin, lacklustre lips and a scentless existence. These innovations become part of people’s daily beauty regimes and consumers tend to exhibit sticky purchasing habits as a result. The repeat purchase nature of cosmetic products positioned as an “affordable luxury” has generated predictable sales patterns and high profits for decades, so it is no wonder the sector has been a compelling fishing ground for quality-focused investors.

This is a theme that Blue Chip holders have been beneficiaries of for a number of years via our holding in L’Oreal. Whilst we continued to admire Estée Lauder from afar (predominantly as a competitor to L’Oreal), the company had always been too richly valued for us to consider it seriously for investment purposes. Then, midway through 2022, the company’s fortunes began to change.

Following Covid, Estée management had anticipated a quick recovery in the Chinese consumers’ desire to travel and assumed pent-up demand would result in a rebound to solid growth in its Asia Travel Retail business. Unfortunately, the lockdowns persisted for longer than the company had expected, and a more gradual recovery ensued. This miscalculation meant that Estée’s travel retail channel was saturated with inventory their retail partners could not shift.

This precarious situation was particularly prominent in Hainan – a popular duty-free holiday destination for the ~80% of the Chinese population who do not possess a passport. The combination of a slower easing of lockdown restrictions and a crackdown on illegal daigou activity (the smuggling of duty-free goods back for sale in mainland China via agents) weighed heavily on demand. In a highly competitive environment, Estée’s retail partners panicked, and they quickly adopted a strategy based on price promotion to reduce inventory levels that better met the subdued consumption environment.

In its last fiscal year, the situation contributed to a 34% fall in the sales associated with Estée’s Global Travel Retail business (which accounts for 20% of Estée’s overall sales). Whilst the numbers made for pretty grim reading, the real question was whether this period of heavy discounting had resulted in any lasting implications for the desirability and allure of the underlying brands.

The precipitous fall in the company’s stock price (circa 70% from its 2021 highs) reveals the markets’ view, but we think it is too soon to draw the conclusion that there has been a broader, more permanent impairment of Estee’s brand to justify such a reaction. There are other issues to consider such as the ‘Bull Whip’ effect – where small changes in consumer demand have amplified ramifications for retailers and manufacturers, which are becoming an increasing issue in a post-Covid world.

We have listened to management’s comments on this issue for well over a year and they now believe the end is in sight. A deeper analysis of the 80% of the business not impacted by these issues reveals continued strong demand. We therefore drew the conclusion that the severity of the adverse share price movement was providing an opportunity to acquire stock in a world-class business at an undemanding valuation. This is the type of risk/reward payoff we favour, and we continue to feel that the margin of safety offered is sufficient to compensate us for any uncertainty surrounding this issue.

On top of this, Hainan currently serves as a destination that provides Estée a solution for expanding its reach beyond the, roughly, 150 Chinese cities where it currently has a physical presence. As the company continues building out its store network in mainland China (to include Tier 2 and Tier 3 cities) we would naturally expect some of the demand that is currently served by Hainan to be replaced by consumption closer to home. There are early indications that this is the case and provided this continues, it will reduce the influence of Estée’s travel business on the overall results.

Whilst there is no denying that the normalising of the inventory position has created headwinds for Estée Lauder, longer-term we fully expect the consumer’s love of Estee’s products to shine through. Our ability to look through these transitory issues is a perfect example of time arbitrage in action. We view our capacity to think about and appraise businesses over longer time frames as one of, if not the, greatest source of edge we have, and it is the driving factor behind some of our best investment returns.

We’re still (hopefully) in the early innings of our ownership period of Estée, but the results have been pleasing (up 30% since initiating our position in November). Whilst we would love to confidently declare we knew this was going to transpire, the reality is that, in the short-term, share price movements are highly erratic. Attributing this early success to anything other than luck would be slightly disingenuous. That said, the chances of producing market-beating returns over the long run are higher when acquiring excellent companies at depressed levels and we are optimistic, based on our fundamental analysis, that this may prove to be the case with Estée Lauder. We look forward to updating you on the company’s progress in future periods.

Deep Dive – ‘New’ Sanofi by Oliver Tostevin

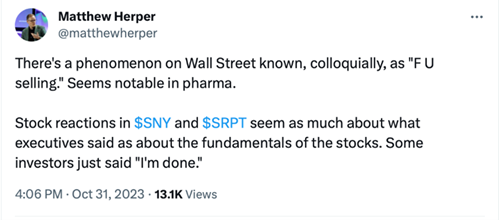

In late October, Sanofi shareholders saw the quoted value of their shares plunge by an astonishing 19% in a single day. One analyst quoted in the Wall Street Journal thought it to be the largest negative single-day stock move in big pharma in over a decade. A widely followed pharmaceuticals journalist captured the insanity of the moment well on his social media account (note: Sanofi’s stock ticker is SNY in the US):

While we were certainly surprised by the size of the move, we were not stunned into inaction – rather, after thinking it over for a couple of days we took the opportunity to increase our Sanofi holding to our maximum weight. We’re actually the most excited we have ever been about Sanofi and here we explain why.

Up until October Sanofi had been performing a pretty handy portfolio role for us in the trailing five-year period – annual returns, including dividends, were about in line with the portfolio average (if a little higher). Moreover, Sanofi’s business is about as detached from the economic cycle as they come, so the shares provided us with a nice degree of ballast in stormy economic seas. In our view, growth is baked into Sanofi’s results for years to come, largely as a result of Dupixent, a wonder drug that is disrupting the treatment of allergic diseases. Dupixent will achieve more than EUR 10bn in revenue in 2023 and it’s still growing at an annual rate of more than 30%[10]. Additionally, Sanofi has no major patent expiries for the rest of the decade (patent expiries being pharma kryptonite). Admittedly, we had one or two minor reservations around management, in particular about capital allocation and the possibility they could choose to enter into a large value-destructive deal at some stage (such is the norm in most big pharma businesses). We remained happy owners so long as the shares remained good value, but we didn’t necessarily view our relationship as a marriage.

The bombshell arrived in October alongside Sanofi’s third-quarter earnings release. Essentially they announced that they would forego earnings growth in 2024 and abandon their long-held profitability target for 2025. The reason: they were going to significantly increase investment in developing a handful of late-stage pipeline assets in order to maximise their potential. It’s fair to say our initial reaction was one of disappointment, given our prior expectations for growth coupled with our hopes that management wouldn’t do anything to de-rail the trajectory. The market reaction, on the other hand, was nothing short of a wild hissy fit: so sharply negative as to have little precedence.

If sentiment before October was rather muted, it has now turned to outright pessimism. Expectations were low, and now they are lower. Why? Sanofi has something of a reputation for being stodgy and bureaucratic, for being left in the dust by more innovative, more competitive peers. On the broad sweep of Sanofi’s actions in the last couple of decades, this reputation is not wholly undeserved and for many, we assume, the October announcement was the last straw. Our view is different. In our view, there were already signs of positive change prior to October, but reflecting on the October announcement and on Sanofi’s recent R&D Day, we have increased confidence that the historical view of Sanofi is now outdated. At this stage, our working hypothesis is that Sanofi has largely passed through the incredibly difficult process of re-inventing itself as a much better pharma business and is emerging on the other side, much like GSK has done (as we outlined here).

With the October announcement, Sanofi’s management was signalling that they are looking many years out into the future and making well-considered long-term investment decisions to both augment the company’s growth profile and to secure its future post-Dupixent. Moreover, the late-stage assets, where they are increasing investment, have already been somewhat de-risked through recent positive proof-of-concept studies. Let’s be clear: this is no wild splurge. It would have been far easier for management to do nothing and simply run the business for cash without regard for the future (make hay while the sun shines). Instead, they took the hard, unpopular, decision - and it’s the right one in our view. Stodgy old bureaucracies do not operate this way.

At the recent R&D event, Sanofi management outlined 12 mid- to late-stage pipeline assets with peak sales potential of EUR 2-5bn each. Naturally, it is not expected that all of these will succeed, but in recent years Sanofi has been demonstrating competency in running clinical trials and we believe they should be given the benefit of the doubt. But assuming at least a moderate degree of success, Sanofi is making great strides towards securing its future post-Dupixent and potentially achieving growth rates well beyond expectations. Additionally, Sanofi’s new head of R&D was hired, in part, due to his experience in capital allocation and he has explicitly declared that he does not intend to “splash the cash” on acquiring expensive assets – this goes a long way towards allaying our previous fears.

So when we consider Sanofi’s low stock market valuation alongside growth that is already baked in for the years ahead, we believe the risk/reward on offer to be very attractive – this is our base case. Throw in the optionality of higher growth potential from the new investment program and things get even more interesting with the possibility of additional upside. In the coming 12-18 months, there are plenty of catalysts on the horizon, including the announced separation of Sanofi’s consumer healthcare business at the end of 2024 as well as a re-acceleration of earnings in 2025. In the meantime, we see this as a classic time arbitrage opportunity and we’re prepared to be patient.

Sources:

- [1] Data from TISE website using O Acc Unit Class NAV’s, compiled by Ravenscroft on 02/01/2024

- [2] Data from FactSet, compiled by Ravenscroft on 02/01/2024

- [3] From eBay's Quarterly Business Results

- [4] Data from TISE website using O Acc Unit Class NAV’s, compiled by Ravenscroft on 02/01/2024

- [5] MSCI World Total Return (Net) return in GBP terms sourced from FactSet 02/01/2024

- [6] MSCI World Equal Weight return in GBP terms sourced from FactSet 02/01/2024

- [7] In USD terms – Source FactSet, compiled by Ravenscroft 02/01/2024

- [8] In GBP terms – Source FactSet, compiled by Ravenscroft 02/01/2024

- [9] In USD terms – Source FactSet, compiled by Ravenscroft 02/01/2024

- [10] Sanofi Q3 2023 earnings presentation