I started my career in this industry in the mid-1980s, and experienced an eventful second half to the decade, which included the inflating and bursting of a spectacular bubble in Japanese equities and property. The combination of a strong economy, led by a tight labour market and technological innovation, a loose monetary policy, easy credit and unbridled speculation drove Japanese stocks and real estate to astronomical price levels.

When the Nikkei index peaked at 38,957.44 on 29th December 1989, Japanese stocks accounted for 45% of the MSCI World Index according to the World Bank. The market traded on a cyclically adjusted price to earnings ratio of 100x and eight Japanese companies, five of them banks, were in the top 10 largest companies in the world in market cap terms. At its peak in 1990, the 1.15 square kilometre Tokyo Imperial Palace was estimated to be worth more than the entire real estate value of California.

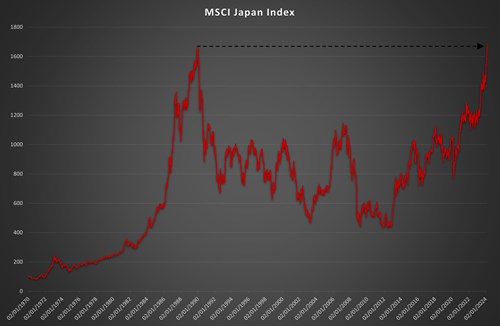

The Bank of Japan started raising interest rates in May 1989 due to inflationary pressures and in order to slow the pace of asset price appreciation. By August 1990, the Nikkei had plummeted to half its peak, although property prices peaked somewhat later in late 1991. Japan has pretty much been in stagnation and deflation ever since, characterised by a prolonged period of very low interest rates and bond yields, anaemic economic growth and a Japanese Yen which is currently trading at a 50-year low. However, at long last, Japan appears to be escaping from deflation and looks to be on a path to sustainable growth and higher (but healthy) inflation. The Bank of Japan (BoJ) is finally thinking about raising rates for the first time since 2007 and on Thursday 21st February, the Nikkei finally made a new high, some 34 years after the last one. Indeed, the index has today breached 40,000 for the first time ever.

Source: MSCI, Data is in price terms in JPY for date range shown. Collated 04/03/2024

Japan is still facing a number of challenges including having one of the worst demographic outlooks of any major economy (although Japan has been successful in encouraging older and female workers back into the workforce), a large dependency on imported energy and a huge amount of government debt. Both the government and the BoJ are very keen to see workers increase their share of the economic pie through higher wage growth. This would help ensure a stronger consumer and economy whilst also helping to push inflation towards their 2% target.

The BoJ is also facing a different challenge as it seeks to ween the economy off low rates at a time when other central banks are about to start an easing cycle. If the Bank abandons its Yield Curve control, whereby it has tried to keep government bonds yields around 0% and which has been in place since 2016, this will have major implications for global financial markets. The Japanese have been major supporters of foreign assets since the Japanese bubble burst in the late 1980s as they sought to boost yields and returns from overseas markets against the background of a depreciating currency. If they start to repatriate this capital, then this will likely be bullish for Japanese assets but less so for other international assets.

Japan has a number of positive tailwinds as well, which investors will do well to remember. Many Japanese companies are well positioned to benefit from growing trade with US, Asia and Europe in an increasingly fractured global economy. Also, Japan is currently enjoying a tourism boom which could last for a long time; as a holiday destination, Japan is considered clean, safe, attractively priced (with a cheap currency) and offers some of the best food in the world.

As for Japanese equities, they have been in a bull market for almost a decade, although this has largely taken place below the radar. Stocks remain cheap, relative to the markets’ own history and other global markets, for example, 37% of Nikkei members are trading below their book value. Also, companies are embarking on a real push to improve governance and shareholder returns. Companies are being encouraged by regulators and market authorities to publish reports on their plans to boost their equity valuations. Some have announced share buybacks and dividend hikes, whilst management buyouts are on the rise and activist investors are stepping up their campaigns. Companies sharing more cash with investors will generally be a catalyst for releasing value. In addition, Japanese profits growth has been strong over recent years, partly thanks to the weaker Yen, and future earnings expectations are being revised upwards, which contrasts positively with downgrades elsewhere.

After decades of disappointment, caution is required before becoming too optimistic about either the Japanese economy or stock market. There’s still plenty that can go wrong. But Japan appears to be in decent health, under owned and underpriced, with solid reasons to expect the bull market in stocks to continue. It’s been a very long time coming but it looks like better times lie ahead for Japanese investors. Just as I have experienced falling inflation, and low interest rates and bond yields for most of my career, this is another example of how entrenched long-term trends can change and is therefore further evidence of the changing world order.

Data sourced from Bloomberg.