Stewart Moyles from our precious metals team discusses the reasons behind fluctuations in the price of gold.

Back in December, the precious metals team attended the Guernsey Careers and Skills show where we ran a competition for the attendees. We asked entrants to predict whether the gold spot price (the current market price of gold) would increase or decrease by the following week and, for a bonus prize, why they chose their answer.

We were pleased to find that many entrants, most of whom were between 14 and 18, had an understanding of what could affect the price of gold.

There are varying factors to consider when looking at what impacts the price of gold, but the most popular answer for the competition was supply and demand, so we’ll start there.

Supply and demand

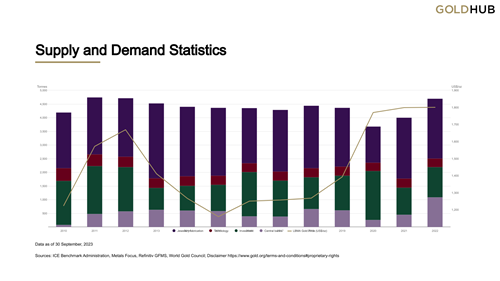

How much new gold is being mined globally versus how much is being bought and sold in any given period has an obvious impact on its market value.

In terms of supply, annual gold production from mining has been consistent, with the World Gold Council putting the yearly average at 3,339 tonnes since 2010. Large increases or decreases in mining output do not happen quickly and new major gold discoveries are rare, which means the supply of gold is relatively stable.

The demand for gold comes from four primary sources: jewellery fabrication, investment, central bank purchases and its technology and industrial uses.

The demand for gold comes from four primary sources: jewellery fabrication, investment, central bank purchases and its technology and industrial uses.

Investor activity can be a factor that tilts supply/demand one way or another. When economic uncertainty rises, investors tend to look to gold (which we discuss in further detail next), therefore boosting demand. In more upbeat times, interest in investment bullion tends to fall, and instead, the predominant demand for gold stems from jewellery and technology.

Gold has unique properties that make it an ideal choice for varying electronic applications. It is resistant to corrosion, an excellent electrical conductor and incredibly malleable so manufacturers use gold in printed circuit boards (PCBs), mobile phones and electronic connectors (found in laptops, smartphones and LEDs). As technology advances and our reliance on electronic devices grows, we expect gold will continue to play an important role in the industry. From a sustainability perspective, recycling and recovering gold from electronic waste will become increasingly important.

Geopolitical factors

Another common answer given by our competition entrants was war. The price of gold is highly sensitive to geopolitical conflicts, economic crises and other destabilising events that fuel investor uncertainty. Wars, trade disputes, natural disasters and political turmoil tend to boost demand for gold among investors seeking shelter.

While every situation is different, gold has shown, historically, reliable benefits when major geopolitical or economic crises strike as investors have continued to seek out the comfort of gold’s stability.

Strength of the US Dollar

The relationship between gold and the dollar is complex, but some common trends that can easily be explained.

Generally speaking, a strong dollar tends to lead to declining gold prices. The main reason for this is a decrease in foreign demand. Gold is typically priced and benchmarked in US Dollars. Buyers of gold who do not own dollars need to exchange their currency for US Dollars, which costs more when the dollar is strong. This ultimately means that fewer investors will buy gold.

As we explain further below, interest rates affect the gold price and this is something we saw throughout 2022 – 2023. Interest rates were raised by the Federal Reserve in an attempt to curb inflation. The higher the interest rates rise, the more demand for the dollar there is from international investors seeking a yield which, strengthens the US Dollar. Throughout 2022 and 2023, gold saw drops in price around the time of these hikes but, ultimately, recovered due to geopolitical events and global uncertainty.

Interest rates

Alongside this relationship is the real interest rate, which accounts for the impacts of inflation. As a non-yield-producing asset, gold becomes more attractive when real rates turn negative. Gold does not pay any interest, nor does it pay investors a dividend, so when interest rates are high, investors can choose to place their money in investments that will yield a return. When interest rates are lower, gold again becomes an attractive way of storing value.

As you can see, gold’s price is influenced by varying complex and interrelated factors, but it has constantly proven its merit as a long-term store of value for centuries, as it can help to diversify and protect against market uncertainties.

If you’d like to find out more about investing with Ravenscroft, or if you have any questions you’d like us to answer, please contact us.