From a market perspective, the “it” phrase of 2023 was the Magnificent 7, the term coined to describe the seven US tech stocks driven by the positivity surrounding AI. This collection of companies drove returns across the technology sector and influenced the performance of the entire market. These seven names masked the significance of returns of many other successful businesses and distracted us from a similar story evolving in the healthcare sector. In aggregate, the sector returned a fairly uninspiring -2%, but under the surface there were two star performers in the name of Eli Lilly, up 52%1, and Novo Nordisk, up 45%1.

Shares of the competing US and Europe pharma giants soared post-approval of drugs with similar active ingredients focused on blood sugar control for those with type 2 diabetes. What caused the additional bout of excitement was that both of Eli Lilly’s products, Mounjaro and Zepbound, along with Novo Nordisk’s equivalent Ozempic, have been proven through multiple studies to also manage weight gain effectively.

And whilst perhaps not the best light reading for a Monday morning; there is certainly a natural tailwind behind the expected demand for these drugs, as the addressable market is set to increase.

According to the International Diabetes Federation, diabetes currently affects one in 10 people. That’s approximately 537 million adults around the world – and this number is predicted to rise to 783 million by 2045. These statistics are concentrated to the emerging world, which is an unutilised opportunity set for these drugs.

Perhaps more importantly, and arguably what has sparked such interest in the drugs, is the weight loss element. Research shows us that ineffective weight management increases the risk of other health issues, including heart attacks and strokes. If you can reduce this, the outcome for people and hospitals is only positive.

Projections by Goldman Sachs Research show the anti-obesity medication sector has seen rapid growth in recent years. It is currently valued at $6 billion but projections show it is set to hit $100 billion by 2030. Both Novo Nordisk and Eli Lilly are expected to dominate this market and control up to 80% of it by the end of the decade.

Given the possible significance of the medical breakthrough, the share price reaction is perhaps unsurprising but, as with their tech counterparts, it is worth questioning whether these stocks are now overvalued.

One measure to consider would be their forward Price-to-Earnings (P/E) ratio, which compares the current share price with the one-year projected earnings. For Novo Nordisk this stands at 36x and Eli Lilly 59x – higher than the likes of Nvidia, which is 49x2. On face value, these appear stretched, particularly when even Novo Nordisk’s is twice the average multiple of its peers. As valuation-driven investors, we are always conscious of overpaying primarily because, despite the opportunity set, there is little margin for error. Instead, we prefer to invest in businesses at prices that allow scope for execution risk and external shocks that remain beyond our (or management’s) ability to manage.

Healthcare remains one of our core long-term investment themes – its relevance underpinned by ageing demographics and increasing healthcare needs. Despite Healthcare being a typically defensive sector, given the steady demand for medical care, it is not immune to the odd crises in the form of pricing pressures, delayed drug approvals, and patent cliffs and it is often used as a political bargaining chip.

Our approach to mitigate these risks is to own a broad cross-section of businesses, either via specialist active managers, who have a direct insight into the latest cutting-edge breakthroughs or directly through the key players in pharmaceuticals, biotech, life sciences and medical devices.

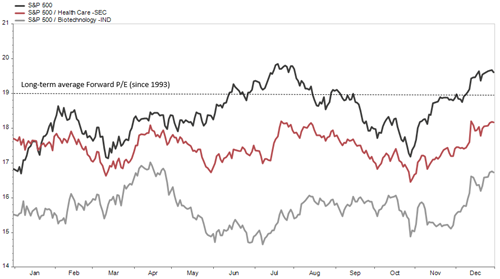

Despite the valuations of “Top 2” Eli Lily and Novo Nordisk, broader healthcare valuations have fallen to below-average levels over the last year, providing an attractive entry point to an increasing opportunity set and accelerating innovation. We continue to remain excited about the potential for long-term investors and the returns we expect them to be beneficiaries of.

Source: FactSet

If you would like to discuss how you can best get exposure to this theme, please reach out to our investment team who would be happy to assist.

Sources:

- 1-2 Share price performance and P/E ratios from FactSet