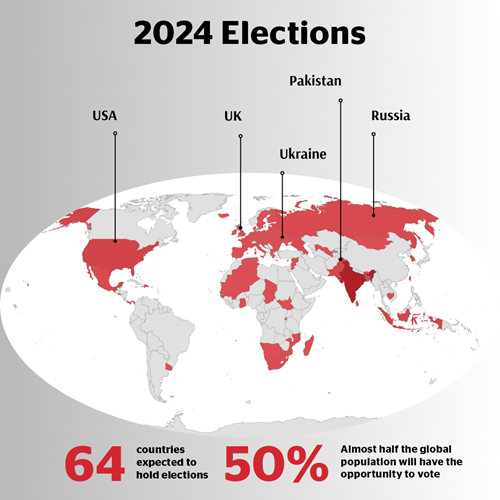

I was reading a Time Magazine article about the political circus that will unfold around us in 2024. At least 64 countries representing roughly half of the global population are scheduled to hold elections this year and these voters can (in theory, at least) influence the shape of their countries’ economic policy and international relations.

I say in theory as not all elections are equal. Consider Pakistan, where the country’s most popular politician, former Prime Minister Imran Khan, sits in jail, while his party has been suppressed and his supporters arrested in the run-up to February’s election. Likewise, consider the Russian Federation where a population of 144 million can vote in March. I don’t think any of us will be staying up late pondering what the election outcome will be. You also have to ask whether the Ukraine election scheduled on 31st March can take place amid war and if there will ever be another election in Mali, where the junta has indefinitely postponed the February election for technical reasons.

Figures according to TIME

It has got me thinking about how big an impact politics will have on investors’ ability to make money in 2024 and over the long term.

The world is undeniably a very unhappy place at the moment. We can see this in the World Happiness Report 2023 (166 pages long if you decide to look it up and read it), which advocates we all be mindful, grateful and kind on International Happiness Day (20th March).

Whilst an oversimplification, unhappy voters are more likely to vote for change. Therefore, outside of the likes of Russia, Pakistan and other parts of the world where votes are worth less than the paper they are cast on, expect change. Whether it be policy change by existing governments or change of government, the direction of travel will be trying to appease the unhappy populace.

The key global issue seems to be the wealth divide and, specifically, the increasing number of people struggling to make ends meet. Between 2009 and 2021 artificially low interest rates propelled investments higher – those who were wealthy in 2009 should be wealthier today as investment returns have been ahead of inflation. In contrast, someone relying on earnings is probably worse off as wage rises are unlikely to have kept pace with inflation. This means that whilst the narrative and policy will differ from country to country, the thrust is likely to be making life easier for those with lower incomes. This is likely to be accompanied by nationalistic overtones making it clear that governments (or governments to be) are placing their own citizens’ interests first and foremost in their policies.

In America, whether it be Republican Trump (shrink government, deport, drill, reshore businesses and levy tariffs on imports) or Democrat Biden (tax the wealthy, tax business and redistribute) the narrative will be about making life better for the average American. In England, the difference in policies between the main parties is not as wide as it is in America but Tory Sunak (cut tax and get a grip on immigration) or Labour Starmer (I will change policy to anything that I think will improve my election chances) will certainly be promising to make life easier for the average Brit. Similar messages will echo in 60+ countries around the world.

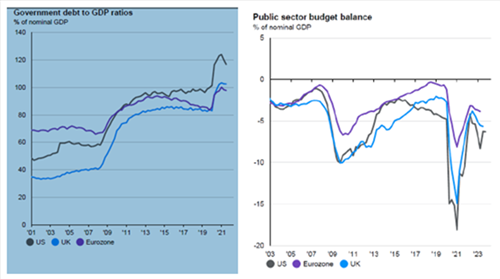

The awkward truth for most politicians in democracies is that they won’t be able to do nearly as much as they would like to. Governments are heavily indebted and the cost of servicing that debt is high. The charts below highlight the high debt levels in America, the UK and Europe as well as their budget deficits relative to their gross domestic product. They don’t have a lot of financial flex. Or, as Old Mother Hubbard would say the cupboard is bare.

Source: JP Morgan

It is also the case that presidents, prime ministers and governments aren’t nearly as powerful as most think. Their term of office is typically four years, which limits the amount of change they can push through. In addition to the financial and time limitations on what they can achieve, there are legislative limitations (ask Rishi Sunak about his Rwanda Bill) and voters are often very tactical, resulting in coalitions rather than risking one party dictating policy. In the case of American politics, there is a self-checking mechanism with the president having to work with the House of Representatives and the Senate.

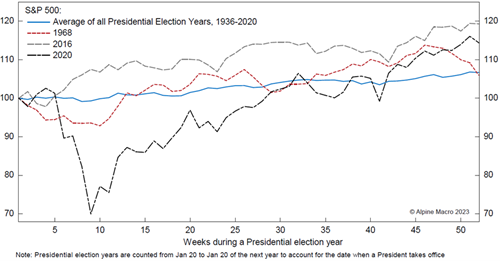

The chart below looks at the performance of the S&P500 from 1936 to 2020, focusing on American presidential election years and it seems that whilst political noise may cause some volatility and dampen overall returns in an election year the usual outcome is a positive year. The risk of implementation of policies that negatively impact the economy or business in an election year is relatively low as government hands are mostly tied. They don’t have time to get anything important through the legislative process and the politicians want to spend their time detailing their manifesto for the years ahead, shaking hands and kissing babies to show what wonderful human beings they are and how worthy they are of a vote. An election year could fairly be described as a year of lots of political noise but little action.

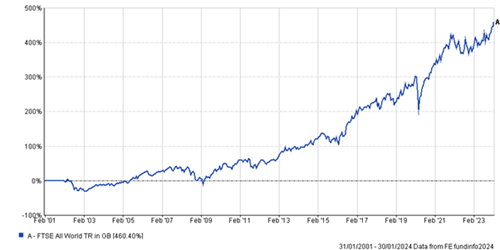

If we look at the financial impact of elections through a wider global lens the story seems to be the same. The chart below shows the FTSE World Index over 23 years from 2001 to 2024. The reality is, despite numerous elections and changes in governments in various countries around the world, during this period there is no significant drawdown in equity markets that can be attributed to an election. The global financial crisis, Covid and the Russian invasion of Ukraine were important events for investors, but changes in governments, prime ministers and presidents seem to have had little impact.

My favourite political quote is “That government is best which governs least”, which neatly rhymes with my life observation on governments around the world. Namely, if you succeed in life, it is likely to be despite government rather than because of government.

In most years, and over the long term, politics seems to have little impact on investor returns whereas the path of interest rates and inflation, messaging from central bankers and the entrepreneurial spirit of business leaders can have a significant impact. If political noise in 2024 delivers bouts of volatility in investment markets I recommend that you take a step back and look for opportunities, as we will be doing.